In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

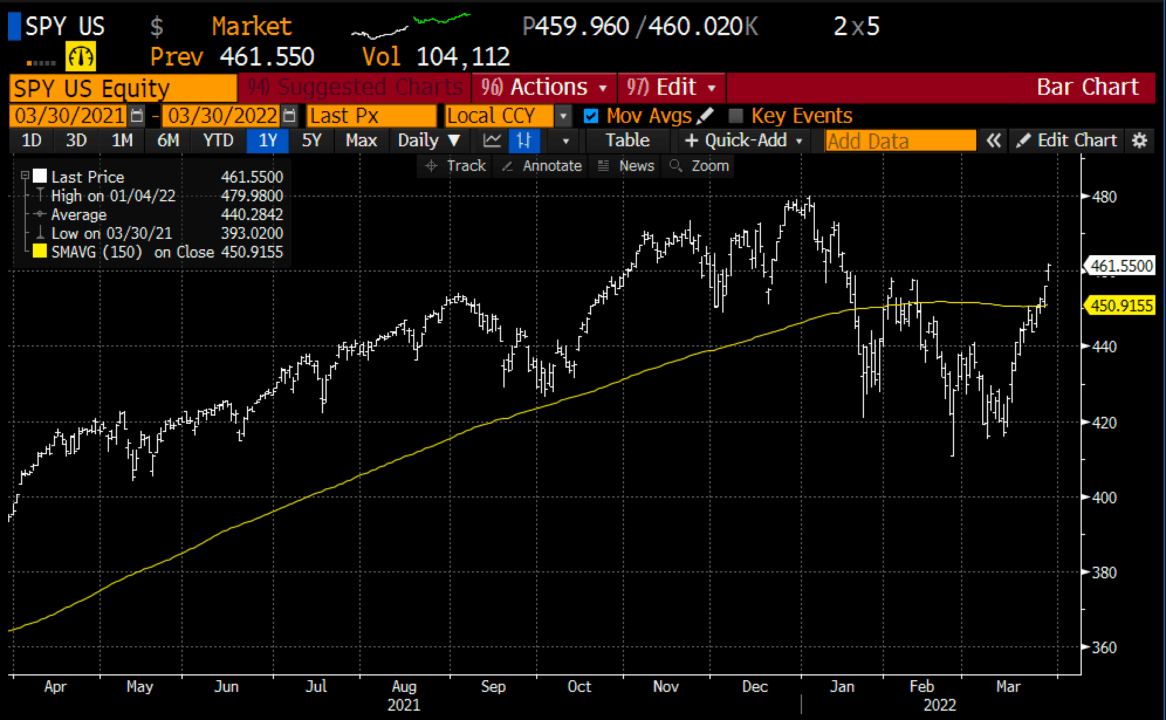

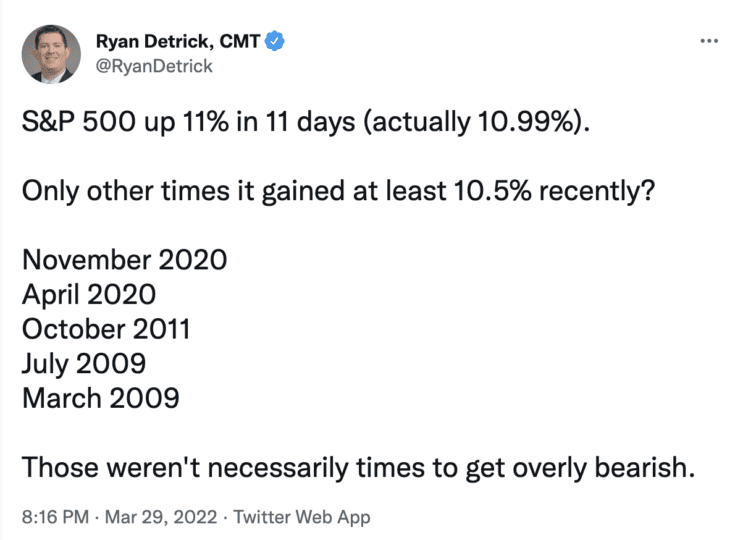

Macro: The stock market has risen a great deal in a short period of time. You could have said prior to the S&P’s 11% rally in 11 trading days that it had fallen a great deal in a short period of time. But what is different about those two statements is that large parts of the stock market had been correcting for months, if not quarters while monetary stimulus and low rates were still very prevalent, vs this past month when the Fed hiked rates for the first time in nearly three years. The tweet below from strategist Ryan Detrick implies that these sorts of rallies are not to be faded too quickly, but what is different this time to the periods mentioned below is that the Fed is tightening battling inflation that risks thwarting growth vs stimulating battling deflationary pressures, also in a slowing growth environment.

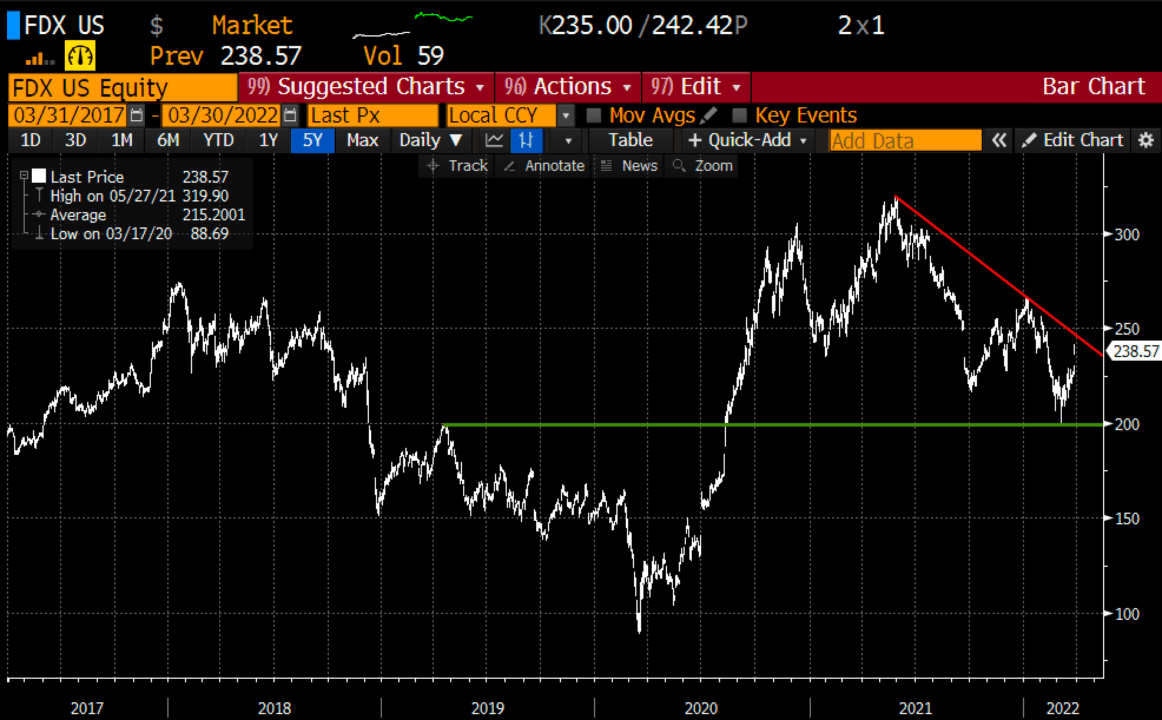

Trade Idea #1: For those who feel like they missed the bottom, and were looking to add some equity exposure it might make sense not to chase the shiniest things, but look to add stocks that have the potential to look past the near-term and move from value to growth. One such stock could be FDX, trading well below a market multiple at just 11x earnings despite expected eps growth this year of 11%.

The company has been faced with no shortage of headwinds from the pandemic, inflation of input costs, wages, supply chain hiccups, and now their founder and longtime CEO stepping down. The stock could be at a fundamental and technical inflection point.

Bullish Trade Idea: FDX ($237) Buy Jun 250 call for ~$6

Break-even on June expiration:

Profits above 256

Losses of up to 6 between 250 and 256 with a max loss of 6 below 250

Rationale: this trade idea risks less than 3% of the stock price, has a break-even up 7.5% and is targeting a move back to at least its Jan highs near 270 but possibly to its 52-week highs near 300.

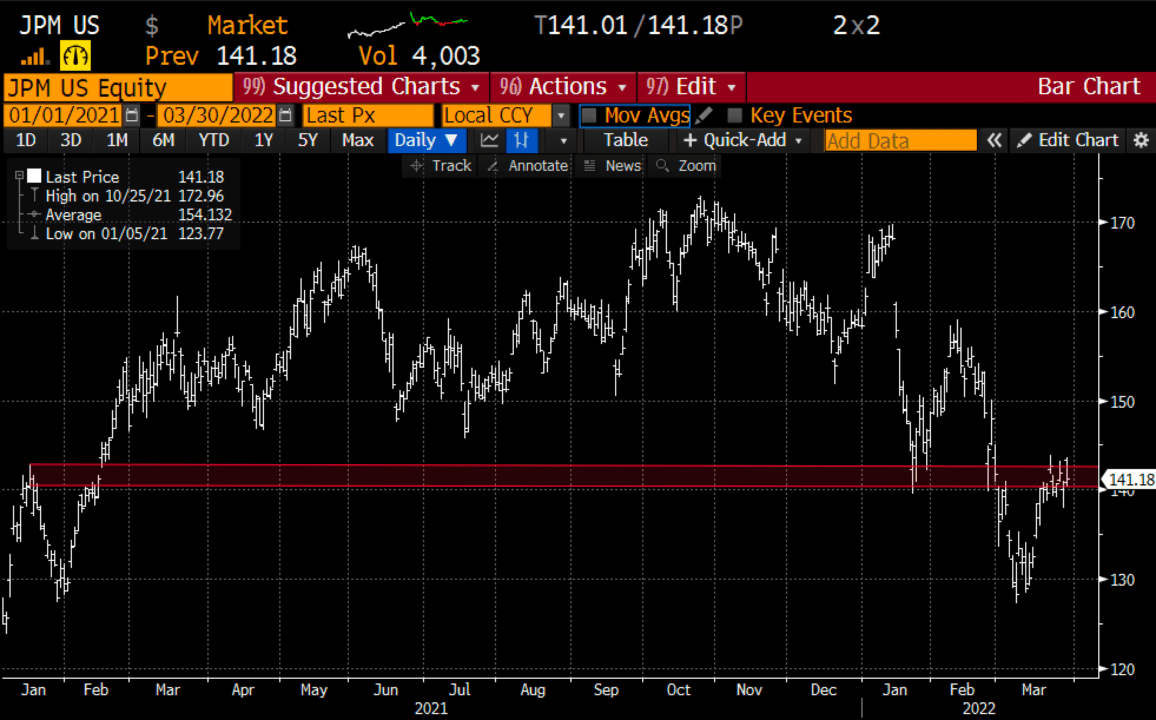

Trade Idea #2: By now you have heard a lot about an inverted yield curve and what that could suggest is coming for the economy, a recession? in this environment banks’ stocks should continue to be challenged. JPM has been in a fairly decisiveness downtrend since its Q4 report in mid-Jan and I suspect the current environment, the prospects for a sustained period where near-term rates are even with longer-term ones and the continued threat of fintech upstarts on their core businesses should keep spending high, and margins lower. Earnings come early in the cycle on Apr 13th.

Bearish Trade Idea: JPM ($141) Apr 140 – 130 put spread for $2.50

-Buy to open 1 Apr 140 put for 3.15

-Sell to open 1 Apr 130 put at 65 cents

Break-even on Apr expiration:

Profits of up to 7.50 between 137.50 and 130 with max gain below 130

Losses of up to 2.50 between 137.50 and 140 with max loss of 2.50 above 140

Rationale: this trade idea risks less than 2% of the stock price, breaks even down 2.5%, and has a max gain of 3x the premium at risk if the stock is back near its March lows, down 8% in the next two weeks.

Lookback – Last week I detailed a trade idea on the SPY, the ETF that tracks the S&P 500, which could have been used to express a near-term bearish view or to hedge a portfolio of stocks that was correlated to the index:

SPY ($449) Buy May 450 – 400 put spread for ~$10

Since then the SPY is up about 2.5% and the put spread that costs $10 is now worth about $6, let’s keep a close eye on this, as we like to use a mental stop of about 50% of the initial premium spent. But this is not a view I want to abandon as I think there is a distinct possibility that the stock market starts to price in a greater chance of a recession in the back half of 2022 and that we will be resting the March lows in the coming months.