In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

Macro: Friday’s May jobs report may be one of the most-watched pieces of economic data in a very long time, especially after the huge disappointment in the April data. If May’s data is weak for the second consecutive month then the Fed has some more cover to reiterate their dovish stance, despite no shortage of calls from economists, strategists, investors, and pundits that the Fed has overstayed its welcome, and risk causing structurally higher inflation which may first manifest itself in asset bubbles.

If market participants think the Fed will start to taper their $120 billion in monthly bond purchases, then rates should creep higher, which should cause the dollar to rally and some popular pandemic trades to reverse.

Trade Idea #1: Bearish Homebuilders (XHB). Low-Interest rates, epic levels of fiscal stimulus, supply chain disruptions, and mass migrations out of urban areas during the pandemic caused a massive supply-demand imbalance in the housing markets. All may abate soon, and it might be as good as it gets for homebuilder stocks. It is also worth noting that surging lumber prices, a big input for housing, which surged 580% from its March 2020 lows have come in 25% from its recent highs earlier this month.

Bearish Trade Idea: XHB ($74.25) Buy July 74 – 66 put spread for $2

-Buy to open 1 July 74 put for $2.50

-Sell to open 1 July 66 put at 50 cents

Break-even on July expiration:

Profits of up to 6 between 72 and 66 with the max gain at 66 or lower

Losses of up to 2 between 72 and 74 with a loss of 2 above 74

Rationale: this trade idea risks ~3% of the etf price, has a break-even down ~3%, and has a max gain of ~8% if the etf is down 11% in a month and a half.

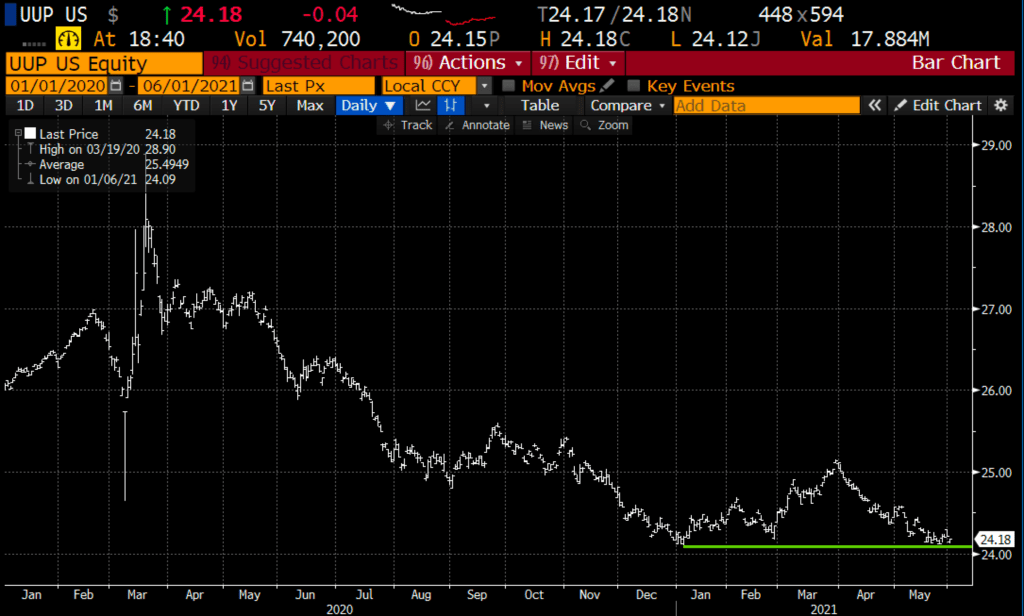

Trade Idea #2: Everyone and their mother thinks the U.S. dollar is going lower. The ETF that tracks it (UUP) is trading very near important technical support. I think you look the other way for a rally. All eyes will be on the St. Louis Fed annual meeting in Jackson Hole, WY in late August. If the economic data reaccelerates, investors will start to think the Fed will signal a more hawkish tone by the end of the summer, a hint of taper and rate increase sooner than expected should cause the dollar to rise.

Bullish Trade Idea: UUP ($24.20) Buy Sept 24 call for 50 cents

Break-even on Sept expiration:

Profits above 24.50, up 1.2%

Losses of up to 50 cents between 24 and 24.50 with max loss of 50 cents at 24 or lower.

Rationale: this trade idea risks 2% of the ETF price with a target of $25.50, up $1 over the next three and a half months. Risk 1, make 2 is the goal.

Lookback: Last week’s detailed bearish trade in XLF

XLF $37.38 Buy July 37 – 33 put spread for 75 cents

With the XLF up nearly 3% in a week, the put spread is now worth about 50 cents, losing about a third of its value, let’s remember to use mental stop near 50% of the premium paid.