In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

Macro: Inflation is coming! Inflation is coming! Inflation is coming! Sound familiar? Well, that has certainly been the call by most of the financial market pundit class, which would include most economists and billionaire investors. It is important to remember that this was the same call to action in 2013/2014 when the investment community became convinced that the Federal Reserve’s continued dovish stance, years after the global financial crisis, clinging to emergency aid measures like quantitative easing and zero interest rate policy ran the risk of creating asset bubbles and causing runaway inflation. They were right on the asset bubbles, but inflation (at least the way the government measures it) never really materialized above their 2% growth target. With the unique dislocations of the pandemic, we are starting to see demand come back for all sorts of goods and services, and consumer balance sheets are in good shape, so for the time being while bank accounts are flush with government cash the Fed sees these pressures as transitory and they remain focussed on the other part of their mandate, full employment, and the weak jobs data the last two months gives them cover to remain dovish.

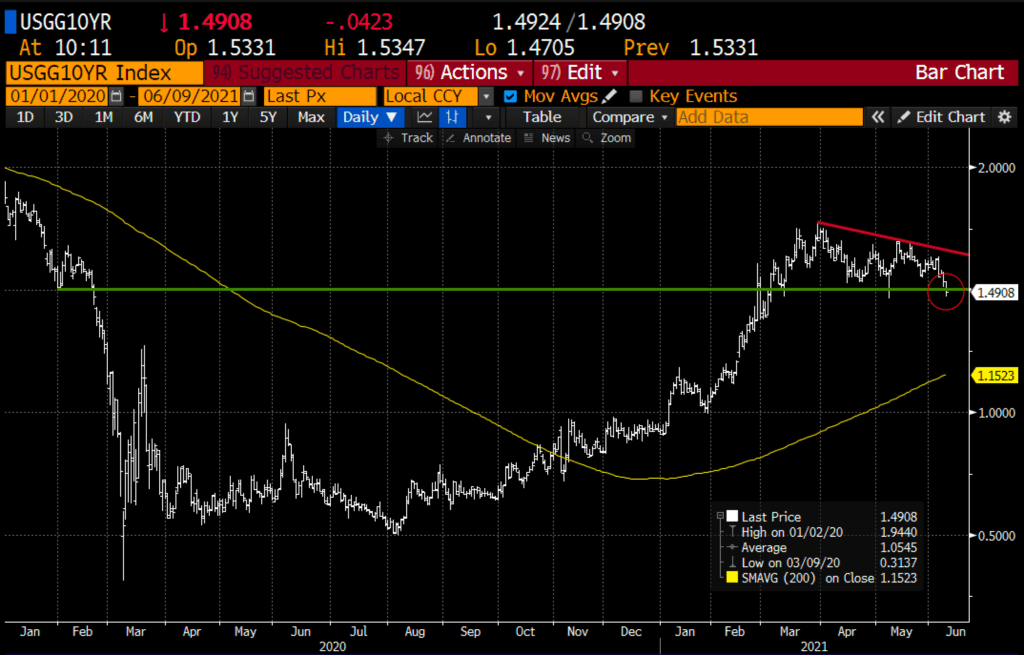

Bond yields act, as my friend Tom Lee of Fundstrat, noted yesterday, indifferent to all of the warnings about rising prices becoming permanently high.

The yield on the U.S.. 10-year treasury yield has been trending lower since its one-year highs made in March. Tom’s view is that tamer inflation expectations and lower rates should be good for equities near-term.

Bond yields are suggesting something very different than the calls for structurally higher inflation. A break of 1yr support could cause a retest of the uptrend from the Aug 2020 lows, very near its 200-day moving average near 1.15%. Market participants do NOT appear to be positioned for that.

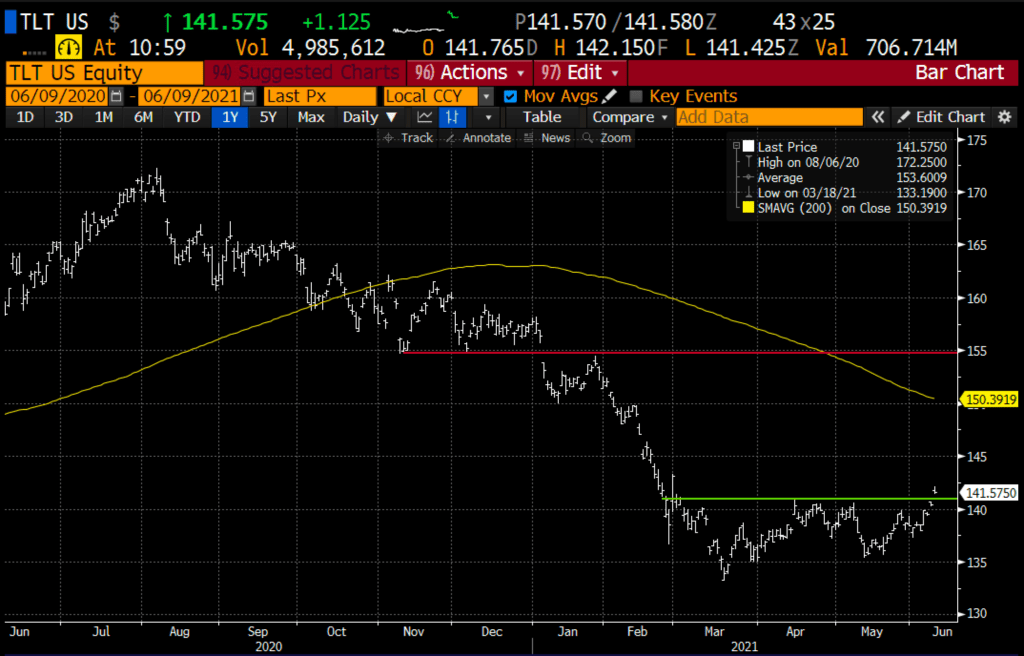

Trade Idea #1: BUY with denied risk, TLT, the 20-yr U.S. Treasury Bond etf. If Bond yields look like they are ready to dip, then the inverse would be true for bond prices… If 10yr yields were to go back to 1.15% then the TLT is likely to be headed back towards its 200-day moving average near $150:

Bullish Trade Idea: TLT ($141.50) Buy Sept 142 – 155 calls spread for $3

-Buy to open 1 Sept 142 call for 3.80

-Sell to open 1 Sept 155 call at 80 cents

Break-even on Sept expiration:

Profits of up to 10 between 145 and 155 with max gain of 10 above 155

Losses of up to 3 between 145 and 142 with max loss of 3 below 142

Rationale: this trade idea risks ~2% of the etf price, has a break-even up 2.5%, and has a max potential gain of 7% if the TLT is up nearly 10% in ~4 months.

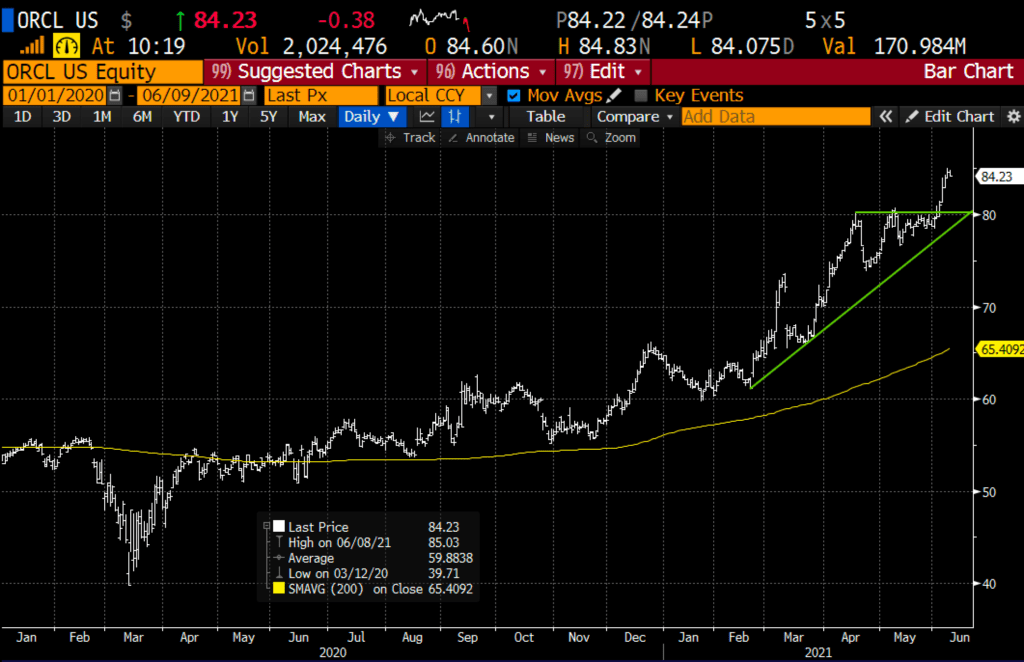

Trade Idea #2: Shares of ORCL are breaking out to new all-time highs, up 31% on the year, and up 11% in the last month alone, for no apparent reason.

Maybe it is perceived value, trading 18x 2022 expected eps, but that’s only expected to grow high single digits on 2% expected sales growth.

ORCL will report Q3 earnings on June 15th, the options market is implying about a 5.5% move in either direction the day after results, if the report was tonight that’s basically $80 or $90. I suspect we see a pullback towards the breakout level near 80 or the uptrend from the Feb lows a little below that as results and guidance will need to be far greater than already rising expectations.

Bearish Trade Idea: ORCL ($84.25) Buy June 25th weekly 84 – 76 put spread for $2

-Buy to open 1 June 25th expiration 84 put for 2.35

-Sell to open 1 June 25th expiration 76 put 35 cents

Break-even on June 25th weekly expiration:

Profits of up to 6 between 82 and 76 with max gain of 6 below 76

Losses of up to 2 between 82 and 84 with max loss of 2 at 84 or higher

Rationale: this trade idea risks 2.4% of the stock price, and makes up to 7% if the stock is down 10% in two weeks.

Lookback: Last week I detailed a bearish trade idea in the homebuilder etf, XHB

XHB ($74.25) Buy July 74 – 66 put spread for $2

The XHB is down about $1 since the trade and the put spread has appreciated a little, with rates down and the XHB not rallying and the chart looking heavy, I think you stick with this trade.