Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

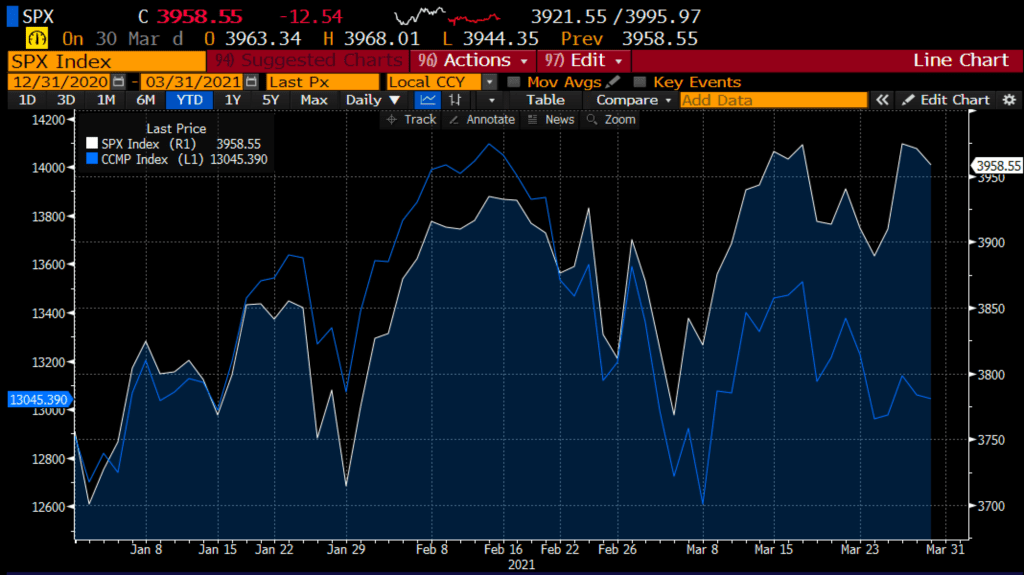

Macro: As we head into quarter-end it makes sense to review where we are in the markets and how we got here so far. The push-pull has been vaccinations vs continued mitigation attempts with the virus have been the cause of most of the excitement and fear, not to mention a similar push-pull between stimulus /infrastructure spending and the associated costs. Investors in the bond market have looked past the mitigation and costs and we have seen the sharpest rise in rates in a 3-month period in a very long time. Equity investors have been a tad more cautious, while they have rotated into sectors they think will benefit from the reopening of the global economy, they have been more cautious on high valuations so-called “winners” of the pandemic. This is most easily reflected in the outperformance of the S&P 500 and Russell 2000 up 5% & 10% respectively on the year vs the Nasdaq’s measly 1% gain, with two of its largest components AAPL & AMZN down 10% and 6% respectively.

YTD chart SPX vs NASD

Trade Idea #1: Long PFE

A study released this morning suggested that the PFE C19 vaccine is 100% effective in children ages 12-15. This will be the last piece of the puzzle to getting schools back open in the fall and thus allowing for businesses of all kinds to do the same.

Despite the company’s success over the last year, the stock has failed routinely just below $38:

Bullish Trade Idea: PFE (~$36.25) Buy July 37 – 42 call spread for 85 cents

-Buy to open 1 July 37 call for $1.05

-Sell to open 1 July 42 call at 20 cents

Break-even on expiration:

Profits of up to 4.15 between 37.85 and 42 with max gain above

Losses of up to 85 cents between 37 and 37.85 with max loss of 85 cents below 37

Rationale: this trade idea risks 2.4% of the stock price, breaks even up 4.2%, and has a max gain of 11.5% if the stock is up 15% in 3 months.

Trade Idea #2: Hedge Large tech holdings, AAPL down nearly 8% on the year, down 15% from its all-time highs made in late Jan. The chart is a mess, below the uptrend from its March 2020 lows, holding on for dear-life just above its 200-day moving average that it has not been below since March 2020.

The next catalyst will be its earnings in the last week of April, collars for long holders make sense for those who do not want to sell, but want a low-cost way to define risk to the downside.

Hedge Idea: vs 100 shares of AAPL ~$123 Buy the May 140 – 115 collar for $1.25

-Sell to open 1 May 140May call at 1.30

-Buy to open 1 May 115 May put for 2.55

Break-even on May expiration:

Profits of stock up to 140, called away at 140, but the long holder can always cover short call prior to expiration to keep long intact

Losses of the stock down to $115 but protected below, less the $1.25 cost of the hedge.

Rationale: Over the last ten years AAPL has routinely had peak-to-trough declines of 30% plus, the stock is still up 120% from its March 2020 lows, this hedge allows for gains of 10% in the coming months, but stops losses down about 8% from current levels.

Lookback: On Feb 24th, I detailed a bullish trade idea in industrial stocks via the XLI etf:

XLI $91.55 Buy Apr 95 – 100 call spread for $1.40

Now with the etf at $98.25, the call spread is worth $3.10

Take the profit so close to the short strike of the spread with a little more than 2 weeks to expiration