In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

Macro: The Fed Stays the course, they do not seem particularly worried about inflation, some FOMC members see rate increases sooner than earlier, but no material movement until 2023! that is a lifetime away. Rates bounced a little, they were oversold, the U.S. dollar firmed a bit and stocks and crypto sold off.

Rate decline over the last few weeks was a signal that the Fed would not surprise by signaling a sooner than expected taper.

Maybe we see a test of the upper end of the nearly 4-month downtrend, but I suspect rates lose steam near 1.6% and then break 1.4%.

Trade Idea #1: Bearish Exxon (XOM) – While market participants appear obsessed with the prospects of higher structural inflation, I suspect some of the dislocations & bottlenecks which have caused price spikes in the last six months will start to abate. we have already seen this lumber, copper and grains. Oil has made new highs seemingly daily for the last few weeks, making new 52-week highs, but I suspect increased supply and maybe a slower pace of reopening might call oil prices to pause. Shares of large integrated oil companies like XOM could be vulnerable near-term, just as it approaches important technical resistance near $65, the breakdown level from Feb 2020:

Bearish Trade Idea: XOM ($62.50) Buy July 62.50 – 55 put spread for $1.50

-Buy to open 1 July 62.50 put for $1.75

-Sell to open 1 July 55 put at 25 cents

Break-even on July expiration:

Profits of up to 6 between 61 and 55 with a max gain of 6 at 55 or lower

Losses of up to 1.50 between 61 and 62.50 with max loss of 1.50 above 62.50

Rationale: this trade idea risks 2.5% of the stock price, has break-even down ~2.5%, and a max gain of ~10% if the stock is down ~10% in a month.

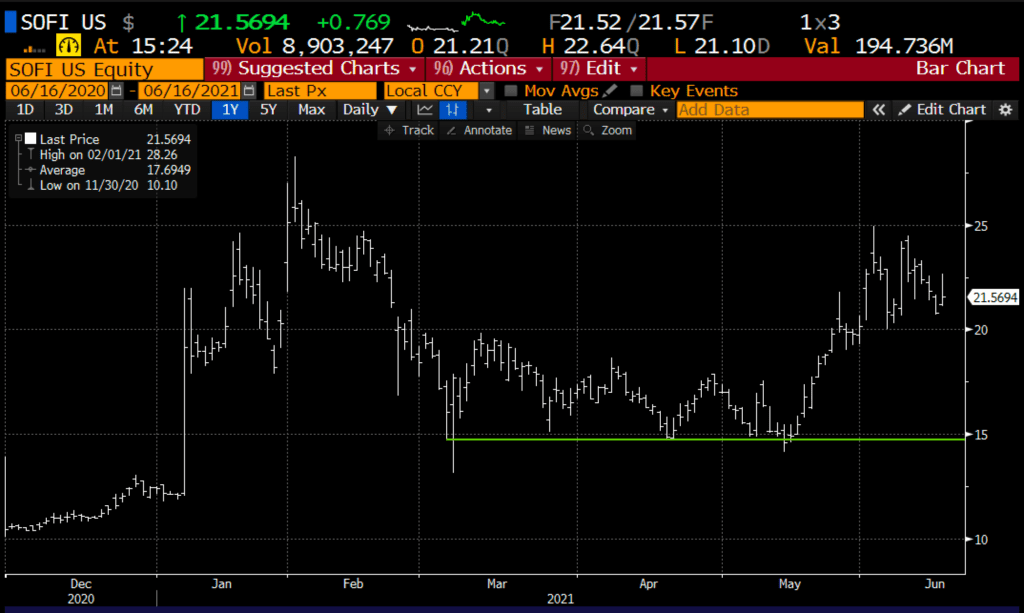

Trade Idea #2: Bullish SoFi – while established financial services brands appear to be facing some challenges from the crypto world, yeah you have probably heard the term DeFi, or decentralized finance, there are still some Centralized Finance companies that want a piece of the existing pie. One of those is called Social Finance, or SoFi. The company just went public through a SPAC and will likely report its first quarterly earnings as a publicly traded company in early August. I suspect the stock will be bought on dips given the unique nature of their business model and their target customer base, millennials. Since the February announcement of a merger with a SPAC, the stock has traded as high as $28 with numerous occasions finding support near $15.

Bullish Trade Idea: SOFI ($21.50) Buy July 22.50 – 30 call spread for $1

-Buy to open 1 July 22.50 call for 1.50

-Sell to open 1 July 30 call at 50 cents

Break-even on July expiration:

Profits of up to 6.50 between 23.50 and 30 with max gain of 6.50 above 30

Losses of up to $1 between 22.50 and 23.50 with max loss of 1 at 22.50 or lower

Rationale: The trade risks ~5% of the stock price, has a break-even up ~9% and a max potential gain of ~30% if the stock is up ~40% in a month,

Lookback: Last week I detailed a bearish trade idea into ORCL’s Q4 earnings report –

ORCL ($84.25) Buy June 25th weekly 84 – 76 put spread for $2

Now with the stock near $77, I would close this position and take the $5 profit, it can only be worth 8, at this point risking some of the gains to only make 1 more.

June:

AMD (~$81.50) BUY JUNE 82.50 – 100 CALL SPREAD FOR $4