In The Money is brought to you by

Shortly after the open Wednesday, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from Wednesday’s show:

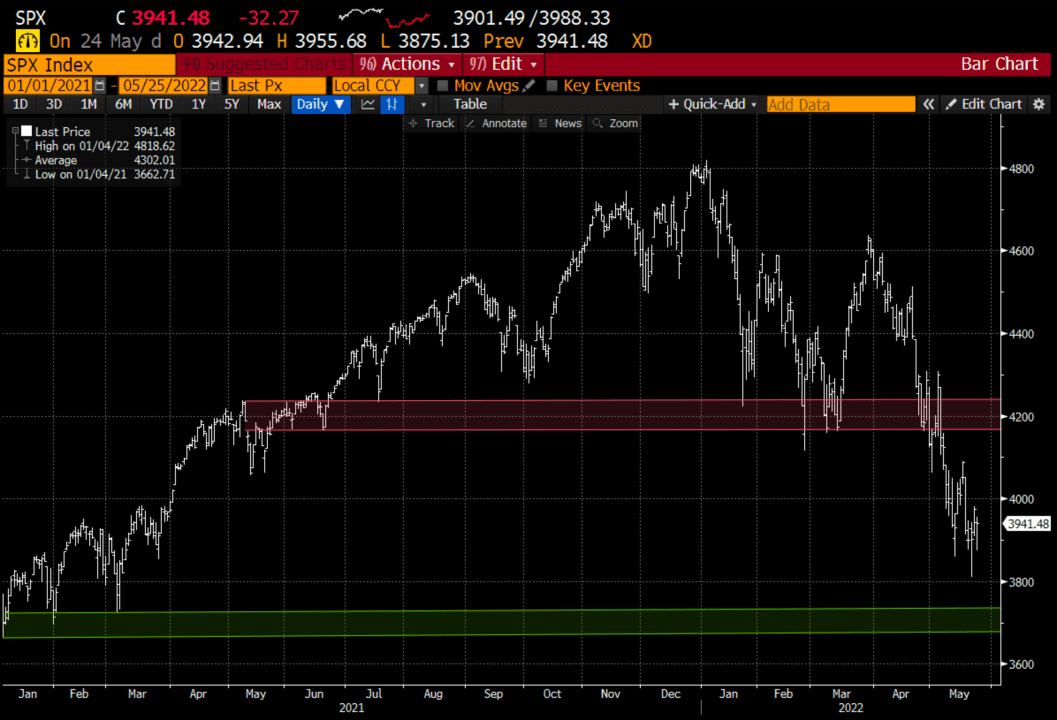

Macro: This is not exactly how investing/trading is supposed to go, but slip a coin, because the next 250 points in the S&P 500 (SPX) could go either way, back to what was prior technical support (now resistance) near 4200 or very near the 2021 low, made in January of last year near 3700:

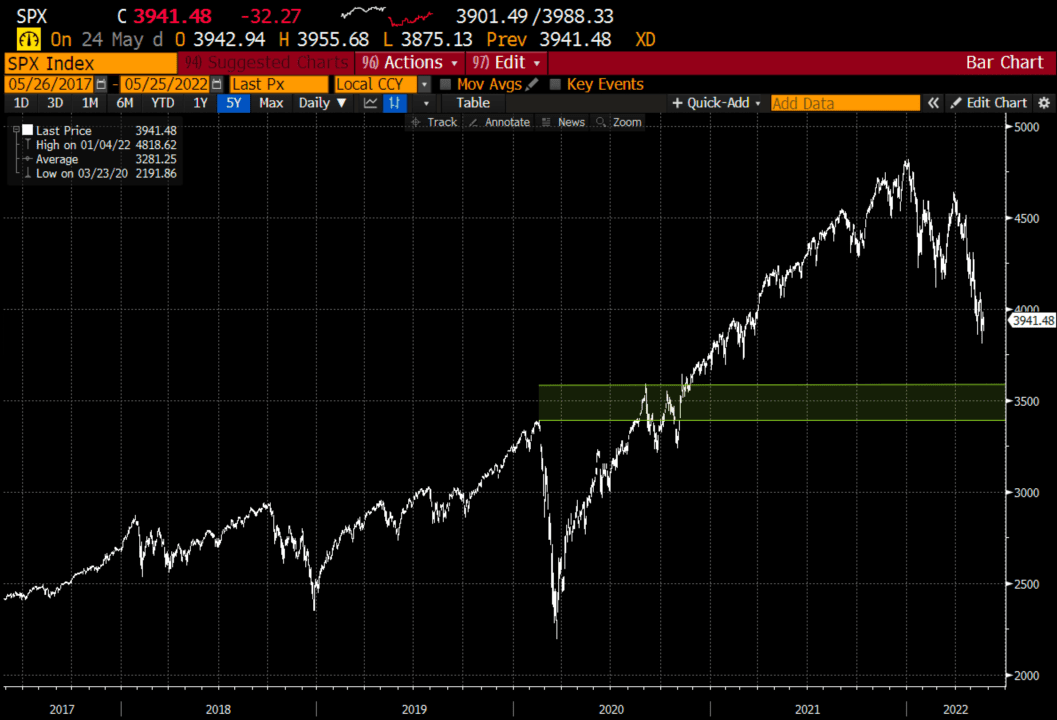

When we do in fact head south, there is a distinct possibility we round trip the move back towards the Feb 2020 pre-pandemic high near 3400:

This is not just a technical exercise though, I don’t believe that the current consensus for S&P 500 earnings growth of ~10%, which would place it around $230 a share is at all reasonable given what we know about inflation, supply chains, the Fed’s intent on raising rates and a weakening consumer is likely. Put the 10-year average multiple of 17x on 5% earnings growth for 2022 and you get about $210 and around 3535 on the SPX.

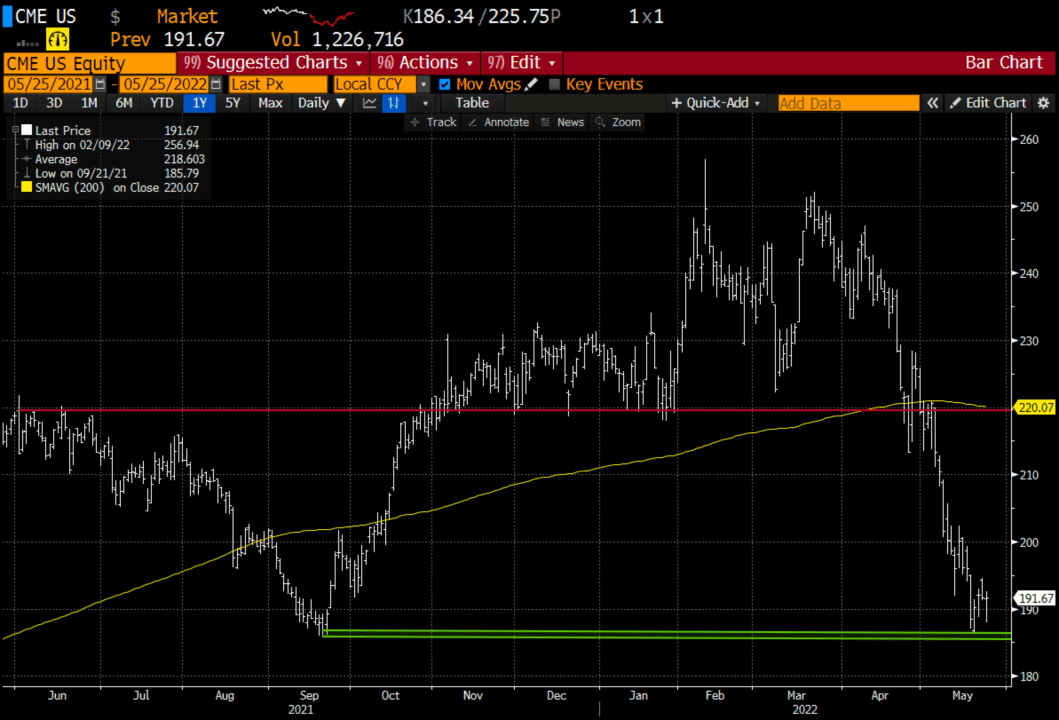

Trade Idea #1: Regardless of your view of this year’s market volatility, there are some companies whose business should be recession-proof and actually benefit from the volatility. One of those is the largest futures exchange on the planet, CME Group. Back in March the stock was making new all-time highs amidst the volatility and uncertainty around the Fed’s first rate increase in years, but since then, despite very strong Q1 results posted in late April the stock has sold off 25% and is down 16% on the year. EPS is expected to grow 18% this year on 8% sales growth, the stock should benefit from a rising rate environment as 25% of their business comes from interest rate products. From a technical perspective, the stock appears to be attempting to make a double bottom and could have a sharp move on a stock market rebound and good fundamental news back towards its 200-day moving average near $220

Bullish Trade Idea: CME ($194.50) Buy July 200 – 230 call spread for $6

-Buy to open 1 July 200 call for 6.50

-Sell to open 1 July 230 call at 50 cents

Break-even on July expiration:

Profits of up to 24 between 206 and 230 with a max gain of 24 above 230

Losses of up to 6 between 200 and 206 with a max loss of 4 below 200

Rationale: this trade idea risks 3% of the stock price, has a break-even up 4% and a max potential gain of ~12% if the stock is up 18% in a little less than two months.

Trade Idea #2: SNAP ($12.79) Shares of SNAP were down 43% yesterday on a negative pre-announcement, the stock is down about 85% from its 2021 all-time highs. I see the value, I don’t know when it will bottom, but I like the idea for those inclined to play for a bounce in the coming months to do so with defined risk. The last time the stock traded this low was 2020, in the throws of the pandemic crash. That year the company booked $2.5 billion in revenue, in 2022 that number should be around $5 billion and north of $7 billion in 2023. The company is more profitable on an adjusted basis and losses less money on a GAAP basis with a small expected loss next year. Most importantly analysts’ consensus for gross margins in 2023 is nearly 10 points higher than the 53% SNAP recorded in 2020. I also think that despite the near-term issues on the ad front SNAP is a unique social property and with a $20 billion enterprise value it could be a very attractive asset for a large media company.

Bullish Trade Idea: SNAP ($13.80) Buy July 15 – 22 call spread for $1.25

-Buy to open 1 July 15 call for $1.45

-Sell to open 1 July 22 call at 20 cents

Break-even on July expiration:

Profits of up to 5.75 between 16.25 and 22 with a max gain of 5.75 above 22

Losses of up to 1.25 cents between 15 and 16.25 with a max loss of 1.25 below 15

Rationale: this trade idea risks 9% of the stock price, but has a break-even 18% and a max potential gain of 40% of the stock price if it is up 57% in two months.

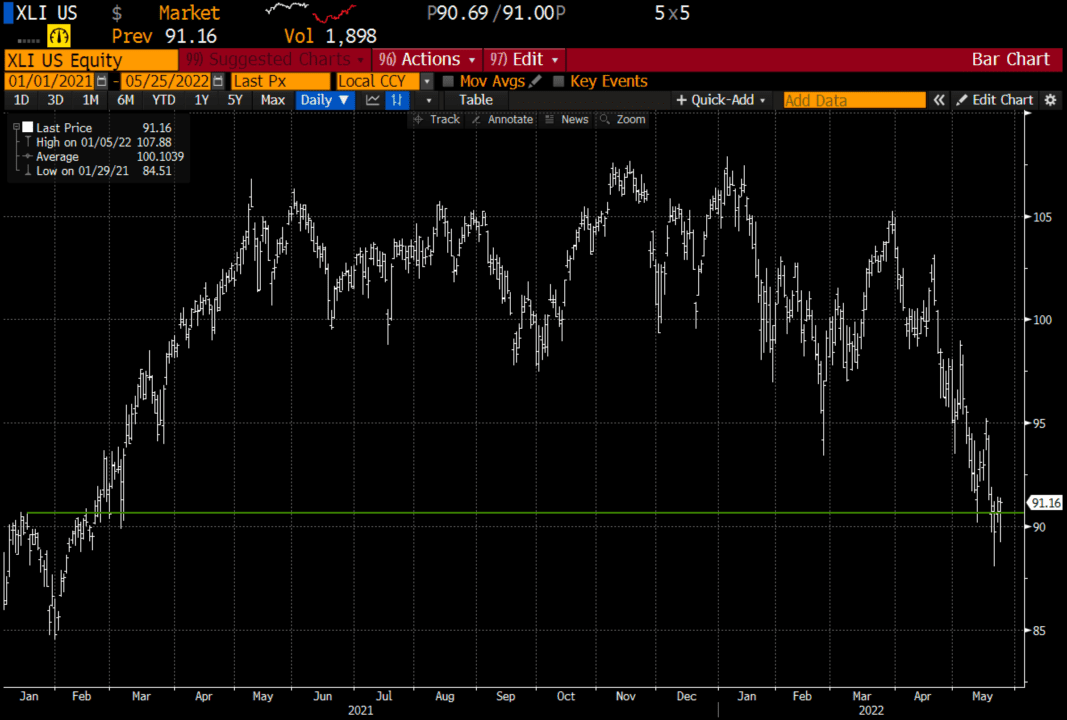

Lookback: Back on May 4 we took a bearish view on the XLI, the etf that tracks industrial stocks. Now with the XLI near $91, it makes a sense to revisit this trade idea:

XLI ($96.25) Buy July 96 – 86 put spread for $2.50

This $10 wide put spread that is now near the midpoint of the spread is worth ~5.25, or more than a double, I think it makes sense to take the profit and move on.