In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

Macro: Pockets of investor euphoria over the last year are correcting meaningfully, work from home stocks, recent IPOs, SPACs, and Crypto. There appears to be more of a value bent as some of the best-performing groups of late in the stock market are banks, homebuilders, oil and material stocks. The combo of the disappointing April Jobs report, last week’s weaker than expected retail sales, and yesterday’s poor housing starts might suggest that investors are thinking that the recovery is priced in at current levels.

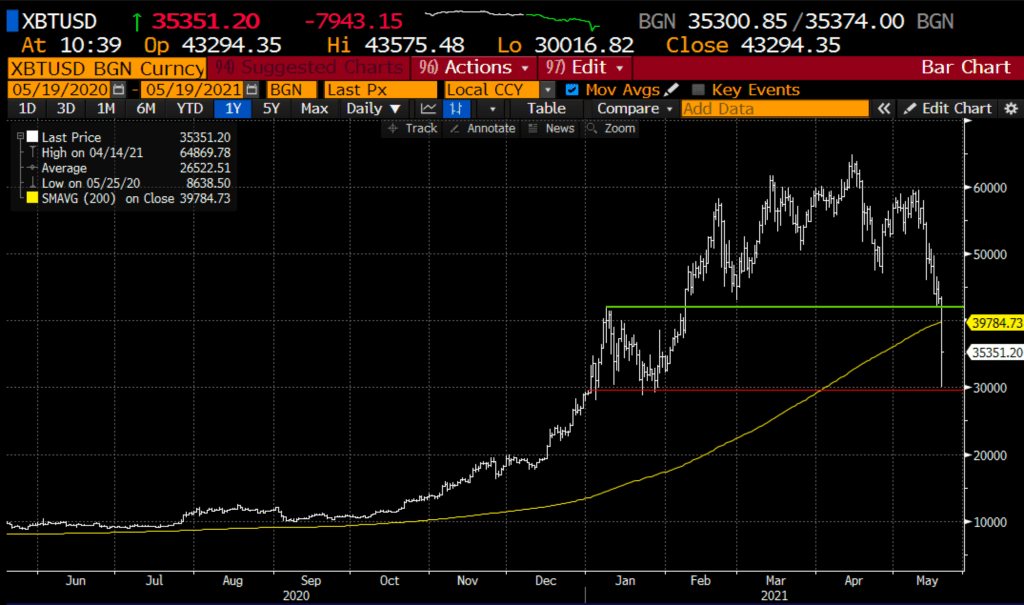

Bitcoin is on just about every investor’s radar of late, like the near-perfect personification of risk appetite. What does Wednesday’s crash and hold at support mean for the digital store of value?

Trade Idea #1: Bearish GLD – It is worth noting that Gold has bounced of late as Bitcoin has sold off, which is the exact opposite of what happened when Bitcoin started to rally last summer. No matter what happens with BTC here, I suspect long term the bullish case for Gold has been diminished by BTC’s acceptance and adoption by many very well-established financial institutions and tens of millions of individuals globally who see it as a superior store of value to the shiny metal.

GLD just broke above the downtrend from its 2020 and decade-long highs. I suspect if BTC holds GLD comes in, but if BTC gets creamed too, I can’t see GLD being all of the sudden the desired store of value after what we have seen over the last year in crypto (ie: development and adoption).

Bearish Trade Idea: GLD ($176) Buy Sept 175 – 155 put spread for ~$5

-Buy to open 1 Sept 175 put for $5.85

-Sell to open 1 Sept 155 put at 85 cents

Break-even on Sept expiration:

Profits of up to 15 between 170 and 155 with max gain of 15 below 155

Losses of up to 5 between 170 and 175 with max loss of 5 above 175

Rationale: this trade idea risks ~3% of the ETF price, breaks even down ~3%, and has a max potential gain of ~9% if the GLD is down 12% in 4 months.

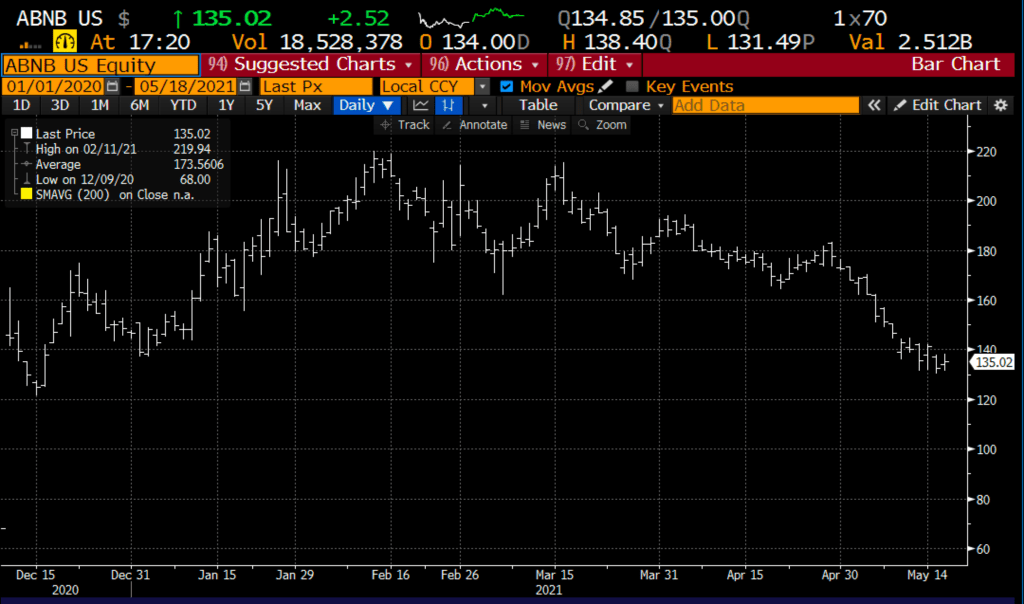

Lookback: ABNB on Apr 28th I detailed a bullish trade idea into their first quarterly report as a public company:

ABNB ($180) Buy May 180 – 215 call spread for $7

The stock is now 135, yes $135 down 25%, that was a horrible call. The spread is now worthless, and this is a good lesson that often defining your risk in speculative names makes sense, this trade loses 4% as opposed to 25%, but I would also add that this is a good example of when the stock started going the wrong way almost immediately that using a 50% premium stop on long premium directional trades makes a lot of sense.