Microsoft (MSFT) will report its fiscal Q2 results today after the close. The options market is implying about a 4.5% one day move tomorrow. With the stock near $232.50, the weekly at the money Jan 29th 232.50 straddle (the call premium + the put premium) is offered at about $10.50, or about 4.5% of the stock price, if you bought that and thus the implied move you would need a rally above $243 or a decline below $222 by Friday’s close to make money. Shares of MSFT have only moved about 3.3% on average the day following their last four earnings reports, with the last two down about 4.5% the next day.

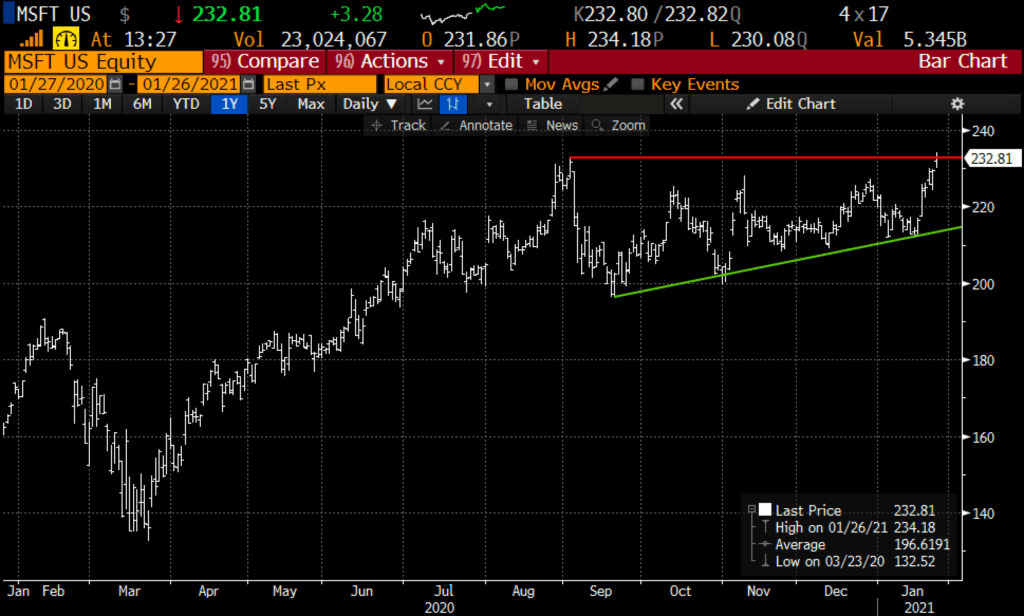

Shares of MSFT are up 4.3% on the year, today making its first new high since Sept 2nd, threatening a breakout after a more than 4-month consolidation:

My friend and Fast Money guest Jared Weisfeld, Tech specialist over at Jefferies offers the following setup into tonight’s print in a note to clients this morning:

All eyes are on Azure Constant Currency Growth. The street is sitting at 41% y/y Azure Revenue Growth for the December quarter and buyside wants more – but expectations are very reasonable and buyside is bracing for a deceleration …low-to mid-40% (43-44%) Azure growth should do the trick. There are also many other tailwinds for the Company this quarter, many of which are in the Company’s MPC segment. Windows OEM street estimates are sitting down ~11% y/y, significantly below end-market demand as per Gartner and Intel’s recent results. Gaming should also be a bright spot although likely limited by well-known supply constraints (I had to resort to StockX to get my Xbox!). Thill noted that Commercial Bookings may decelerate vs. last quarter given a smaller expiration base but investors are prepared for this. Investors are also prepared for limited margin leverage given prior company commentary on investments.

MSFT investors have been frustrated over the past 6 months given recent underperformance as MSFT is hovering around 1-year lows relative to the IGV (although not idiosyncratic to MSFT w/all of large-cap tech recently underperforming). Also, think about this…MSFT is trading at essentially the same multiple on CY2022 as Accenture. Nothing against Accenture – I just couldn’t believe that was the case when looking at relative valuation. I also included a sensitivity – don’t forget how sensitive the model is to implied Server Licensing …a 1% change in Intelligent Cloud Server Product Licensing revenues can significantly impact the implied Azure growth rate. MSFT continues to remain one of my favorite names across large-cap tech into 2021

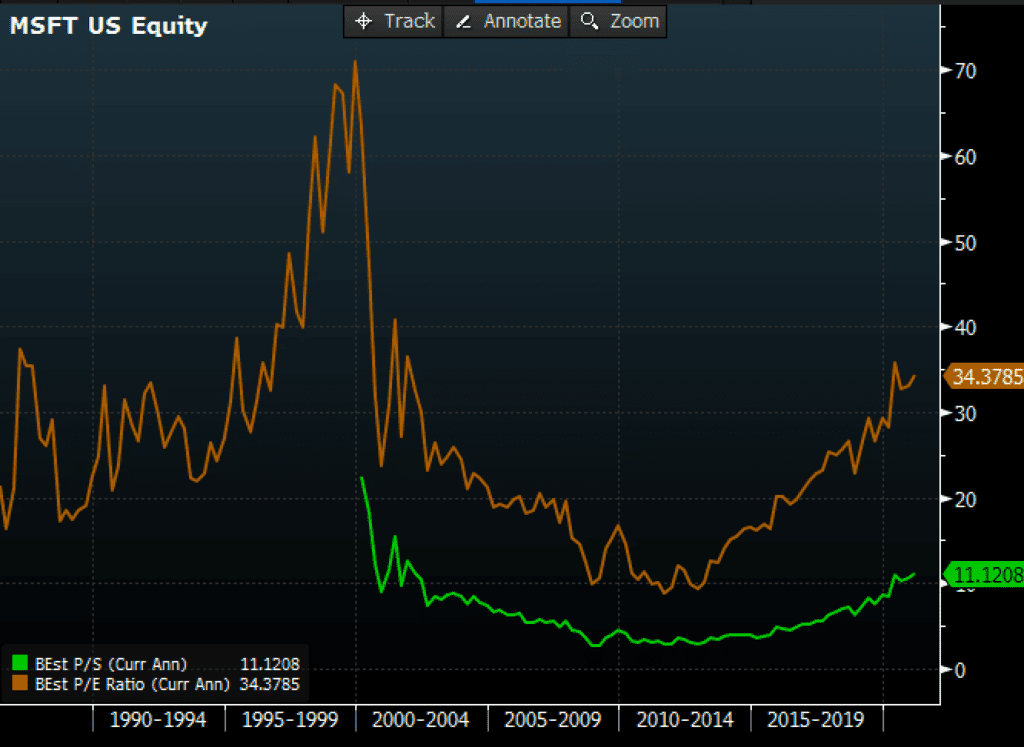

I don’t disagree with Jared’s fundamental take on MSFT, but it is clearly the consensus thinking as 37 analysts rate the stock a Buy with only 3 Holds and NO Sells. Shares of MSFT trade at 34x this year’s expected earnings per share and 11x sales, both very near Internet bubble highs:

My Take into the print: I suspect it will take a substantial beat and raise for the stock to breakout and maintain those gains… Over the last two quarters, the stock has pulled back about 4.5% (see green mark below) but then proceeded to rally 10% from its post-earnings low:

So what’s the trade?

If I were inclined to play for a 5% pull-back this week, I might consider a weekly put spread… for instance:

Bearish Trade Idea: MSFT ($232.50) Buy Jan 29th weekly 230 – 210 put spread for $3

-Buy to open 1 Jan 29th 230 put for $4

-Sell to open 1 Jan 29th 220 put at $1

Break-even on Jan 29th expiration (Friday):

Profits of up to 7 between 227 and 220 with a max gain of 7 at 220 or lower

Losses of up to 3 between 227 and 230 with a max loss of 3 at 230 or higher

Rationale: this trade idea risks 1.3% of the stock price, has a break-even down 2.4%, and has a max gain of 3% of the stock price if the stock is down 5.4% in three trading days.

I’ll offer my usual disclaimer for long premium directional trades into events like earnings, you need to get a lot of things right to merely break-even, first and foremost direction, then magnitude of the post-earnings move, and of course timing.

Or for those who think the company’s results and guidance keep the stock on an upward trajectory, but it is likely to continue to consolidate gains and have a broader breakout in the weeks/months to come, consider call calendars, selling a near-dated out of the money call and use the proceeds to buy a longer-dated out of the money call of the same strike, for instance:

Bullish Trade Idea: MSFT ($232.50) Buy Jan 29th – March 240 call calendar for $5

-Sell to open 1 Jan 29th weekly 240 call at $2.60

-Buy to open 1 March 240 call for $7.60

Break-even on Jan 29th weekly expiration (Friday):

The ideal scenario is that the stock closes just below 240 on Jan 29th expiration (Friday), then left owning March 240 call for $5 or about 2% of the stock price, which is the max risk of the trade, with a break-even at $245 on March expiration.