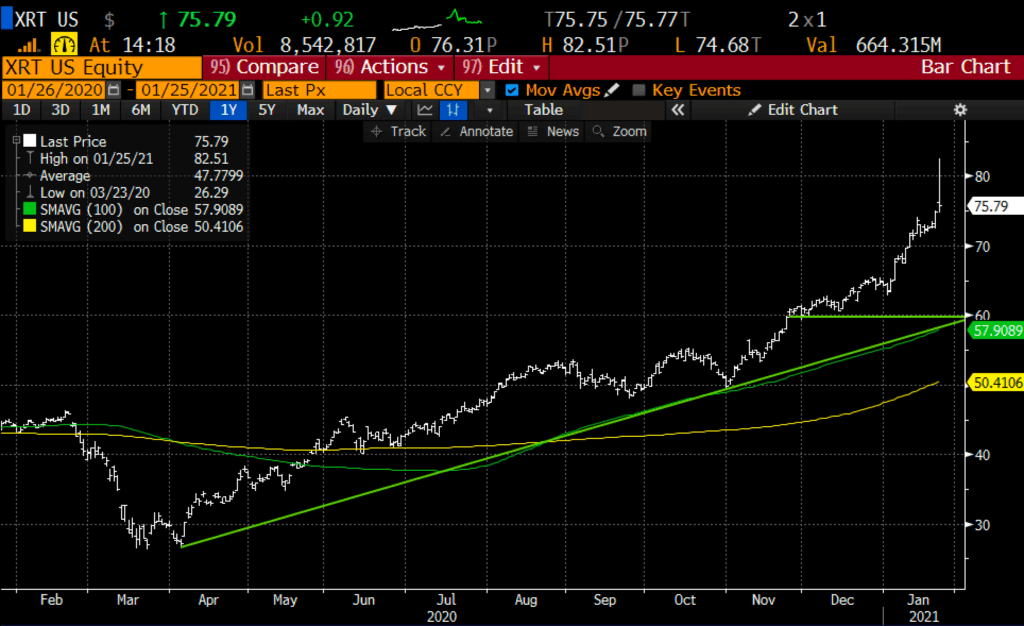

My Main Man Carter Braxton Worth, Technician Extraordinaire from Cornerstone Macro Research issued the following report today on Retail Stocks, as measure by the XRT, the S&P Retail etf, suggesting that today’s reversal from an all-time high is a form of “textbook/classic exhaustion”. Carter highlights the following charts to make the case to take profits in or short retail stocks and buy Consumer Discretionary:

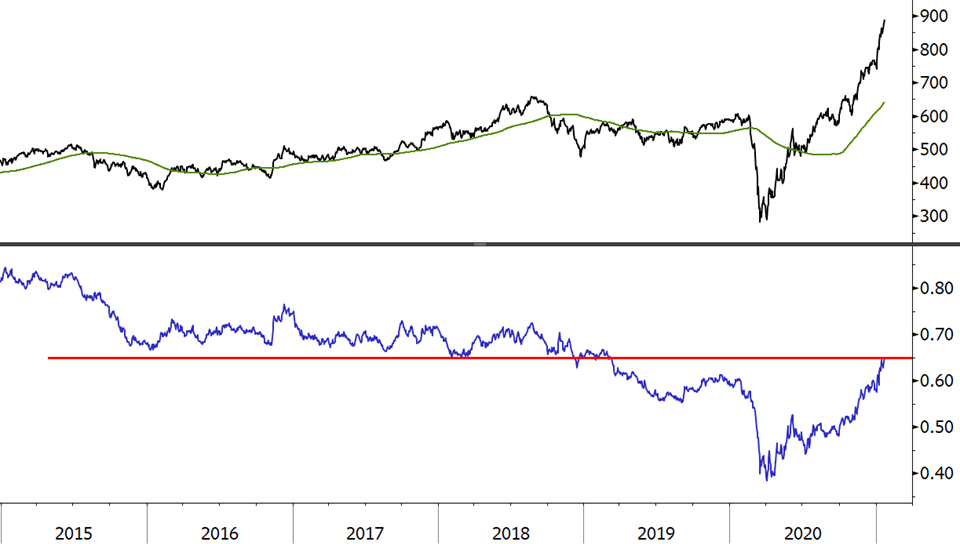

S&P 600 Small Cap Consumer Discretionary Sector with its 150-day moving average (top panel)

Relative Performance to the S&P 500 Large Cap Consumer Discretionary Sector (bottom panel)

A recovery to a difficult level (one way to draw the lines)

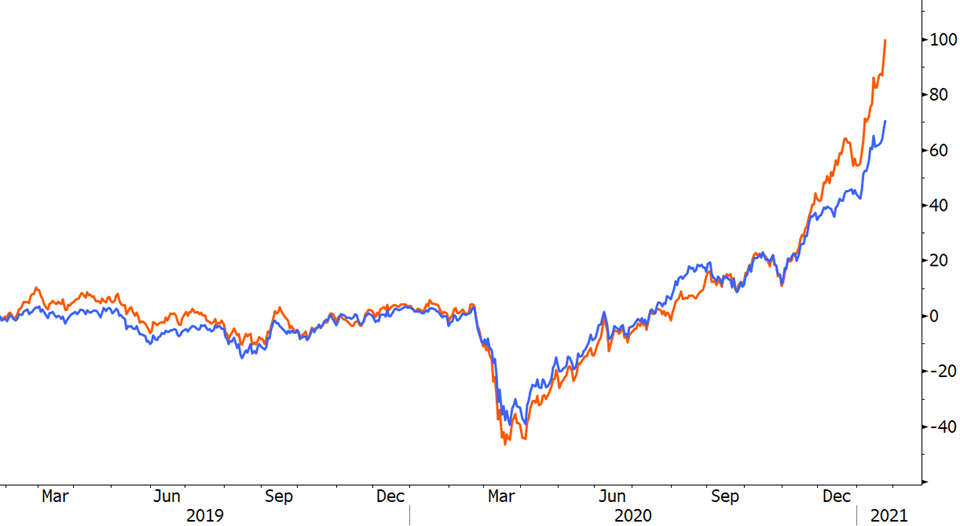

He adds that XRT’s recent gains have been fueled by heavily shorted stocks in the etf:

Goldman Sachs Most Short Rolling Index vs. SPDR S&P Retail ETF (XRT)

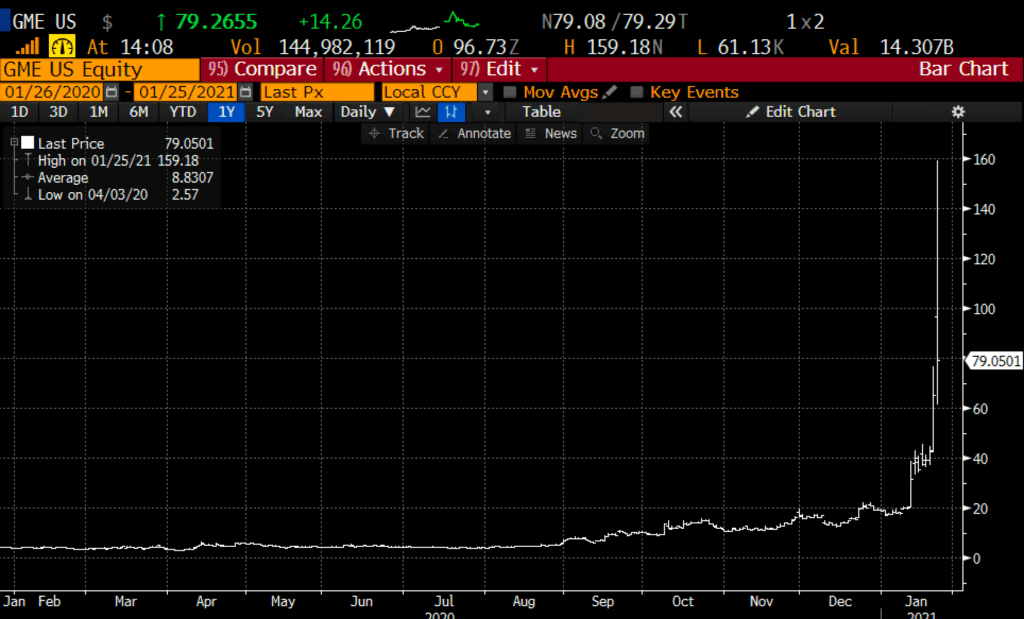

Exhibit A, GameStop (GME), which is up 300% on the year, and down more than 50% from its highs TODAY:

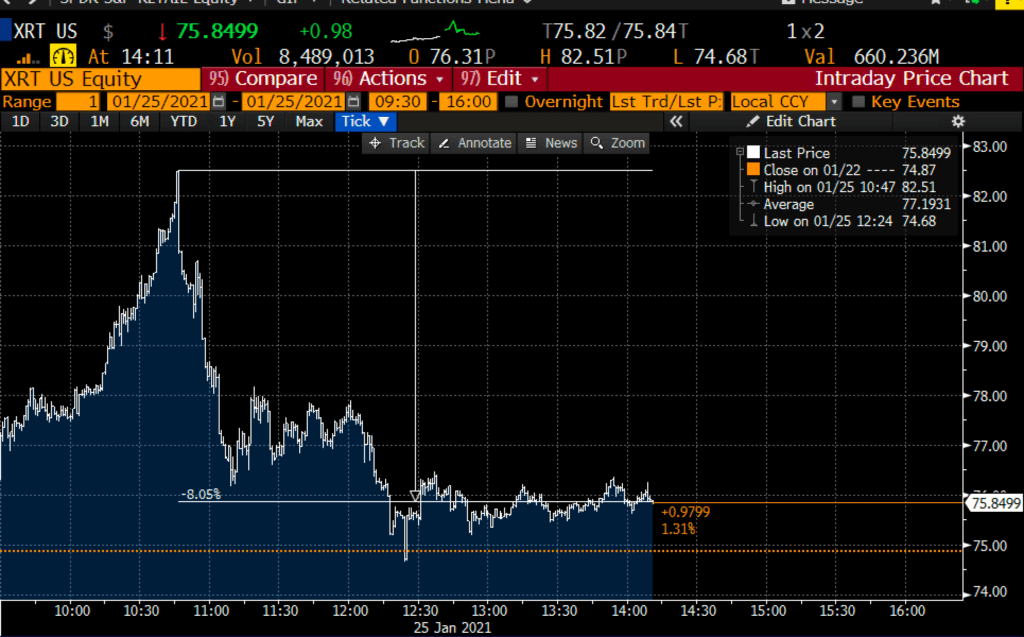

IN the last few days GME has become the largest weighted stock in the XRT, today nearly 5%, with the next largest component just below 2%. The XRT is up 16% on the year, down 8% today from its highs this morning…

The XRT is 50% above its 200-day moving average, and to my eye, a near-term target on a pullback could be the intersection of its early December breakout and the uptrend from its March lows, and also the 100-day moving average.

If you agree with Carter’s outright technical take on XRT and think the fever broke in GME and other heavily shorted retail stocks like Macy’s (M) were going to give back some recent gains that have NOTHING to do with fundamentals, then I might consider buying a put spread in February expiration, for instance:

Bearish Trade Idea: XRT ($76.25) Buy Feb 75 – 65 put spread for $2.50

-Buy to open 1 Feb 75 put for $3.10

-Sell to open 1 Feb 65 put at 60 cents

Break-even on February expiration:

Profits of up to 7.50 between 72.50 and 65 with a max gain of 7.50 at 65 or lower

Losses of up to 2.50 between 72.50 and 75 with a max loss of 2.50 at 75 or higher

Rationale: this trade idea risks 3.3% of the etf price, has a break-even down ~4.5%, and has a max gain of 10% if the etf is down 15% in a month.

Lots of market participants are acting like this GME situation is somehow new…

I’ll just quote Slim Charles from The Wire: “Game’s the same, just got more fierce”