Today at 1 pm, Guy Adami, Dan Nathan and Carter Worth will go live on YouTube to discuss:

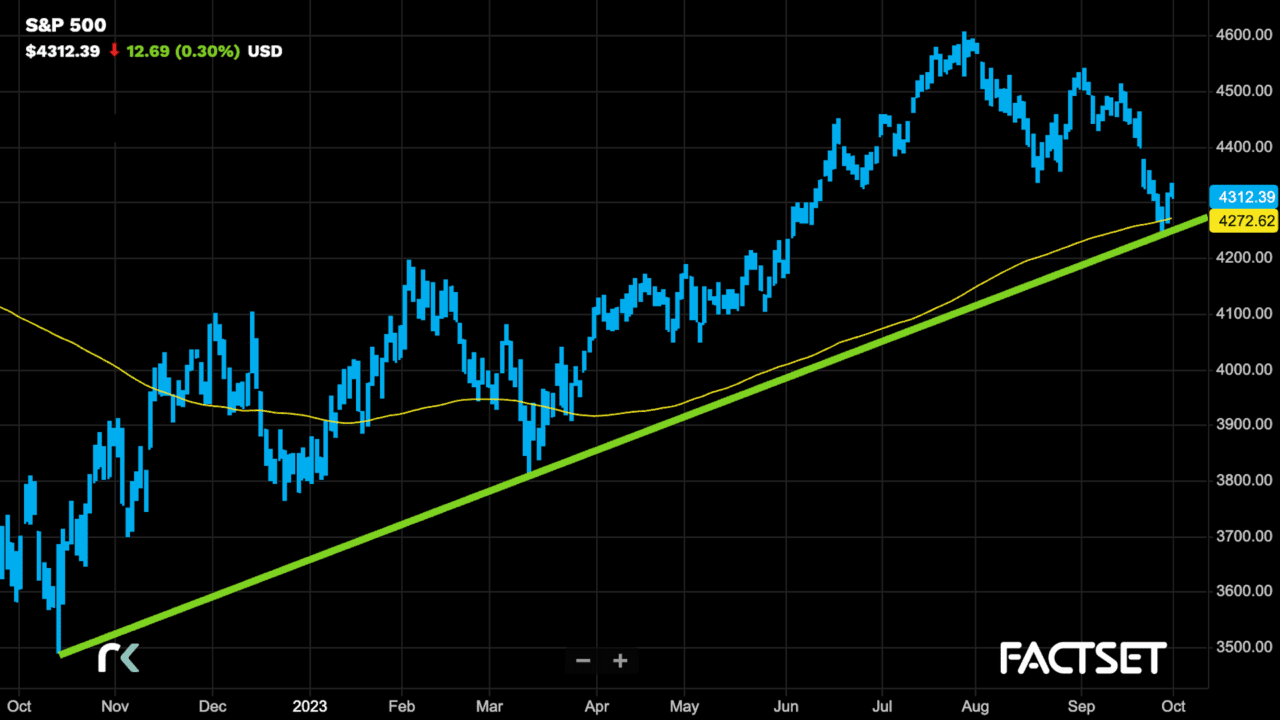

- Q3 wrap

- What to expect in Q4

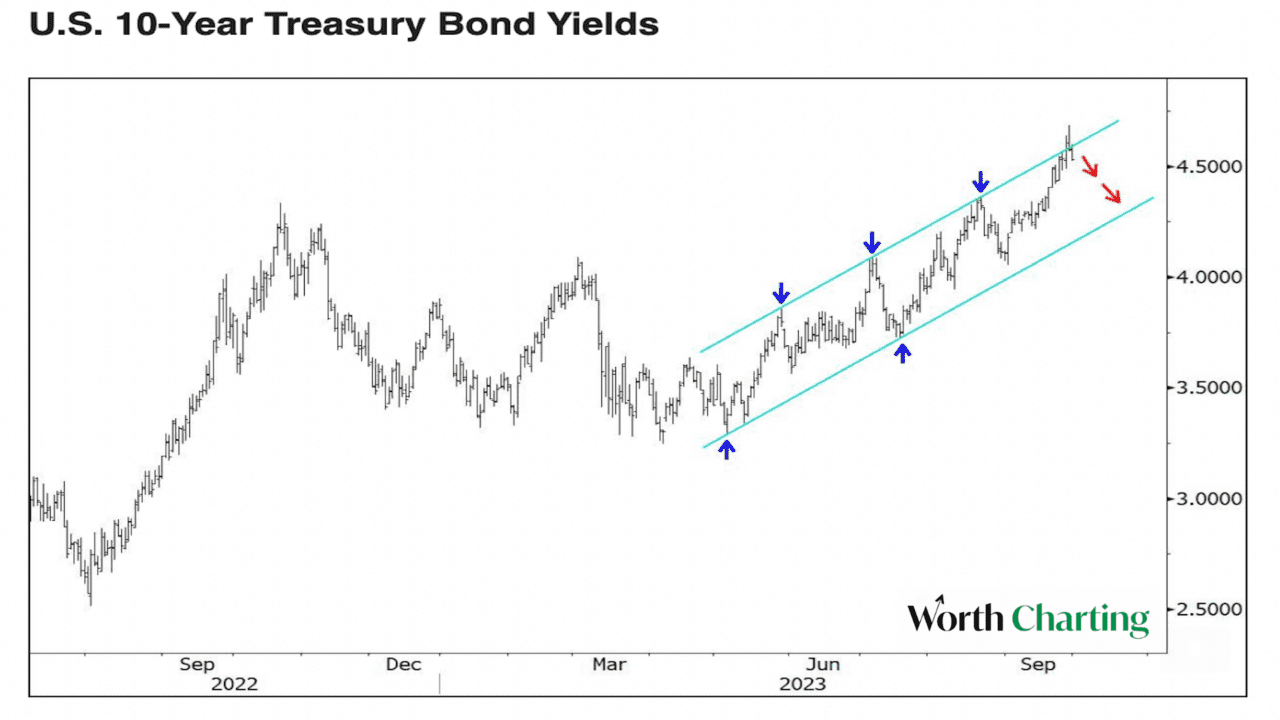

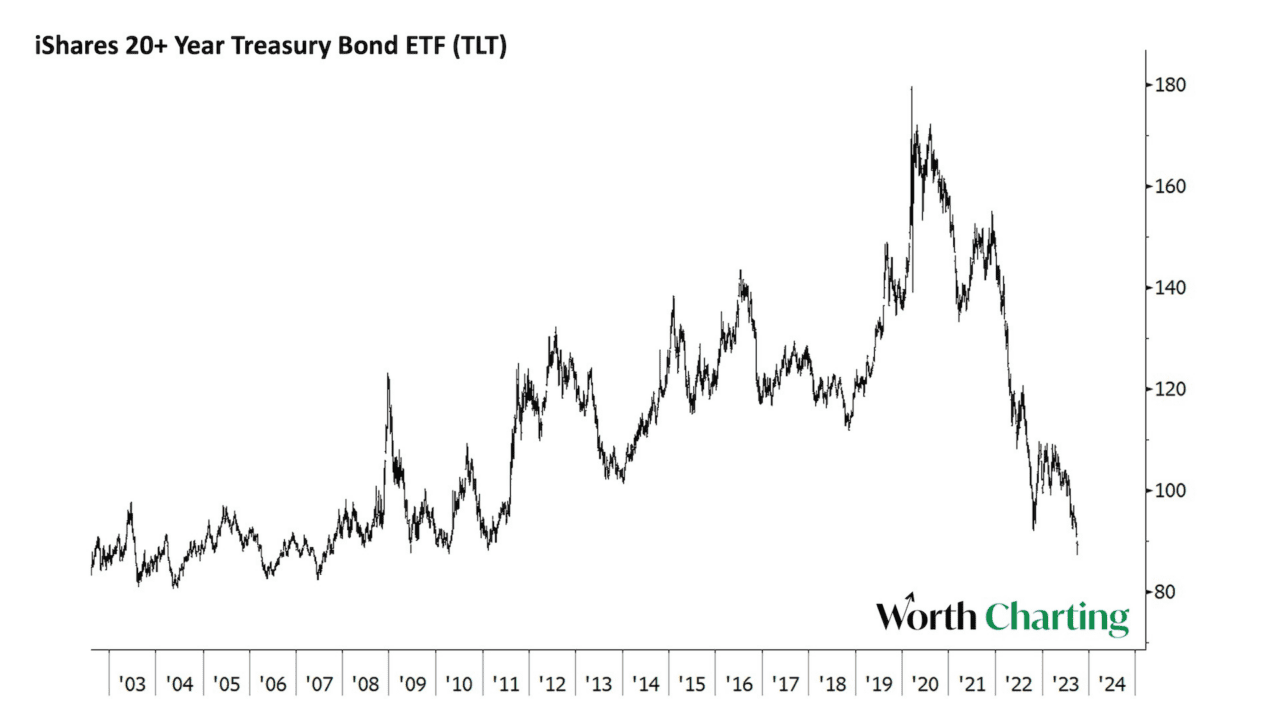

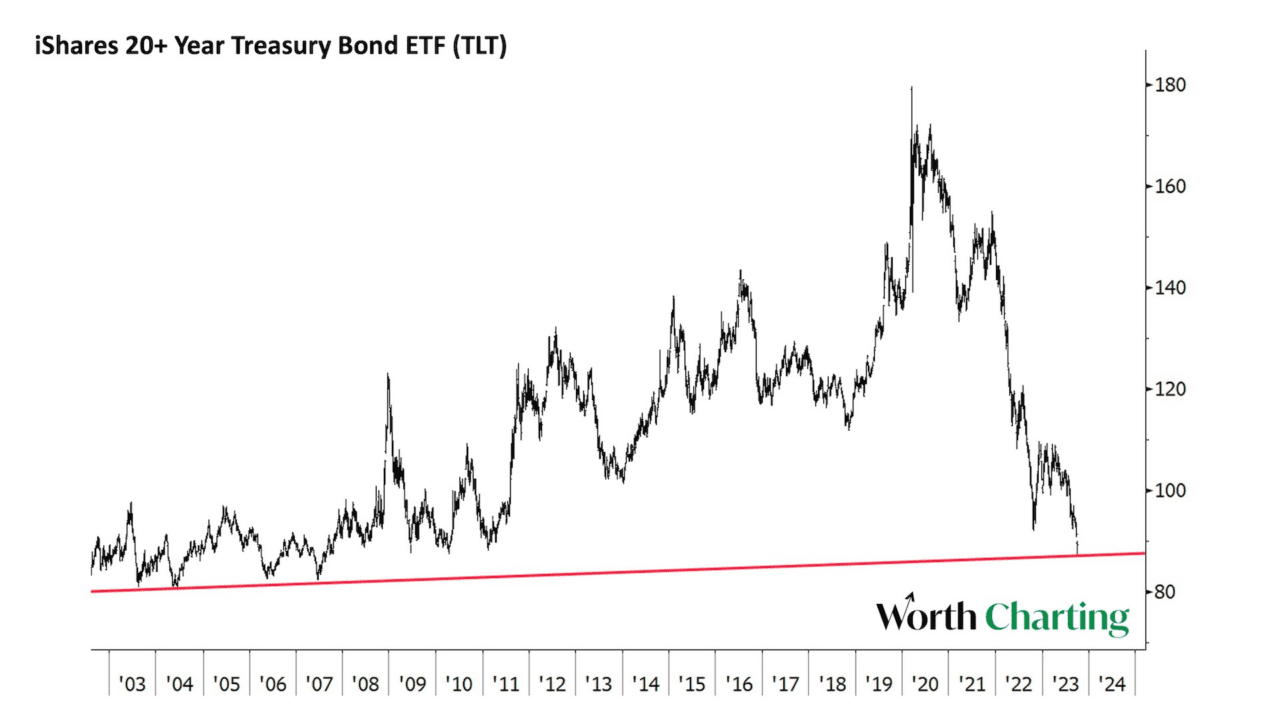

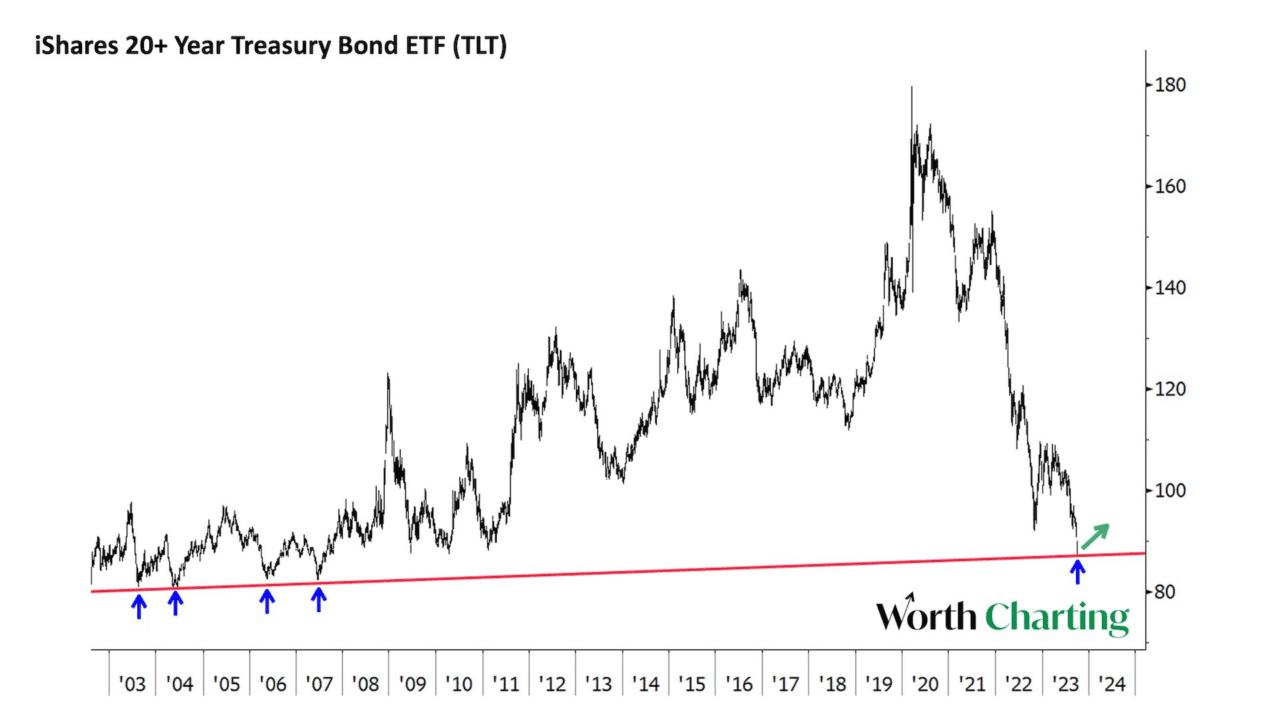

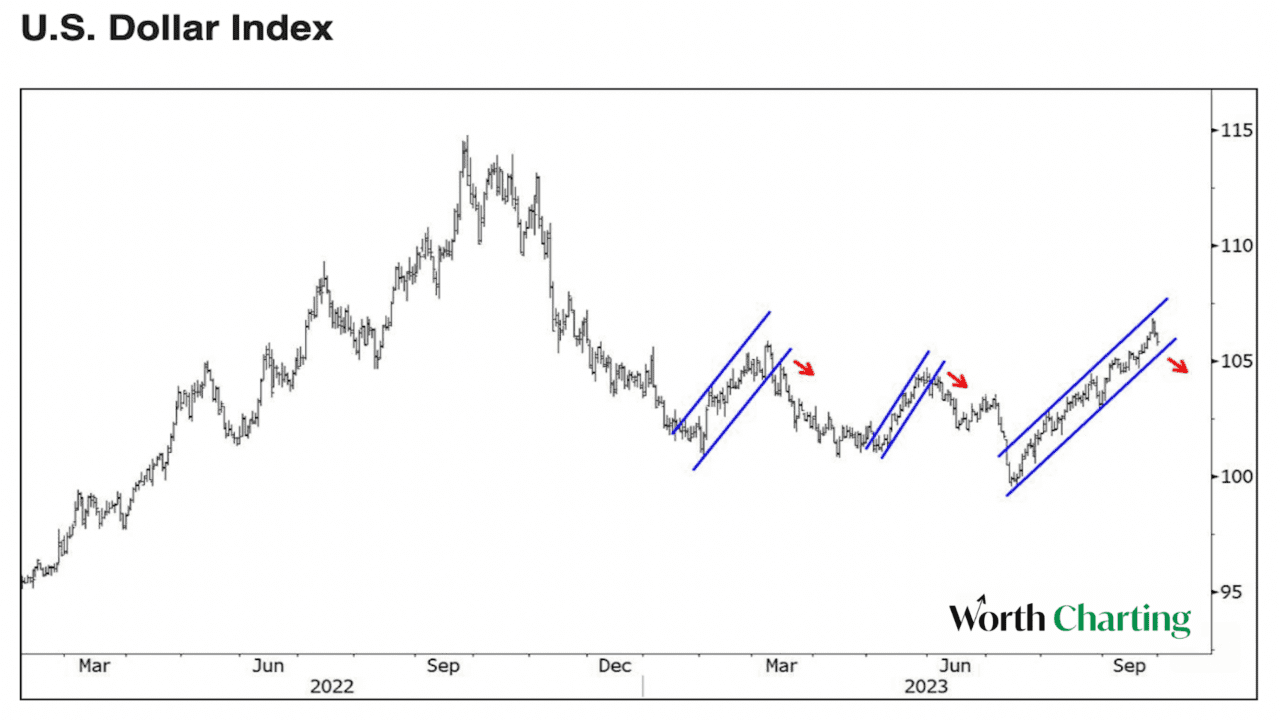

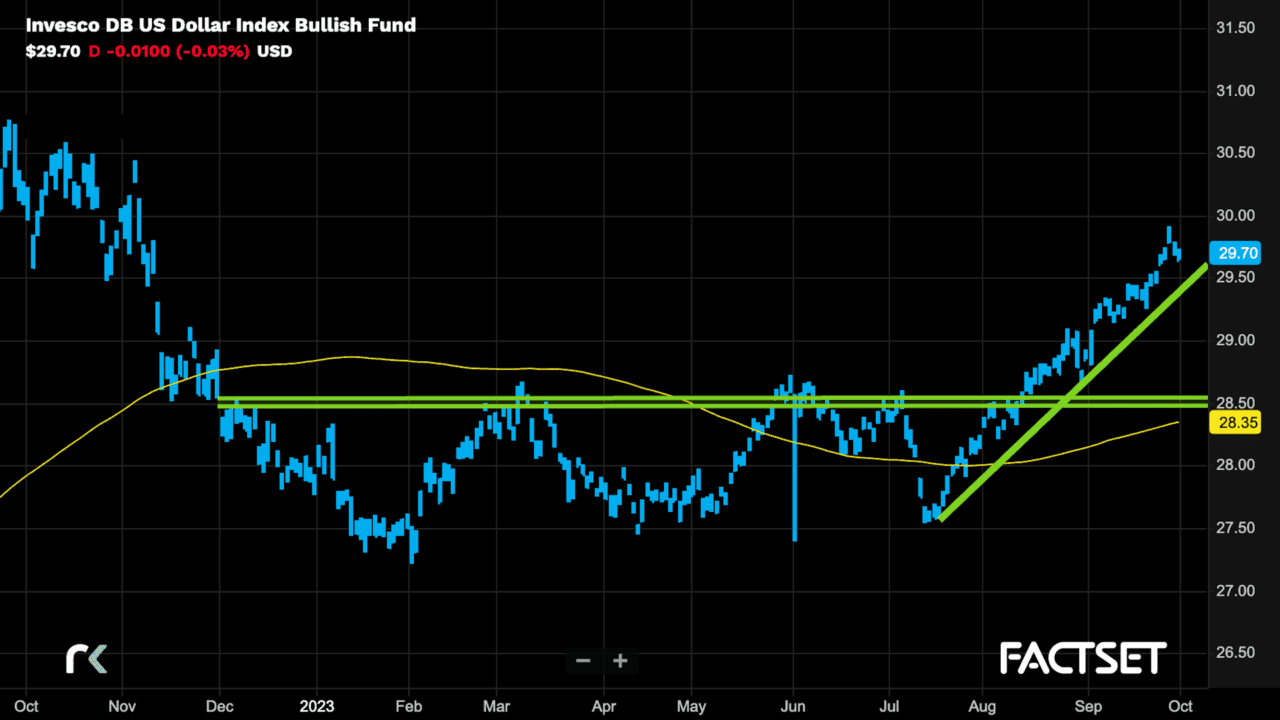

- Three trade ideas: Energy (XLE), the Dollar (UUP), and Rates (TLT)

Tune in live or watch the replay below:

SHOW NOTES:

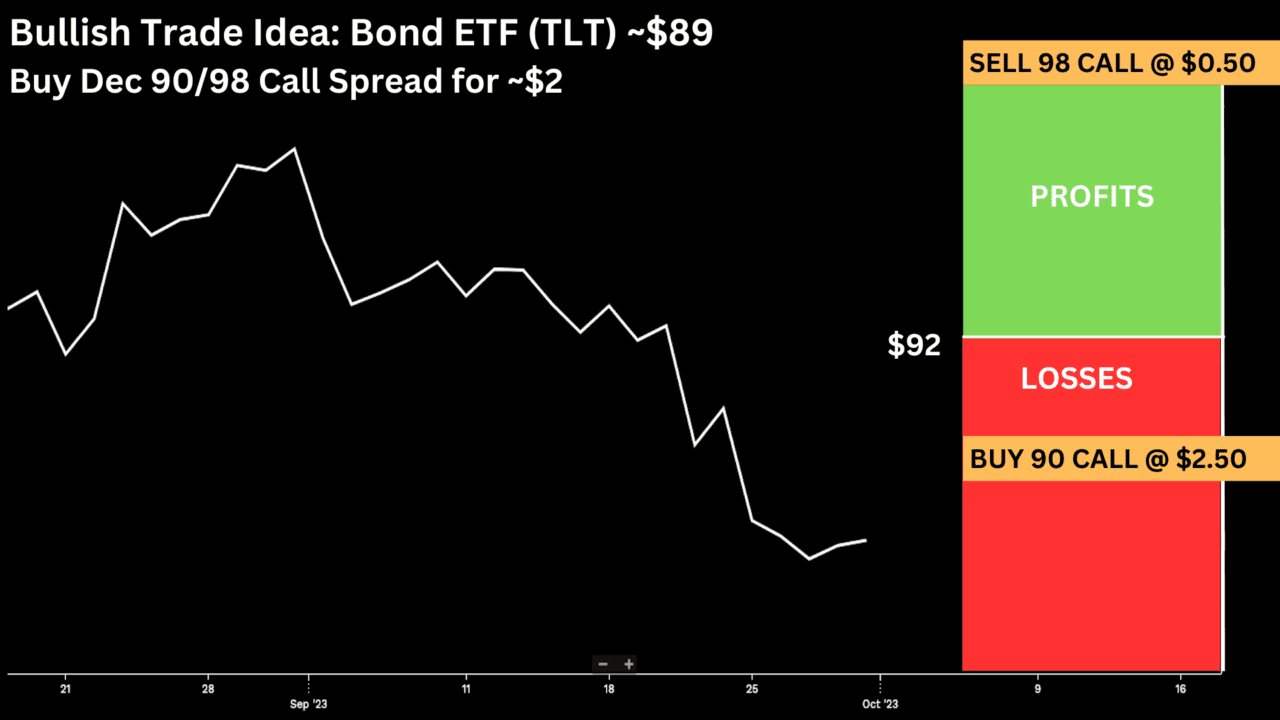

TLT ($89) Buy Dec 90 – 98 call spread for ~$2

-Buy to open 1 Dec 90 call for ~$2.50

-Sell to open 1 Dec 98 call at ~50 cents

Break-even on Dec Expiration:

-Profits of up to 6 between 92 and 98 with a max gain of 6 at 98 or higher

-Losses of up to 2 between 90 and 92 with a max loss of 2 below 90

Trade Rationale:

This trade idea risks 2.2% of the etf price, with a break-even up of 3.3% and a max potential gain of nearly 7% if the etf is up ~10% in two and half months. Risks 2 to make 6.

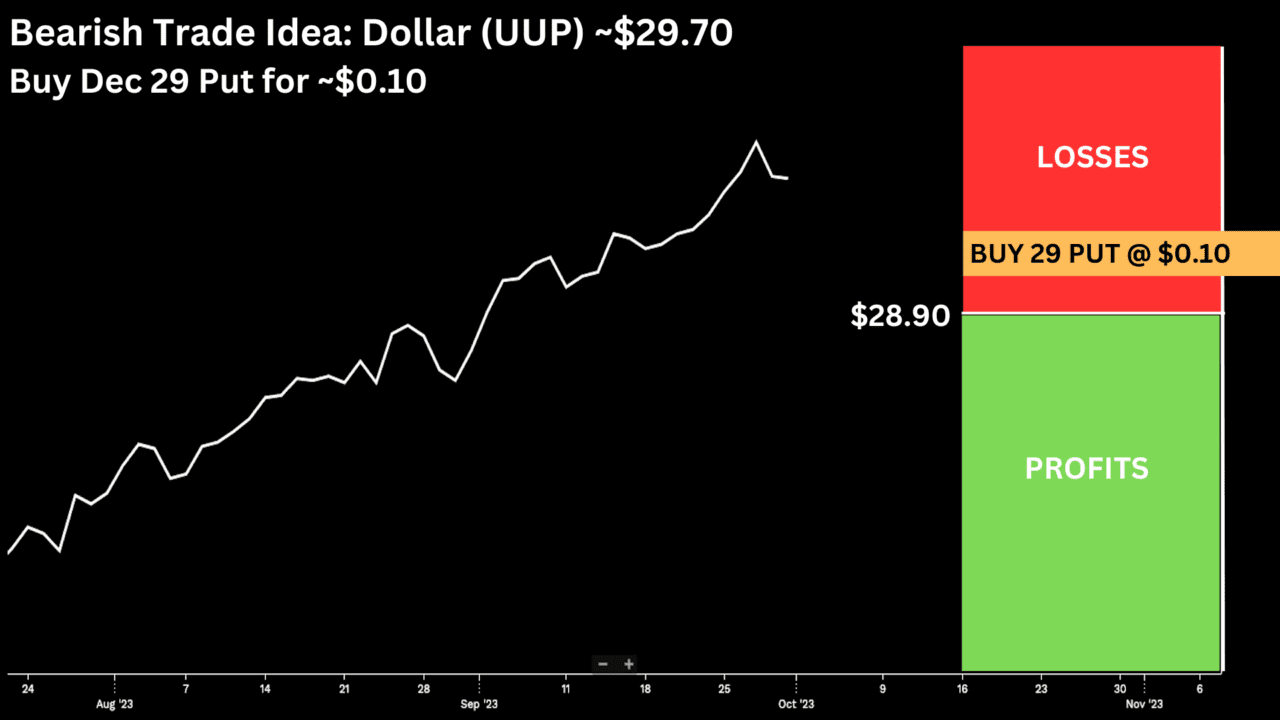

UUP ($29.70) Buy Dec 29 put for 10 cents

Break-even on Dec Expiration:

Profits below 28.90

Losses of up to 10 cents between 28.90 and 29

Rationale:

This trade has about a 20% probability of being in the money on December expiration but an attractive risk-reward if the dollar were to have a precipitous drop in the next two months. Retracing the move of the last two months

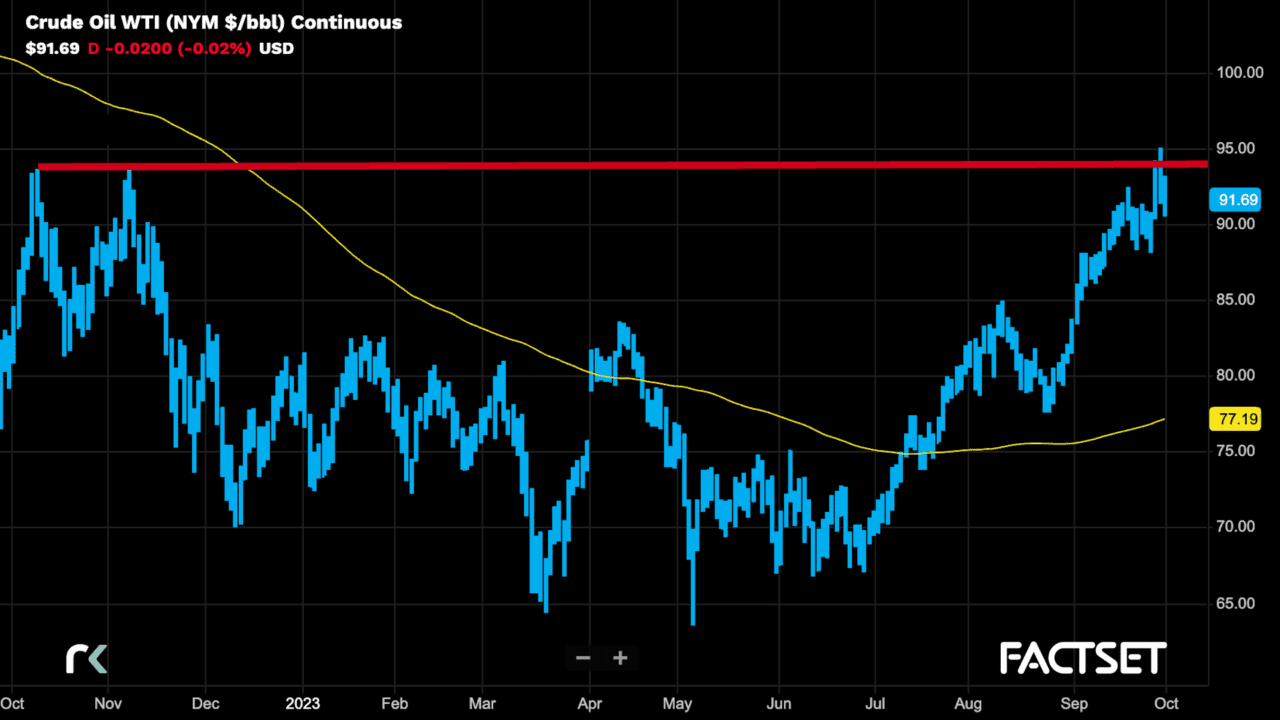

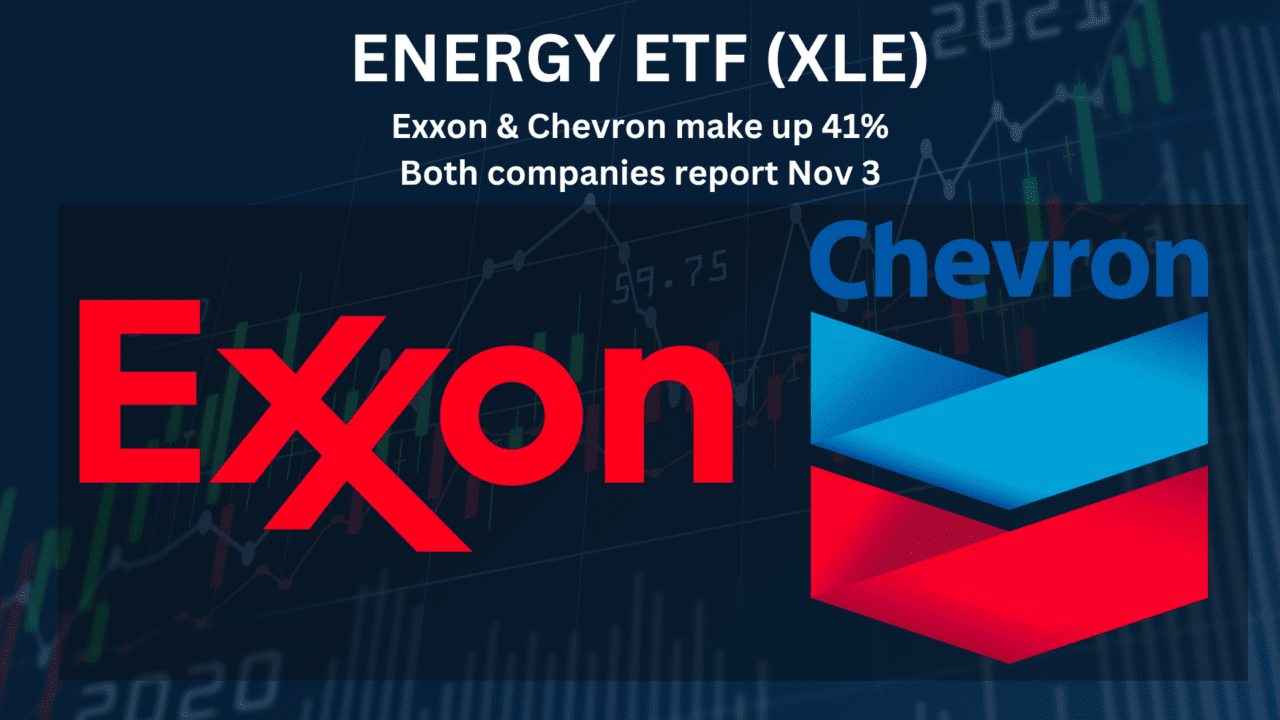

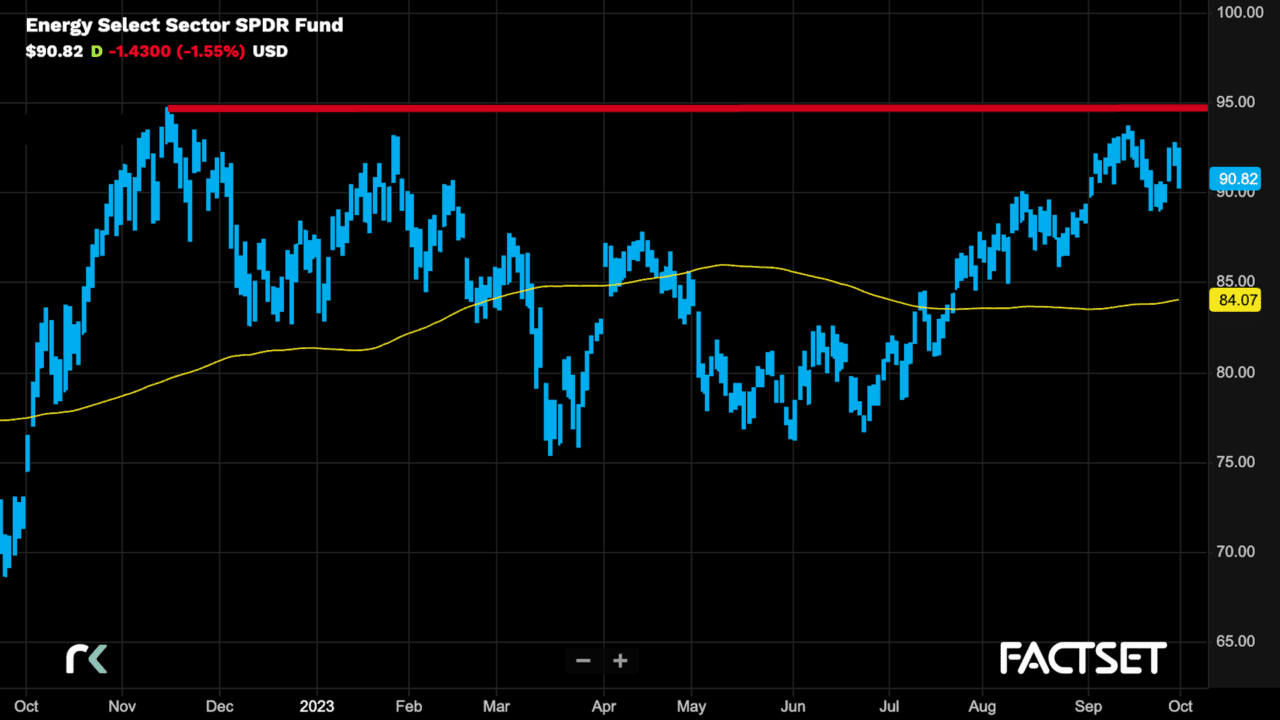

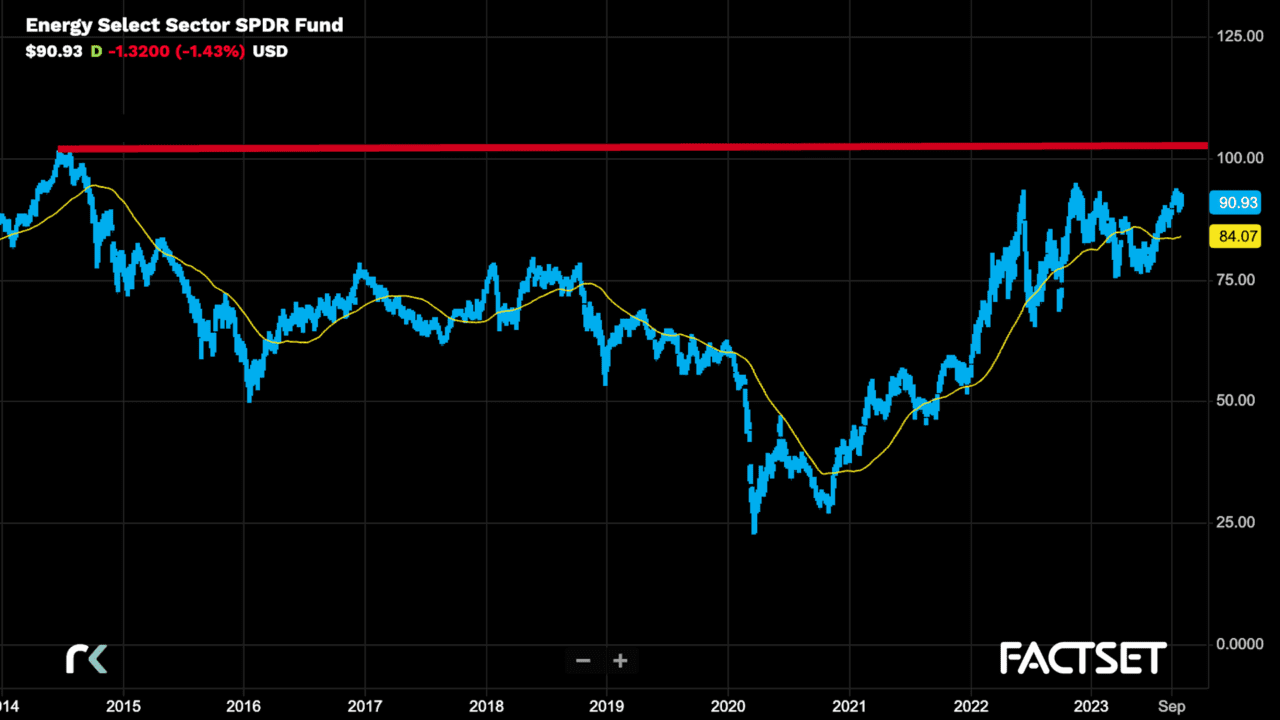

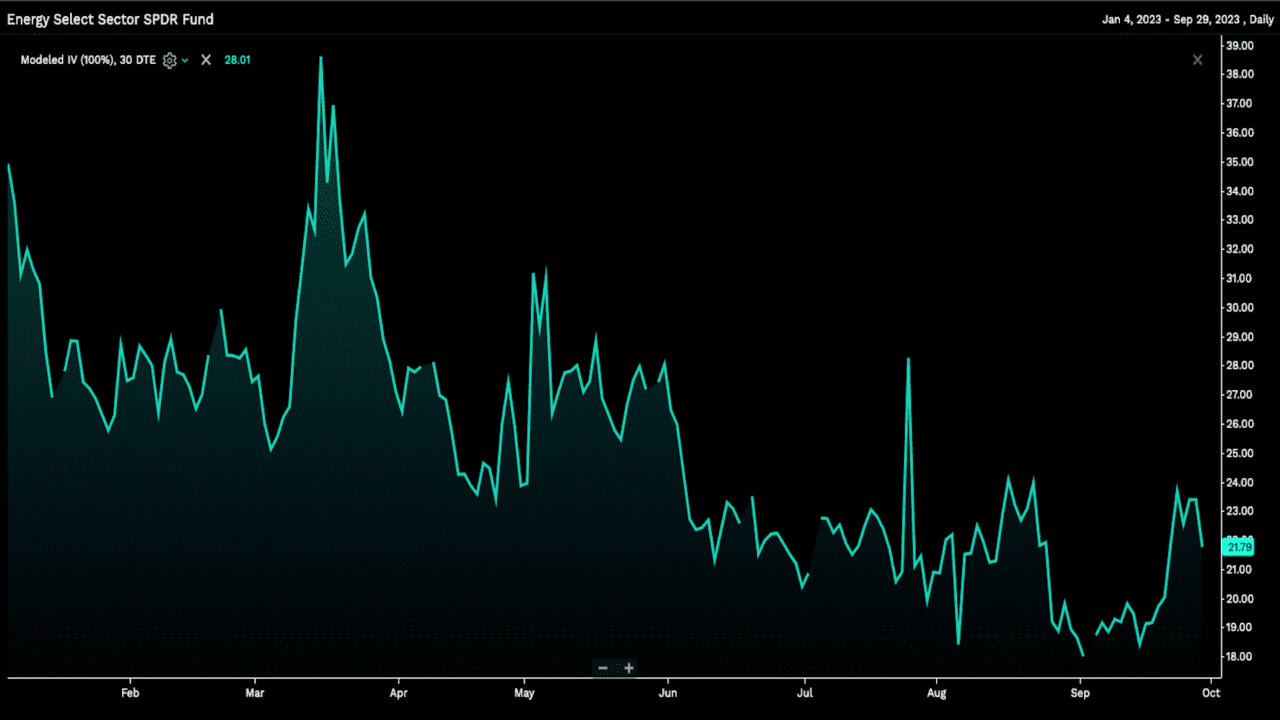

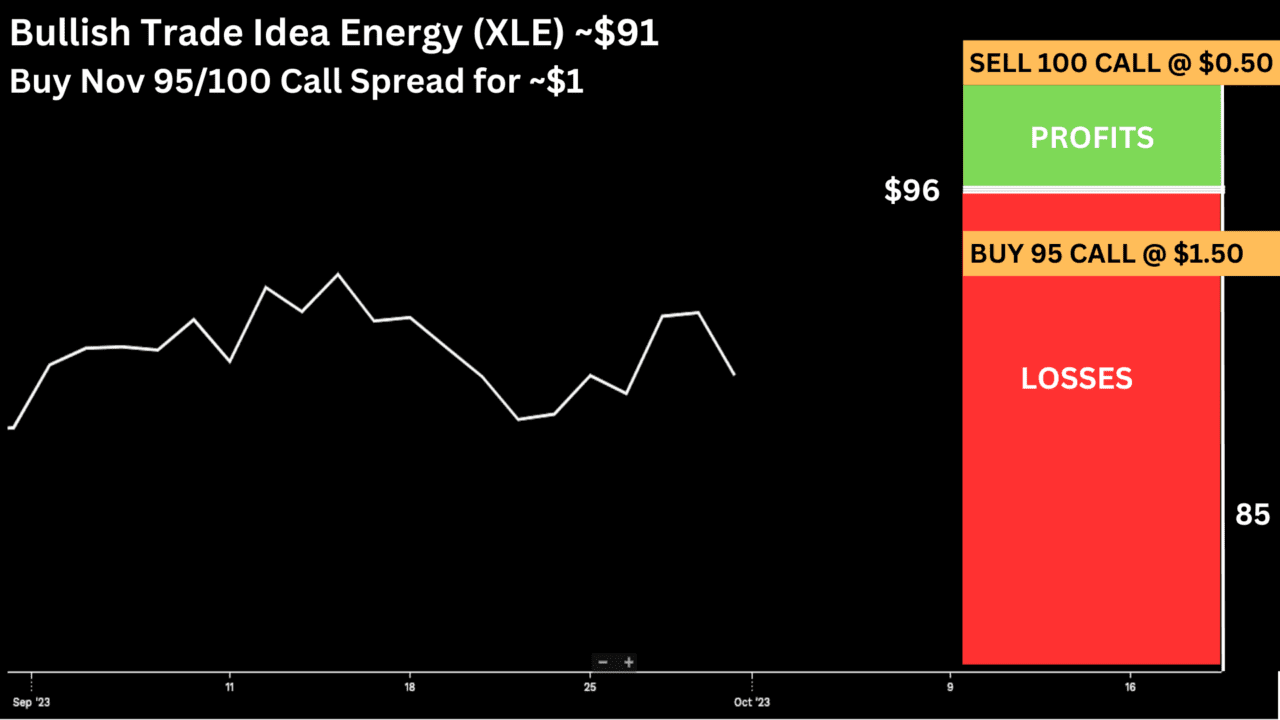

XLE (~$91) Buy Nov 95 – 100 call spread for ~$1

-Buy to open 1 Nov 95 call for ~1.50

-Sell to open 1 Nov 100 call at ~50 cents

Break-even on Nov expiration:

Profits of up to 4 between 96 and 100 with a max gain of 4 above 100

Losses of up to 1 between 95 and 96 with a max loss of 1 below 95

Rationale: this trade idea risks ~1% of the etf price and has a break-even up ~5.5% with a max gain of ~4.5%, up 10%

The options market is suggesting there is only a 15% chance of a max gain, but it is a decent risk reward if you think some event lurking could cause a spike in oil, causing the stocks to follow.