In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show drafted this morning:

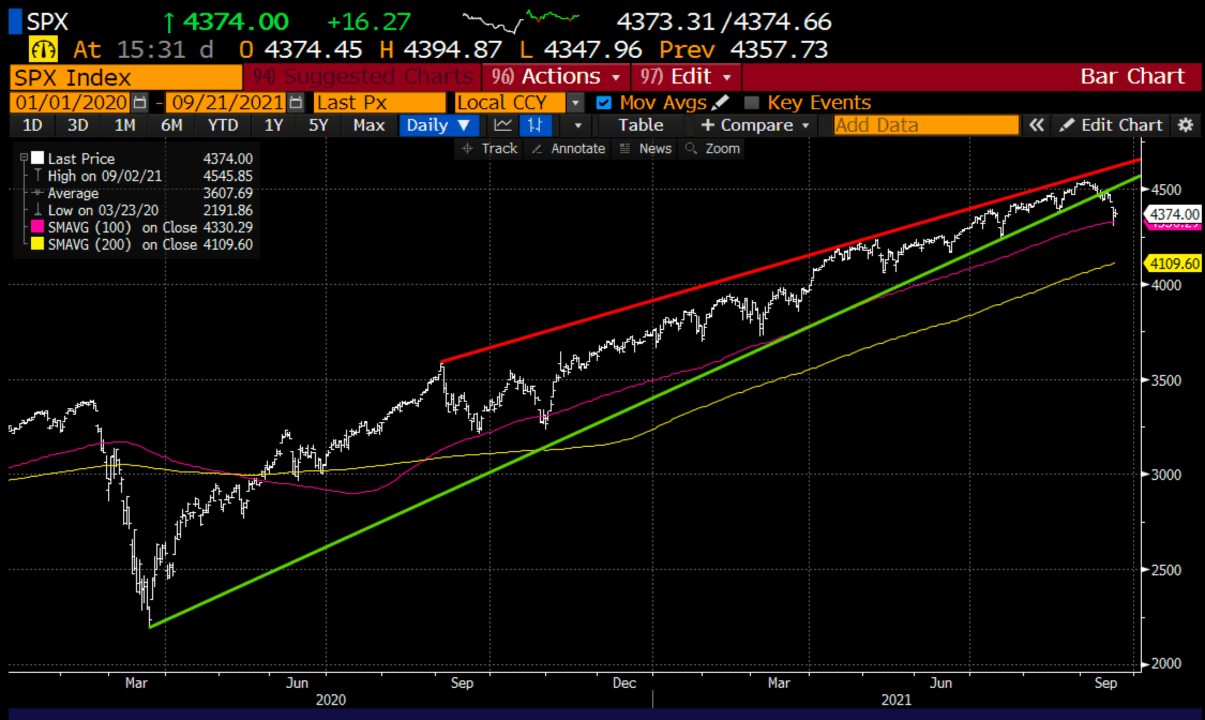

Macro: Global growth fears, spurred by fears of a credit contagion emanating from China, plus a continued spread of the C19 Delta variant and fear that the U.S. Federal Reserve may start to taper bond purchases soon caused investors to hit the pause button over the last week. Later today we will get some clarity from Fed Chair Powell at his post-meeting presser as to just how quickly the Fed will look to normalize interest rates, but before the Fed starts to move its feet investors will continue to wrestle with the uncertainty surrounding China’s regulatory crackdown on their “tech champions” and whether or not they will look to shore up Evergrande, the large property developer which has halted making interest payments on their $300 billion in debt.

All of this caused the trend to unfriend the S&P 500.

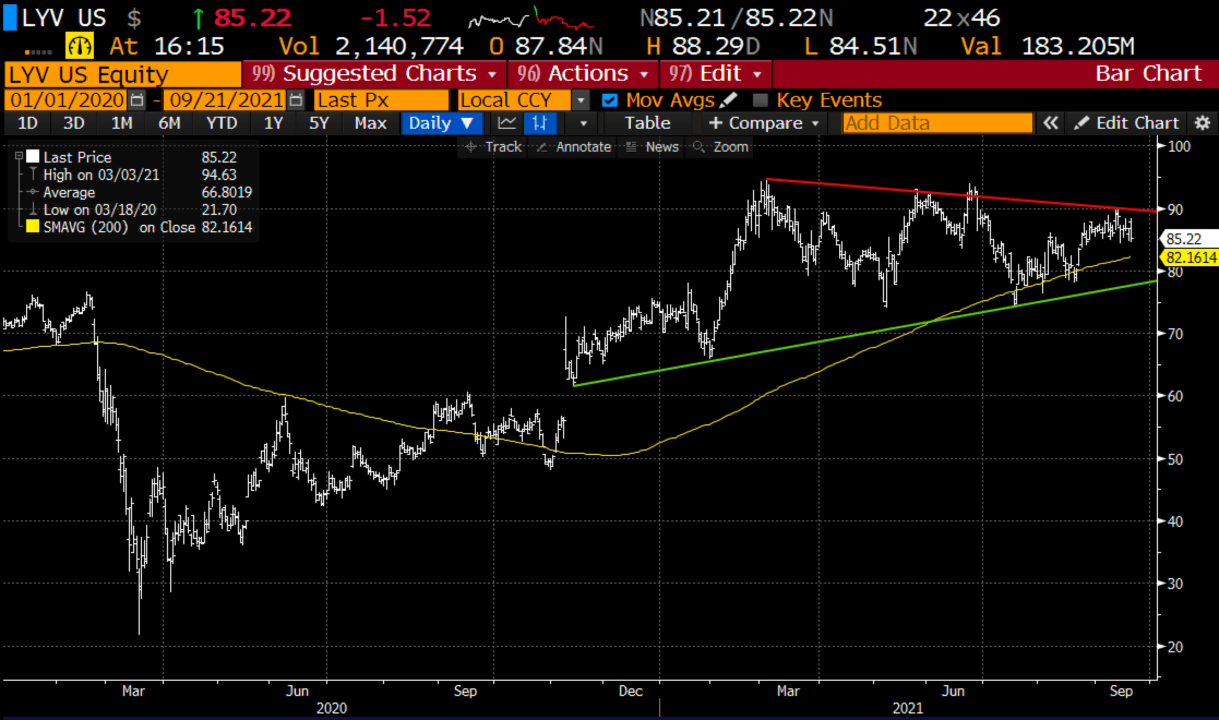

Trade Idea #1: Delta might still be raging, and lots of purchases for experiences might be slightly delayed, but there is one company that got rocked by the pandemic that is only looking forward and through their subsidiaries Ticketmaster and FrontGate Tickets they are racking up the fees for events in the future that will happen, and that’s LiveNation (LYV).

Personally, I can attest that one of my largest discretionary expenditures at the moment is tickets to concerts, festivals, and sporting events.

The company suffered steep earnings losses in 2020 which are continuing throughout this year, as revenues went from a peak of $11.55 billion in 2019 to just $1.8 billion in 2020 but are expected to rebound to a new all-time high of $12.7 billion in 2022 with GAAP eps to go to $1. This makes the stock look expensive after swinging from massive losses to gains, but the stock looks poised to break out of the range it has been in for the better part of the spring and summer as the events business has dealt with fits and starts from the delta variant.

The chart shows a bit of a triangle pattern forming with a series of lower highs and higher lows. If you think the fundamentals are about to inflect, then this stock could be making new highs by year-end.

Trade Idea: LYV ($88) Buy Jan 90 – 120 call spread for $6

-Buy to open 1 Jan 90 call for 7.50

-Sell to open 1 Jan 120 call at 1.50

Break-even on Jan expiration:

Profits of up to 24 between 96 and 120 with max gain of $24 above 120

Losses of up to 6 between 90 and 96 with max loss below 90

Rationale: this trade idea risks 7% of the stock price, has a break-even up 9% and a max gain of 27% if the stock is up 34% in 4 months.

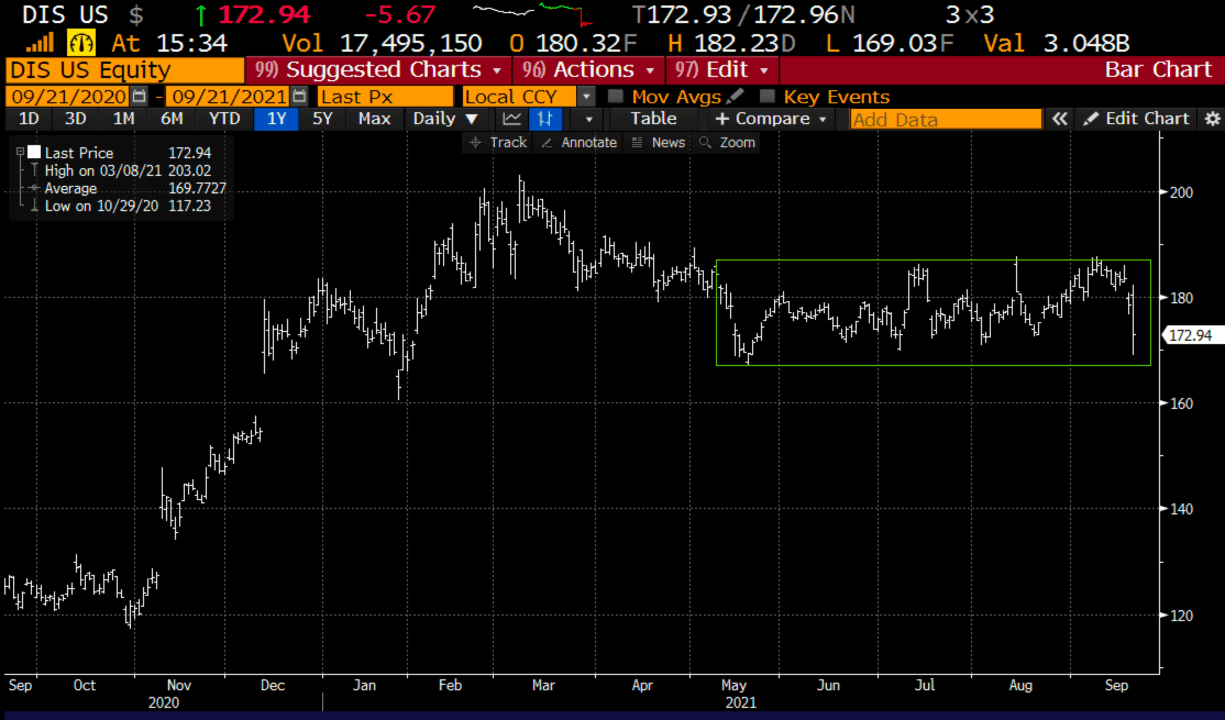

Trade Idea #2: Shares of Disney (DIS) were down 4% yesterday after the company revealed that Q3 and Q4 subscriber growth for their streaming Disney + service would be slower than previously expected.

The stock has been fairly rangebound over the last few months trading between $188 and $168, and now with today’s decline down on the year, and down about 15% from its all-time highs made in March.

The company is not likely to give a meaningful update to streaming guidance until their fiscal Q4 results in mid-November. Long holders of the stock might consider selling out of the money calls (over-writing their shares) to potentially add yield in what is likely to remain a range-bound stock.

Trade Idea: DIS ($174) vs 100 shares of stock Sell to open 1 Nov 190 call at $2.10

Break-even on Nov expiration:

Profits of the stock up to $190, with an effective call-away level at $192.10, up 11% in two months. If the stock is below 190 on Nov expiration then the call seller will receive the $2.10 in premium, or 1.2%. Annualized that would be nearly a 5% yield.

If the stock is 190 or higher on Nov expiration the 100 shares of stock that are long vs the 1 short call would match up and be called away, but the investor could always cover the short call and keep the long position intact.

The 2.10 in premium will serve as a small buffer to the downside.

Lookback – On Aug 31st I detailed a near-term bearish trade idea in shares of MSFT:

MSFT ($303) Buy Oct 300 put for $6

Now with the stock near $300 the Oct 300 put is worth about $7, it makes sense to spread this by selling a lower strike put in Oct expiration to reduce the premium at risk, for instance, the Oct 275 put is $3 bid, by selling 1 of those vs 1 Oct 300 put, the trader has reduced the premium at risk by $3, and now has a $25 wide in the money put spread for $3.