Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

Macro: We have seen a massive rotation of late out of large liquid tech and high valuation tech into interest rate sensitive areas of the market like banks, and those deemed to be more cyclical like energy and industrials. Throughout this rotation, we have seen a couple of bouts of volatility, resulting in a peak to trough decline of about 5.5% in the S&P 500 (SPX) and 12% in the Nasdaq 100 (NDX) at their lows Monday. But both indices are still up on the year, and investors remain confident that despite the sharp rise in interest rates this year, the pace and availability of vaccines coupled with the new stimulus package will serve as a bridge to the other side of the pandemic. Macroeconomists believe our new $1.9 trillion stimulus package could add as much as 1% of global GDP in 2021. This would suggest that the U.S. could be leading the global reflation trade, which could result in a rising U.S. dollar after last year’s precipitous drop resulting from the Fed’s action to lower rates to essentially zero last year. Banks have done well in a rising rate environment, but energy stocks that have benefited of late from economic optimism could be vulnerable if the U.S. Dollar were to follow rates higher.

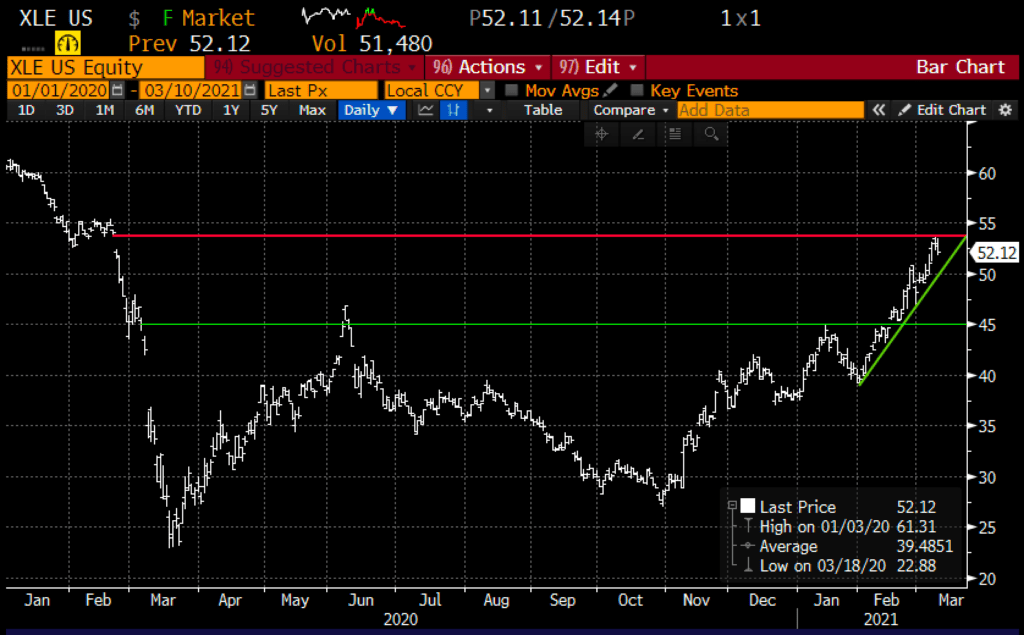

Trade Idea #1: Bearish XLE (Energy Select etf). The XOM and CVX make up 45% of the weight of this etf. It has doubled from its March 2020 lows. The 1yr chart below shows the ETF’s pause nearly to the penny of the year-ago breakdown level, the steep uptrend since early Feb of nearly 40%, and what might be decent near-term support near its breakout level around $45:

If rates were to continue to rise, and the U.S. were to follow, oil could get hit and oil stocks could give back some of their recent gains, retracing back towards technical support in the mid $40s.

Bearish Trade Idea: XLE ($52.70) Buy April 52 – 45 put spread for $2

-Buy to open 1 April 52 put for $2.45

-Sell to open 1 April 45 put at 45 cents

Break-even on April expiration:

Profits of up to 5 between 50 and 45 with max gain of 5 at 45 or lower.

Losses of up to 2 between 50 and 52 with max loss of 2 above 52

Rationale: this trade idea risks 4% of the etf price, breaks even down 5% and has a max gain of nearly 10% if the etf is down 15% in a little more than a month.

Trade Idea #2: Near-Term Bullish Chinese Stocks (FXI)… WESTERN News reports that the term “stock market” is no longer searchable on the Chinese internet. Some might say that could mark the end of the recent downdraft in stocks over there, and could set up for a short-term pop…

The iShares China etf, the FXI, is down about 11% from its recent highs made last month, but still up about 3.5% on the year. Rather than picking one of its large holdings like BABA, Tencent, or JD, which combined make up about 22% of the weight of the etf, it makes sense to express this view with the FXI avoiding any idiosyncratic risk one of its components:

Bullish Trade Idea: FXI ($47.84) Buy April 48 call for $1.50

Break-even on April expiration:

Profits above 49.50

Losses of up to 1.50 between 48 and 49.50

Rationale: this trade idea risks ~3% of the etf price, breaks even at about 3.5%, and allows for the potential to spread if the FXI were to rally soon by selling a higher strike call and reducing the premium at risk.

Risk Management: for a straight call purchase like this, we want to be disciplined and stop the trade at 50% of the premium we spend to avoid not only being wrong but having the trade expire worthless.

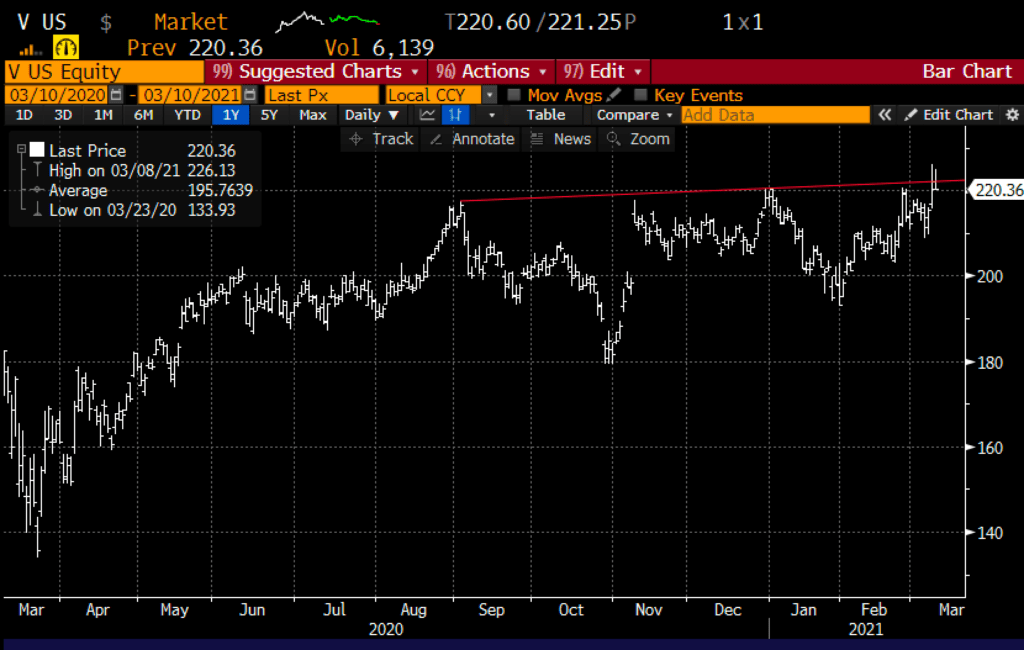

Lookback: On Feb 3rd, I detailed a bullish trade idea in Visa (V), playing for a breakout to new highs. With a little more than a week to expiration, let’s manage this winning trade idea:

Visa ($201.50) Buy March 205 – 225 for $4.50

Now with the stock at $220, the call spread is worth about $14 for nearly a $10 gain. Let’s take the profit but look for a reentry on weakness to play for a meaningful breakout as the stock looks to establish a new range above prior resistance around $220: