Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

Macro: Stocks don’t seem too bothered by rates sticking around 1.5% in the ten year UST, as investors appear to believe the Fed – they have no intention of raising rates or tapering QE in the face of a very disappointing vaccine rollout in Europe and global infections still making daily highs. Vaccine development is not ending in 2021, and we are likely to see continued innovation in and around boosters for years. Earnings season is underway, which is a great time to listen to the hopes and fears of management, and at this point, some sectors might be discounting too much good news expecting a return to pre-pandemic levels of activity in the back half of 2021.

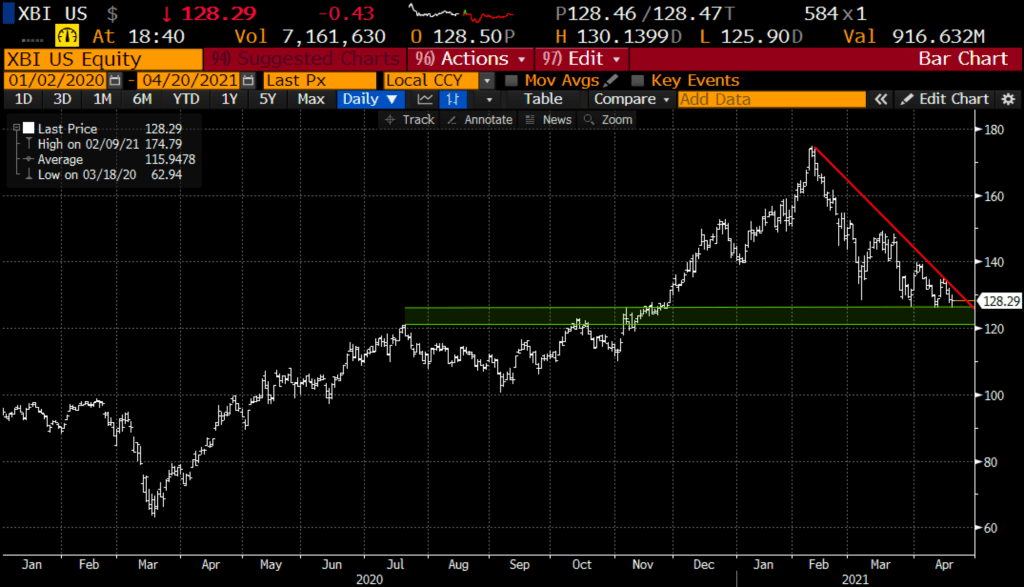

Trade Idea #1: Long S&P Biotech etf, XBI… Despite the heavy lifting done by Big Pharma and Biotech companies in our country on the c19 Vaccine, Pharma is just making new highs, while Biotech measured by XBI is well off of their highs…The XBI chart might be so bad it’s good… approaching its breakout level from November, and down about 25% from its Feb highs…

Bullish Trade Idea: XBI (~$131) Buy June 131 – 150 call spread for ~$5

-Buy to open 1 June 131 call for ~$6

-Sell to open 1 June 150 call at ~$1

Break-even on June expiration:

Profits of up to 14 between 136 and 150 with max gain of 14 above 150

Losses of up to 5 between 131 and 136 with max loss of 5 below 131

Rationale: This trade idea risks 4% of the etf price, has a break-even up 5%, and a max gain of nearly 11% if the XBI is up 16% in two months.

Trade Idea #2: Short (with defined risk) AXP into Q1 Earnings Friday morning. The options market is implying about a 3.5% move post results in either direction on Friday, which is a tad rich to its 4 qtr avg one-day post-earnings move.

With the U.S. state department’s recent travel warning, covering nearly 80% of countries around the world, and United Airline’s commentary about business travel, I suspect that AXP’s 20% YTD gain, with the stock a few percent from its all-time highs made in early March, that the stock incorporated any good news and is NOT discounting disappointing forward guidance.

The one-year chart shows the stock’s recent rejection just below the prior high and now testing the uptrend from its Nov lows, while the stock is still 26% above its 200-day moving average.

Bearish Trade Idea: AXP (~$147) Buy May 145 – 130 put spread for ~$3

-Buy to open 1 May 145 put for 3.80

-Sell to open 1 May 130 put at 80 cents

Break-even on May expiration:

Profits of up to 12 between 142 and 130 with a max gain of 12 at 130 or lower.

Losses of up to 3 between 142 and 145 with a max loss of 3 above 145

Rationale: This trade idea risks about 2% of the stock price, for about a month which includes an earnings event that the market prices a 3.5% one day move on Friday alone, with a potential profit of about 8% if the stock is down about 12% in a month.

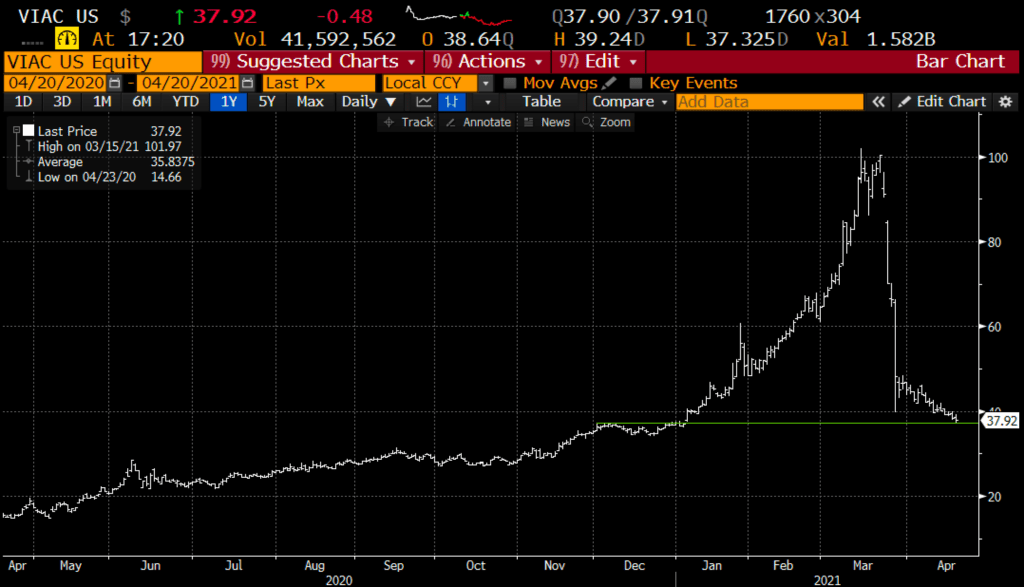

Lookback: Last week I detailed a bullish trade idea in shares of VIAC…

VIAC ($41.50) Buy May 42.50 – 57.50 call spread for $2.50

Shares of VIAC have declined about 6% over the last week and the May call spread that cost 2.50 is now worth only about $1.15, it makes sense to cut losses as the premium is now below the 50% mental stop we like to use for long premium directional trade ideas.