In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

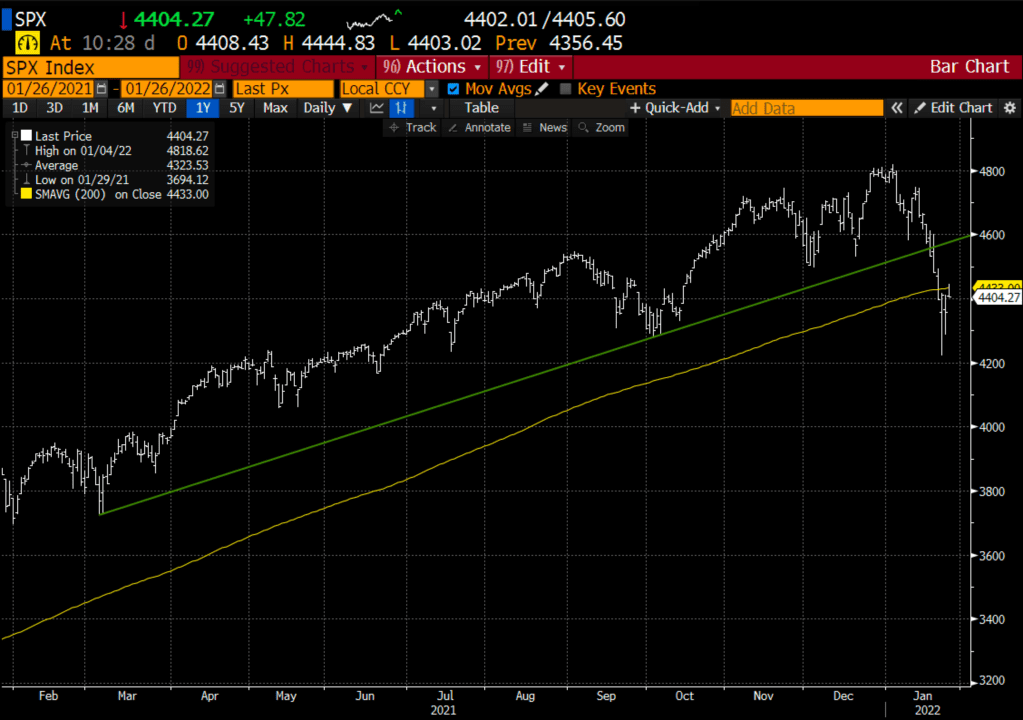

Macro: The stock market is a mess. There is no way to sugarcoat it. We have been suggesting for months that the concentration of the top 7 stocks, mega-cap, generally expensive tech stocks that made up nearly 30% of the S&P 500 (SPX) and 50% of the Nasdaq 100 (NDX) would become a problem if there was ever a reason for them to follow the dozens of stocks in the NDX and hundreds in the SPX that have been correcting for months. We have also discussed that the buy the dip mentality in the SPX that worked very well in 2021 was not likely to last, as it was one of 5 years in about 50 that had not seen a 10% peak to trough decline, with the worst drop just 5.5%. Now below its 200-day moving average for the first time since spring of 2020, a new high might be hard to come by in the near future as that uptrend that had been support for a year should now serve as healthy technical resistance.

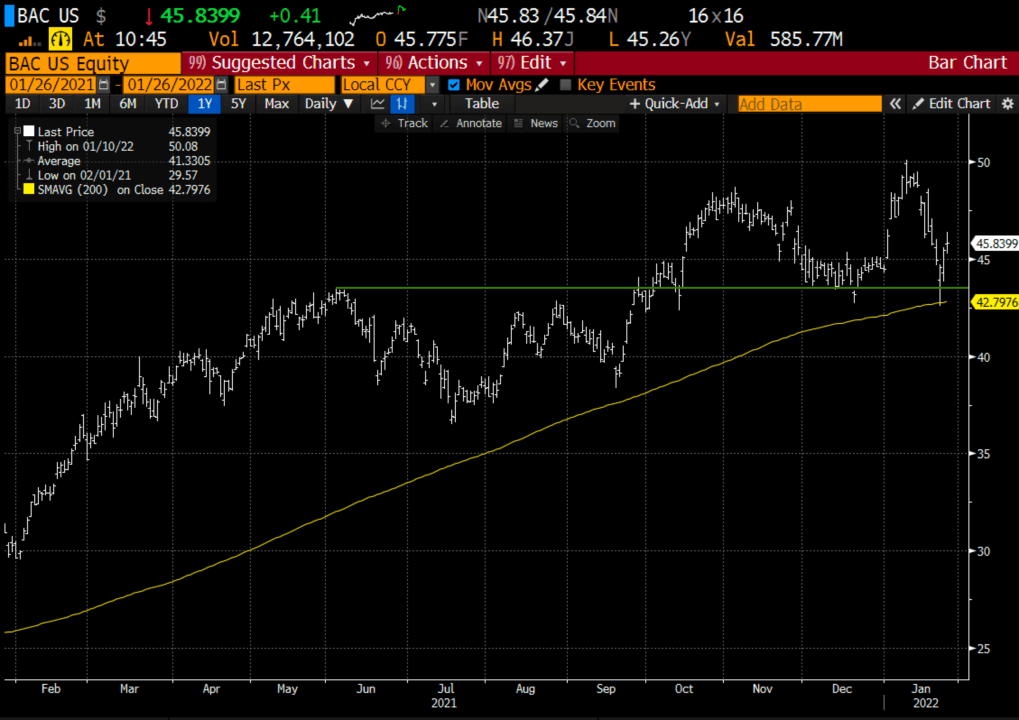

Trade Idea #1: Long BAC – In a market, like we are in now, if you are looking to be opportunistic with cash that has been waiting for a moment just like this, look to buy stocks that show good relative strength in the broad market and its sector, has delivered better than expected fundamental news in a challenging environment, reasonable valuation and has a strong technical set-up.

Bank of America fits that bill, down less than 10% from its recent highs, had better than expected earnings, trades cheap to its sector, and found support at its 200-day moving average and its breakout level from Oct:

If the market were to find its footing, and the yield curve was to steepen this would be good near-term for BAC’s net interest margins and likely propel the stock to a new high.

Bullish Trade Idea: BAC ($46.30) Buy Feb 48 – 50 call spread for 50 cents

-Buy to open 1 BAC Feb 48 call for 77 cents

-Sell to open 1 BAC Feb 50 call at 27 cents

Break-even on Feb expiration:

Profits of up to 1.50 between 48.50 and 50 with a max gain of 1.50 above 50

Losses of up to 50 cents between 48 and 48.50 with a max loss of 50 cents below 48

Rationale: While this trade has a break-even up 5% it is important to note the stock was trading there last week and if the stock were to rise 8% by Feb expiration this trade idea would be worth 3x the premium at risk. In a volatile market, risking 1% of the underlying for a near-term play back towards prior highs seems reasonable.

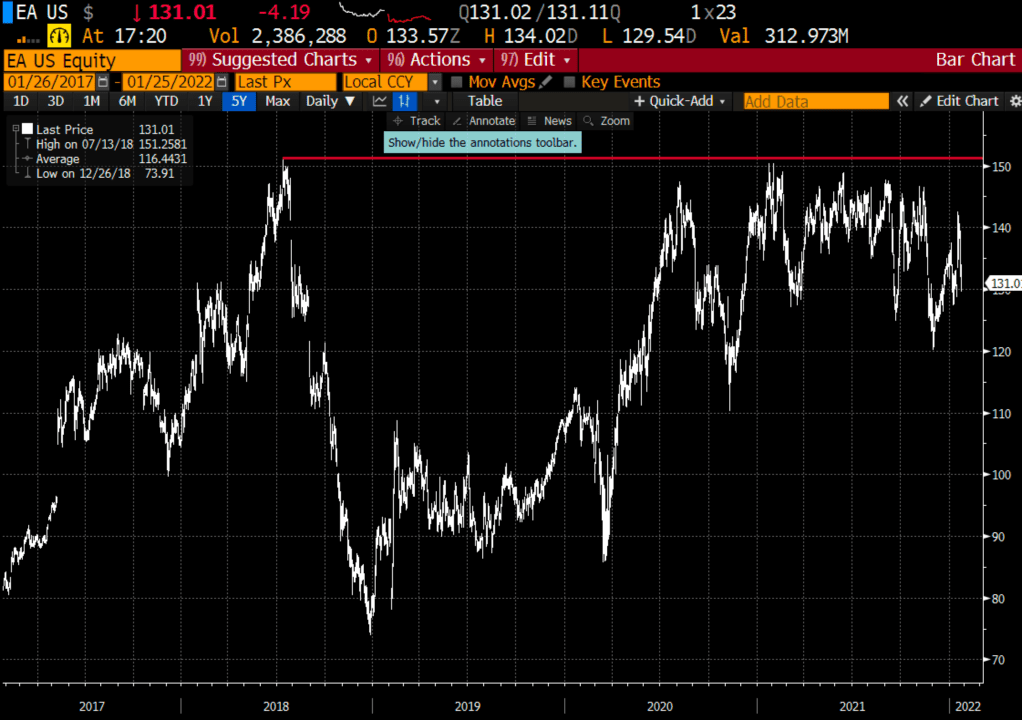

Trade Idea #2: Buy EA – last week before the market melted down, MSFT made a $70 billion cash bid for Activision (ATVI) as the company looks to bolster its content offering as they hope to create their own versions of metaverses as many of their competitors are squarely focused on own the real estate on your soon to be VR laden head. I am hard-pressed to see how EA, the dominant player in sports games, which has only a $37 billion enterprise value, is expected to grow earnings and sales 11% this year, and trades below a market multiple that does not screen as an attractive takeover candidate for a large media of platform company.

But with the recent market volatility, short-dated options prices are very expensive. Look to sell options to help finance the purchase of longer-dated options using a calendar structure. For instance a call calendar for those looking to express a directional view higher in a stock.

For instance…

Bullish Trade Idea: EA ($131) Buy Feb – June 140 call calendar for $5

-Sell to open 1 Feb 140 call at $2.60

-Buy to open 1 June 140 call for $7.60

Break-even on Feb expiration: If the stock is below 140 then the short Feb 140 call will expire worthless, leaving long the June 140 call, but for about a third less than it would have cost outright. The best-case scenario is the stock moves closer to the 140 strike, but expires worthless or can be converted for a small amount. In the event that the bullish stance remains then I might look to spread the June call by selling a higher strike call in the same expiration, further reducing my premium at risk,

If there was a deal for the company it would happen above the all-time highs near +$150.

Lookback #1 – Last week I detailed a defined risk way to play for a bounce in biotech stocks via the XBI ETF:

XBI ($96) Buy March 97 – 117 call spread for ~$5

The XBI has since come in hard below $92 and the call spread that cost $5 is now worth a little less than $4, not bad considering a 5% move lower. But vol has risen, helping the nearer the money long call. Stay the course, this is a good exercise in how small underlying moves can result in large vol moves.

AND

Lookback #2: On Jan 5th I detailed a bearish trade idea in Ford, thinking it had run too far too fast:

F ($23.60) Buy Feb 4th weekly 23.50 – 19.50 put spread for ~$1

Now with the stock around $20, the put spread is worth about $2.65, take the profit and move on.