Guy Adami and I are back with our weekly video podcast series The Macro SetUp brought to you by our presenting sponsor IG US, one of North America’s fastest-growing foreign exchange brokers. See the charts referenced in the video below.

Topics:

“Bidenomics”

U.S. Debt Binge…

What the promise of added stimulus, QE forever, structurally low rates and possible infrastructure spending means for risk assets like stocks.

Key to not having a double-dip recession, successful vaccine rollout.

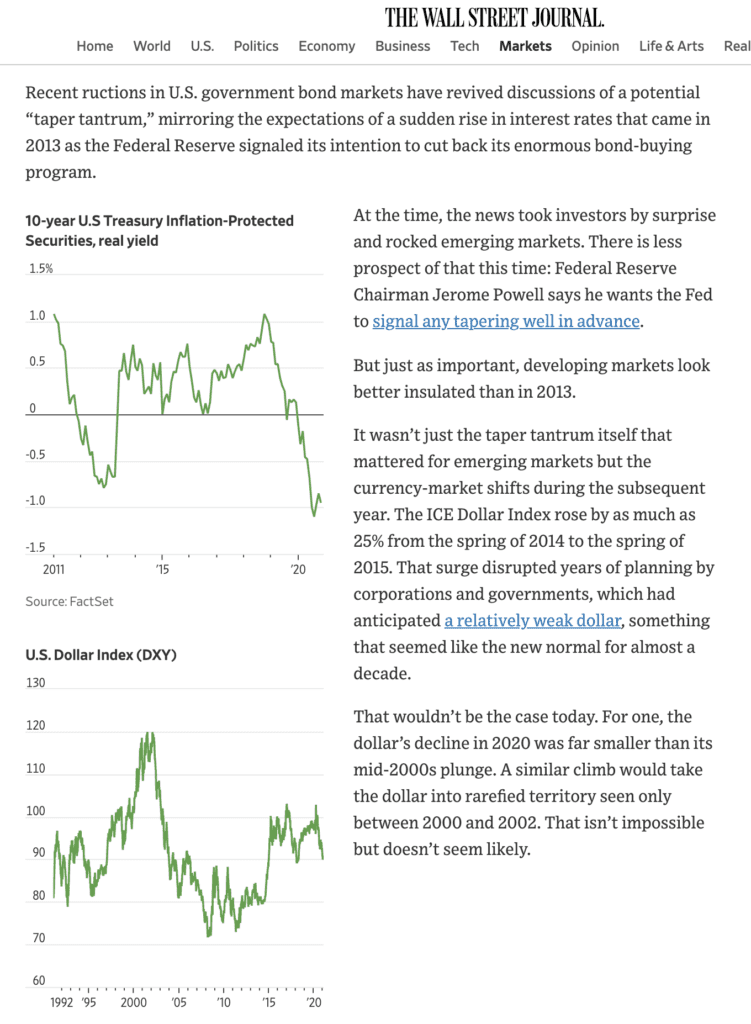

Implications for U.S. Dollar and inflation expectations from WSJ today:

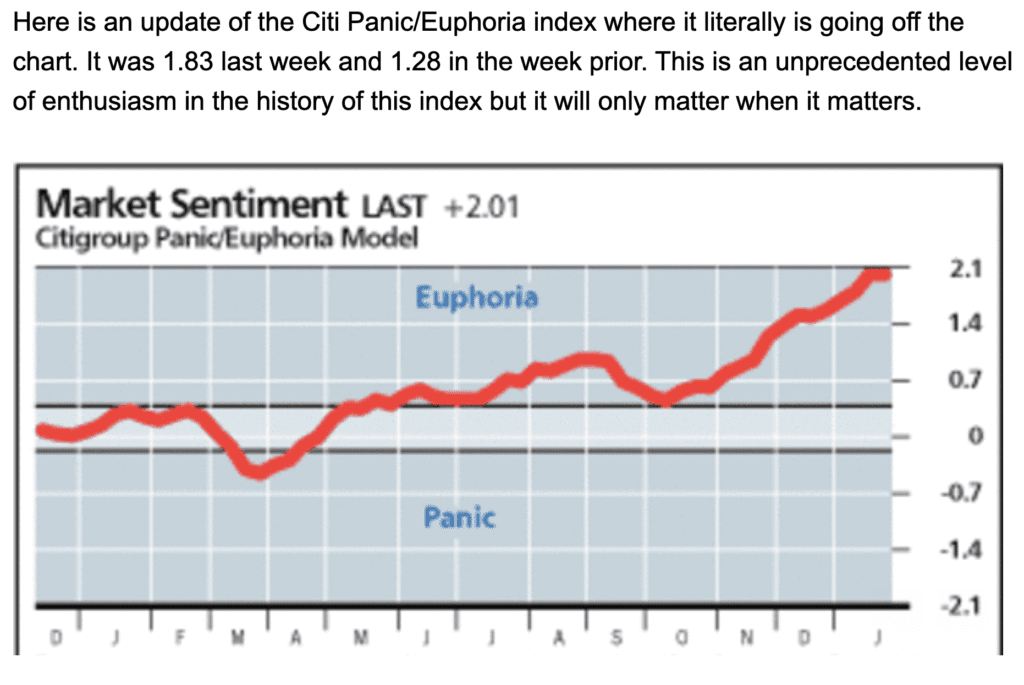

What does it mean for Stocks?? Our friend Peter Boockvar from Bleakley Advisors points to screaming sentiment:

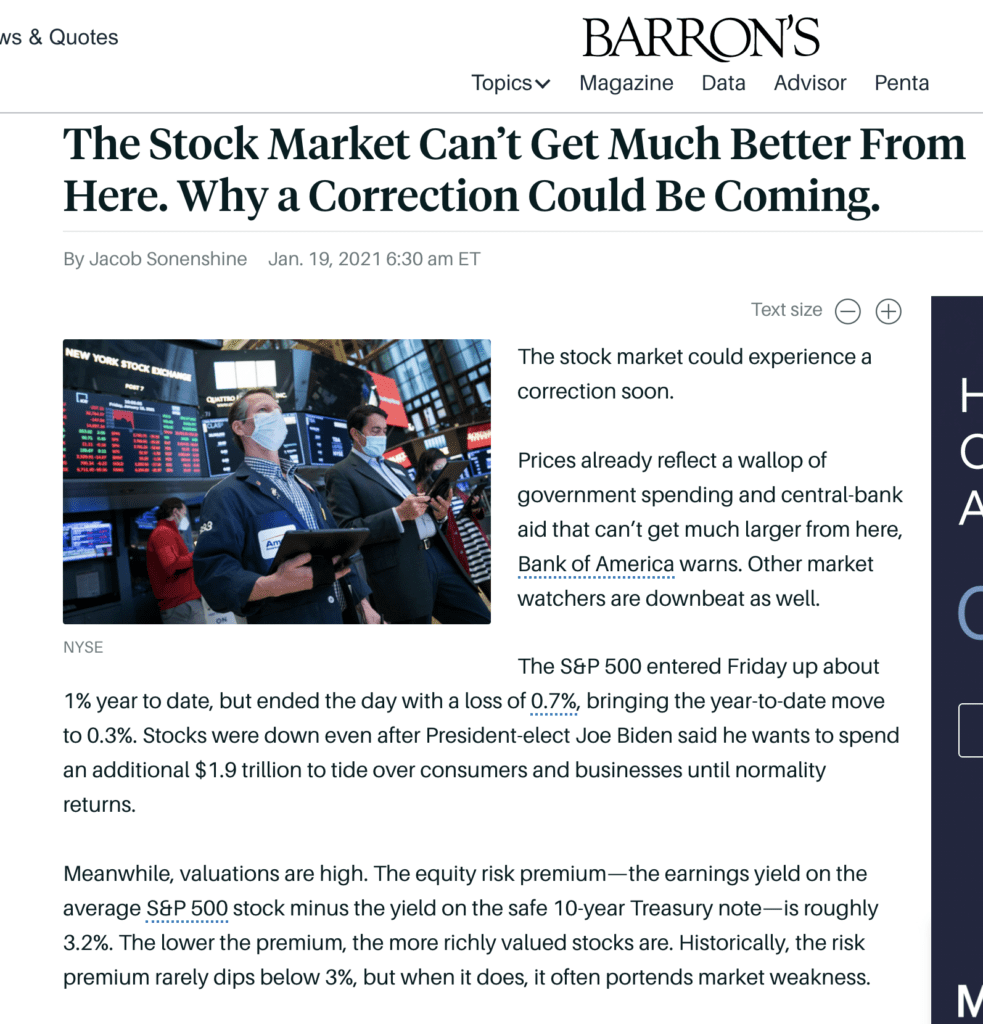

Barron’s highlights what may be priced into equity valuations at current levels:

Reuters is reporting this morning:

China’s economy picks up speed in fourth quarter, ends 2020 in solid shape after COVID-19 shock

China’s economy picked up speed in the fourth quarter, with growth beating expectations as it ended a rough coronavirus-striken 2020 in remarkably good shape and remained poised to expand further this year even as the global pandemic rages unabated.

Gross domestic product grew 2.3% in 2020, official data showed on Monday, making China the only major economy in the world to avoid a contraction last year as many nations struggled to contain the COVID-19 pandemic. And China is expected to continue to power ahead of its peers this year, with GDP set to expand at the fastest pace in a decade at 8.4%, according to a Reuters poll.

The world’s second-largest economy has surprised many with the speed of its recovery from the coronavirus jolt, especially as policymakers have also had to navigate tense U.S.-China relations on trade and other fronts.

Bloomberg: EU Eyes Dollar’s Global Dominance in Bid to Bolster the Euro

The European Union will unveil its plan on Tuesday to strengthen the international role of the euro as it seeks to erode the dominance of the U.S. dollar and to insulate the bloc from financial risks, including U.S. sanctions.

The European Commission blueprint will outline how the region can fortify its economic and financial resilience by bolstering the single currency’s architecture and through growing markets like green finance, according to a draft of the plan seen by Bloomberg.

CHARTS:

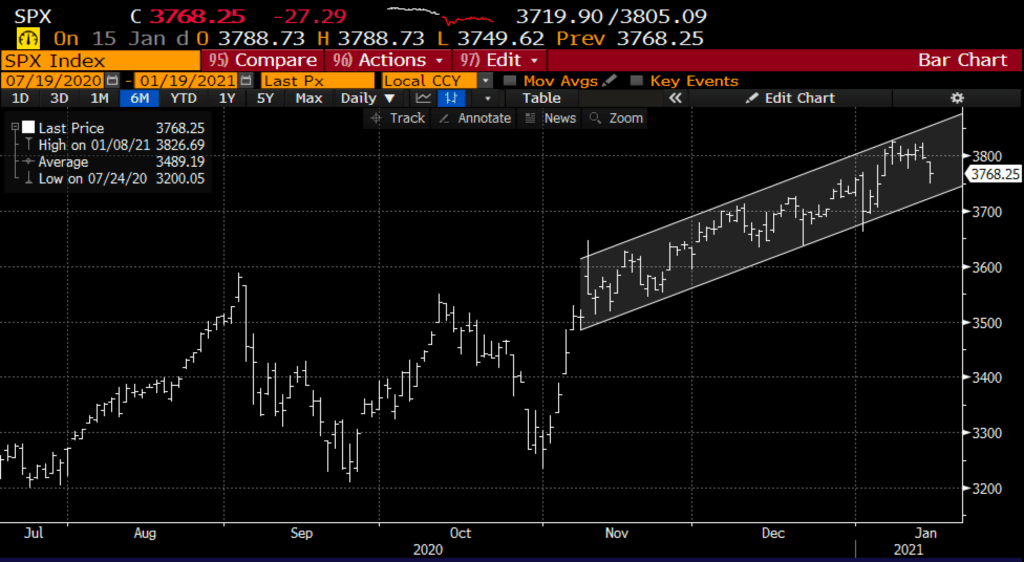

SPX 6month:

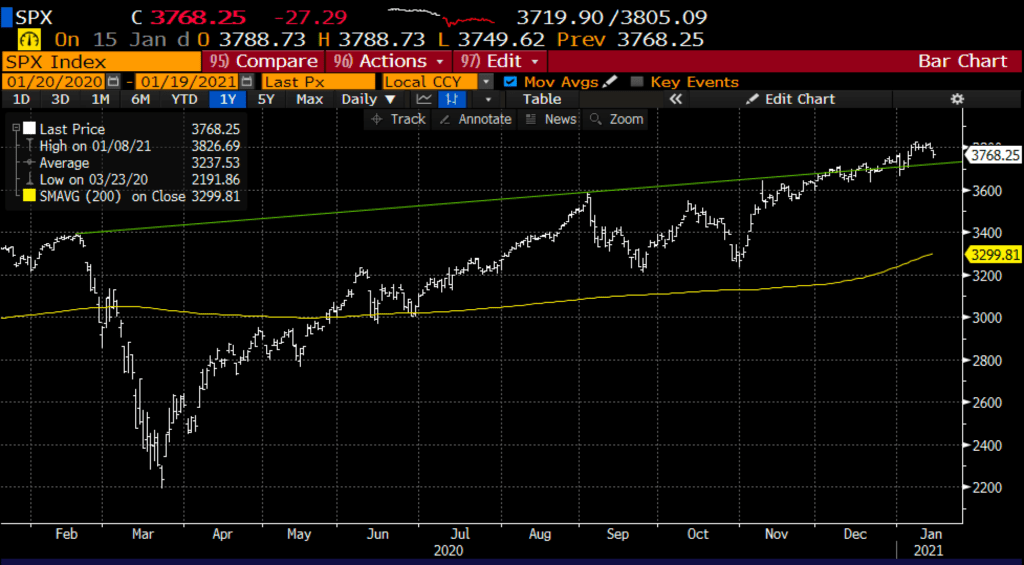

SPX 1yr:

Nasdaq 100 (NDX) 1yr:

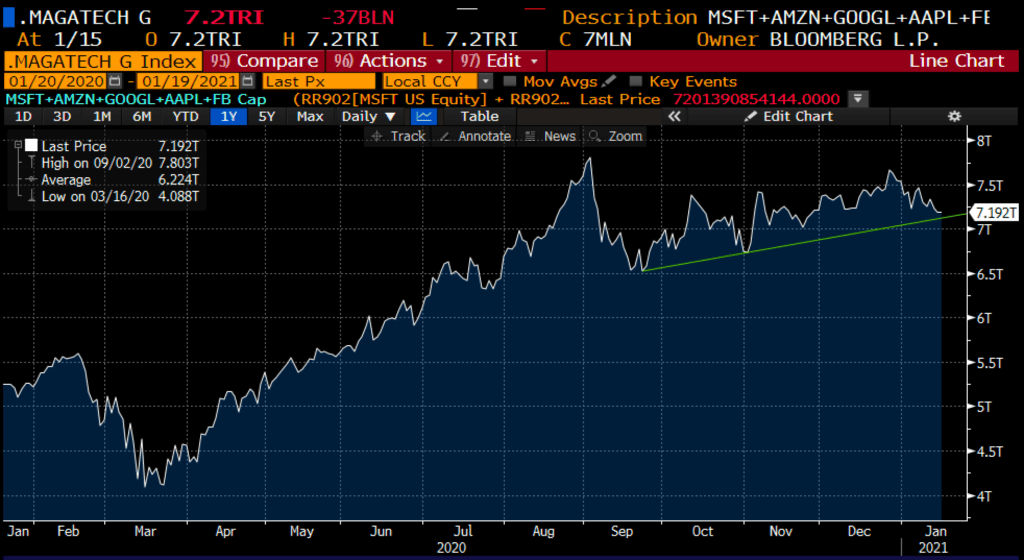

F’MAGA Market cap:

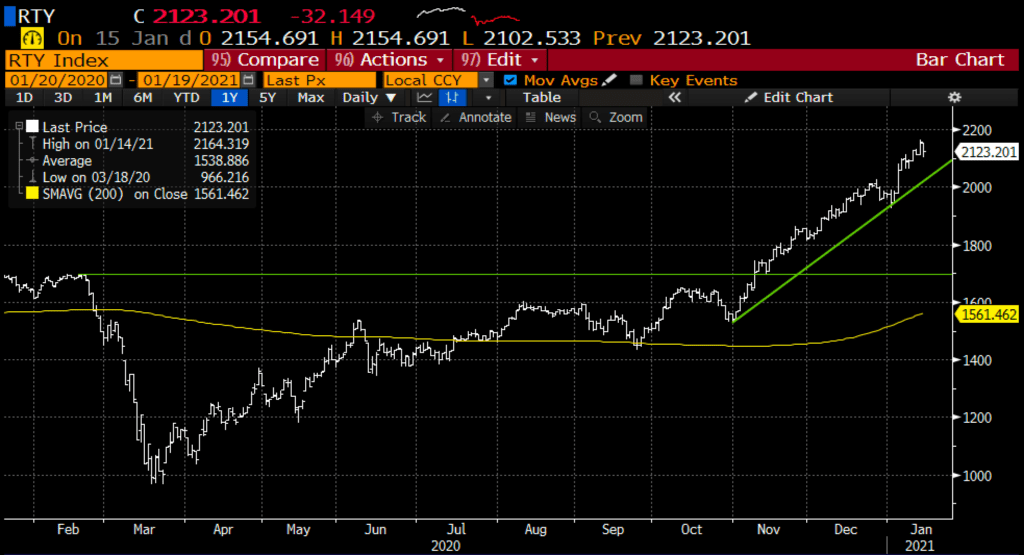

Russell 2000 (RTY) 1yr:

VIX 2yr:

10yr U.S. Treasury Yield, 1yr chart:

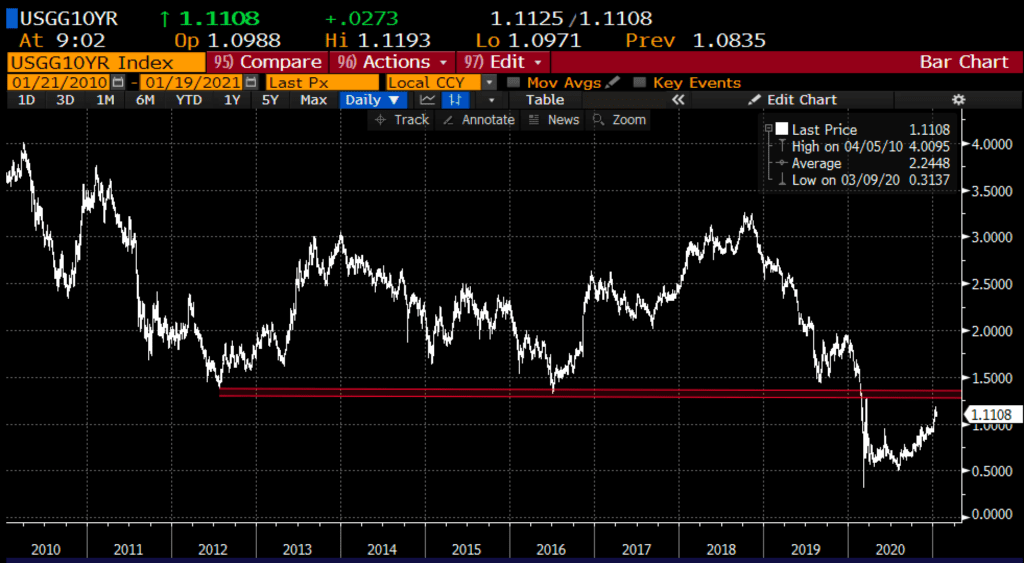

10yr U.S. Treasury Yield, 10yr chart:

USD (DXY) 1yr

USD (DXY) 10yr

Gold XAU 1yr

Bitcoin 5yr

Bitcoin 1yr