In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

Macro: If you have been in the markets long enough, then you have likely heard sayings like “the market is climbing a wall of worry”, and “be fearful when others are greedy, and greedy when others are fearful”. Well, the stock market has done all of the above over the last few months. It’s been a little manic, to say the least. Late in 2021, the market was climbing a wall of worry, all of the reasons the market sold off early this year were disregarded, rising rates to battle 40yr high inflation, geopolitical risks, and high valuations. Well, when investors got extremely fearful late last week of the potential for Russia to invade Ukraine, they bought U.S. Treasuries, pushing the yields below two-year highs, but with the news of the possible de-escalation, we can through in another market idiom, “they sold the news”.

Trade Idea #1: TLT – rates might have topped out near-term as investors either sell the news of the hikes or maybe U.S. Treasuries get bought for flight to quality reasons in the event of a geopolitical dustup. Play for a move back towards the 200-day moving average in TLT, which would likely be equivalent to about 1.7% in the 10-yr U.S. Treasury Yield.

Bullish Trade Idea: TLT ($135) Buy March 135 – 145 call spread for $2.50

-Buy to open 1 March 135 call for $2.85

-Sell to open 1 March 145 call at 35 cents

Break-even on expiration:

Profits of up to 7.50 between 137.50 and 145 with max gain of 7.50 above 145

Losses of up to 2.50 between 135 and 137.50 with max loss of 2.50 below 135

Rationale: this trade idea risks less than 2% of the etf price, has a break-even up 2%, and has a max potential gain of 3x the premium at risk if the etf is up 7.5% in a little more than a month.

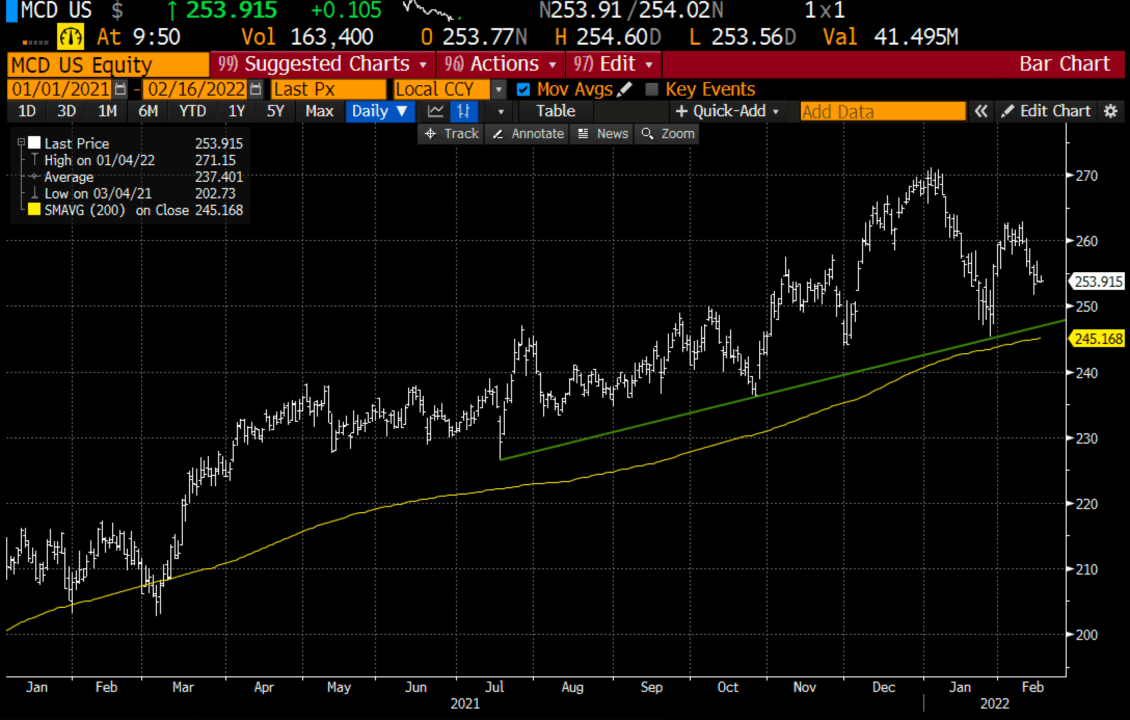

Trade Idea #2: MCD, consumers might start trading down, data has been worse than expected could benefit QSRs like MCD. The stock has good support at its uptrend just above its 200 day moving average.

Bullish Trade Idea: MCD ($254) Buy March 260 – 270 call spread for $2

Buy to open 1 March 260 call for $2.50

-Sell to open 1 March 270 call at 50 cents

Break-even on March expiration:

Profits of up to 8 between 262 and 270 with max gain of 8 above 270

Losses of up to 2 between 262 and 260 with max loss of 2 below 260

Rationale: this trade idea risks less than 1% of the stock price, has a break-even up 3%, and a max potential gain of 4x the premium at risk if the stock is back near its recent all-time highs in a little more than a month.

Lookback: A few weeks ago on Jan 26 I detailed a bullish trade idea in shares of EA when the stock was $131. Now with the stock near $135 and a few days for expiration it makes sense to manage it.

Bullish Trade Idea: EA ($131) Buy Feb – June 140 call calendar for $5

-Sell to open 1 Feb 140 call at $2.60

-Buy to open 1 June 140 call for $7.60

The short Feb 140 call that was sold at $2.60 can now be bought back for 25 cents, and the June 140 call that was bought for $7.60 is now worth about $7, so the spread that cost $5 is now worth a little less than $7. I would cover the short Feb call and sell to open the June 170 call for $1.25, which would result in a net credit of $1, thus further reducing the premium at risk to just $4. The new trade is Long June 140 – 170 call spread for $4 which has a breakeven at $144 and a max potential gain of $26 up to $170.