In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

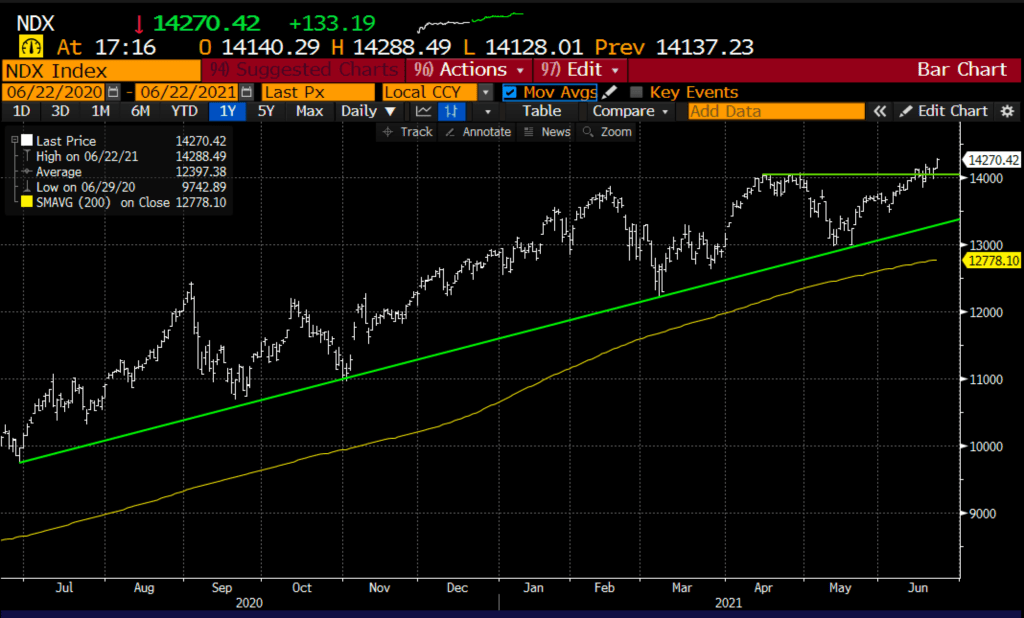

Macro: The first response by investors following last week’s Fed meeting was to sell the cyclical reflation trades, like banks, resources, and industrials, and buy tech, a sector that had been out of favor for much of the year as investors looked to more GDP exposed areas of the economy. Now that it appears the country is reopening for good, investors will have to contend with decelerating growth rates and may once again be interested in the recurring revenue streams of many of the leaders in mega-cap tech.

I suspect we see a solid week into quarter-end, and if stocks get too far ahead of themselves we could see a pullback to that uptrend and possibly towards the 200-day moving average if 2nd half guidance disappoints.

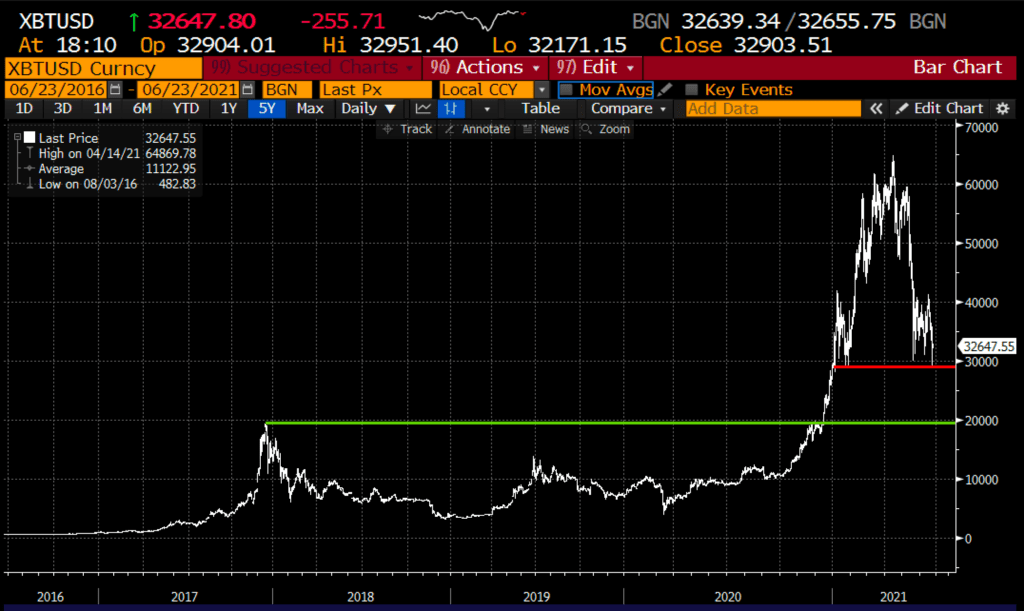

Trade Idea #1: Coinbase (COIN) came public through a direct listing in mid-April with a reference price of $250. Shares of COIN are down about 50% from its intra-day highs that day, Bitcoin’s all-time high, which is also down about 50% from its all-time highs made the same day.

COIN trades ok given the violent move of late in Bitcoin. And make no mistake, BTC is at a crucial technical spot, held at its Jan/Feb lows but below that there is an air pocket to the Dec highs near $20k.

COIN should report earnings in Mid July, and if BTC can hold here, then related equities could also rip.

Bullish Trade Idea: COIN (~$228) Buy July 250 call for $4

Break-even on expiration:

Profits above 254

Losses of up to 4 between 250 & 254 with a max loss of 4 below 250

Rationale: this trade idea breaks even up about 10%, which sounds like a lot, but this stock could be a coiled spring, risks ~2% of the stock price.

Trade Idea #2: Starbucks (SBUX) is the sort of stock that might have already priced in their reopening, and might also be adversely affected by input cost increases, including labor. I am not sure that revenge spending includes lattes that people might have gotten used to making themselves at home during the pandemic.

X Marks the Spot in SBUX. at least on the chart…

Bearish Trade Idea: SBUX (~$112) Buy July 112 – 107 put spread for $1.50

-Buy to open a July 112 put for $2.10

-Sell to open 1 July 107 put at 60 cents

Break-even on expiration:

Profits of up to 3.50 between 110.50 and 107 with max gain of 3.50 at 107 or lower

Losses of up to 1.50 between 110.50 and 112 with max loss of 1.50 at 112 or higher

Rationale: this trade idea risks about 1% of the stock price and has more than a 2 to 1 payout if the stock is down ~4.5% in a little less than a month.

Lookback: On May 5th when TWTR was $54 I detailed the following bullish trade idea

TWTR ($54) Buy July 55 – 70 call spread for ~$3

Now with the stock near $65, the call spread is worth about 9.50, take the profit and move on.