In The Money is brought to you by

Shortly after the open on Wednesday, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from the show:

Macro: Investors don’t seem the least bit bothered by inflation readings and expectations at 30-year highs. Stocks have rallied nearly 10% in a straight line since the start of October, placing the S&P 500 (SPX) up about 25% on the year at a new all-time high, while bond yields remain below the 52-week high despite the Federal Reserve’s recent announcement that they would begin to taper their bond purchases. It would appear that we are in a sort of “goldilocks” environment for investors as we head into a seasonally strong period for stocks.

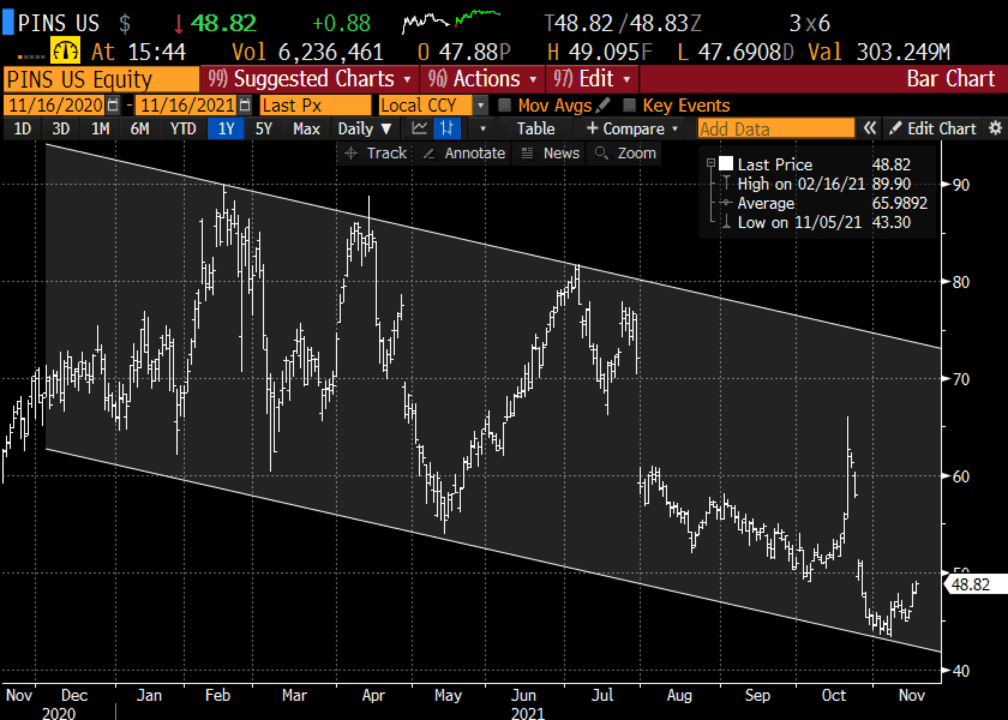

Trade Idea #1: Pinterest (PINS) was one of the companies that benefitted from all of us having too much time on our hands during the pandemic. The stock though has come off very hard from its all-time highs near $90 earlier this year as the company has seen a deceleration in many customer metrics which has caused investors to rethink its valuation.

A few weeks ago, prior to its disappointing earnings, the stock rallied to mid $60s on media reports that PayPal (PYPL) was considering a $40 or $45 billion bid for the company. The company came out and said they were not bidding and the stock made a new 52-week low, down 26% on the year, sporting a market cap of just $32 billion. I suspect there may be other interested parties, maybe a Walmart (WMT) who has invested heavily in digital sales and would benefit from a property that could provide lead generation as they diversify away from groceries.

The chart is a trainwreck, but it has had a history this year of sharp rallies after sharp declines, we could be setting up for such a move again soon:

Bullish Trade Idea: PINS ($48) Buy Jan 50 – 65 call spread for $2.50

-Buy to open 1 Jan 50 call for 3

-Sell to open 1 Jan 65 call at 50 cents

Break-even on Jan expiration:

Profits of up to 12.50 between 52.50 and 65 with a max gain of $12.50 at $65 or higher

Losses of up to 2.50 between 50 and 52.50 with a max loss of 2.50 below 50

Rationale: this trade idea risk 5% of the stock price, has a break-even up 7.5%, and has a max gain of 5x the premium at risk or about 25% of the stock price if the stock is up 33% in two months. IN 2021 PINS has had three 40% plus rallies in less than two months and one 30% plus rally.

Trade Idea #2: It’s my view that inflation expectations are peaking and the bond market is sniffing this out, but the dollar’s rise should also be bearish for gold. lastly, Bitcoin has recently been corrected but it is my view that crypto, in general, is taking incremental investment dollars that would have prior gone to gold as an inflation hedge, but crypto has other uses than just an inflation hedge.

GLD recently broke out of the uptrend that has been in place from its all-time highs back in August 2020 but as inflation fears abate, and if Bitcoin were to rally I suspect GLD re-tests its moving averages in the mid $160s where it was a few weeks ago:

Bearish Trade Idea: GLD ($174) Buy Dec 173 – 165 put spread for $2

-Buy to open 1 Dec 173 put for $2.50

-Sell to open 1 Dec 165 put at 50 cents

Break-even on Dec expiration:

Profits of up to 6 between 171 and 165 with max gain of 6 at 165 or lower

Losses of up to 2 between 171 and 173 with a max loss of 2 at 173 or higher

Rationale: this trade idea risks 1.1% of the etf price, has a break-even down 1.7% and has the potential to make up to 3x the premium at risk if the etf is down 6.3% in a month.

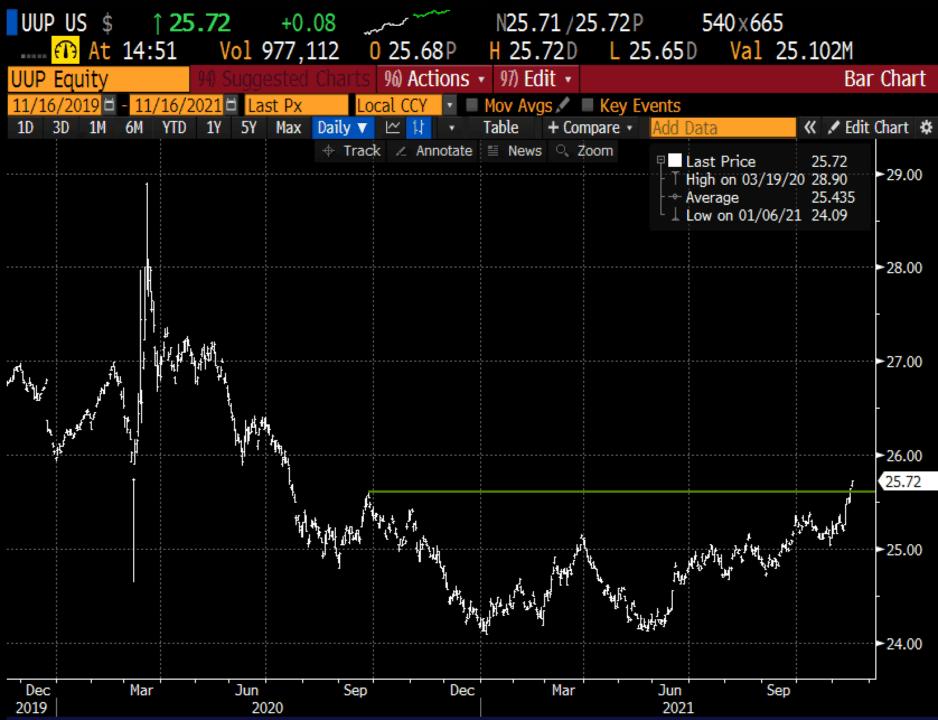

Lookback: On Sept 28th I made a bullish case for the U.S. Dollar

UUP ($25.17) Buy Dec 25 call for 34 cents

Now the UUP is $25.72 and the Dec 25 call is worth 72 cents for more than a double. I still think the dollar has more to run but I might consider rolling the Dec 25 call to the Dec 26 call.

-Selling to close 1 Dec 25 call at 72 cents and

-Buy to open 1 Dec 26 call for 12 cents