In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

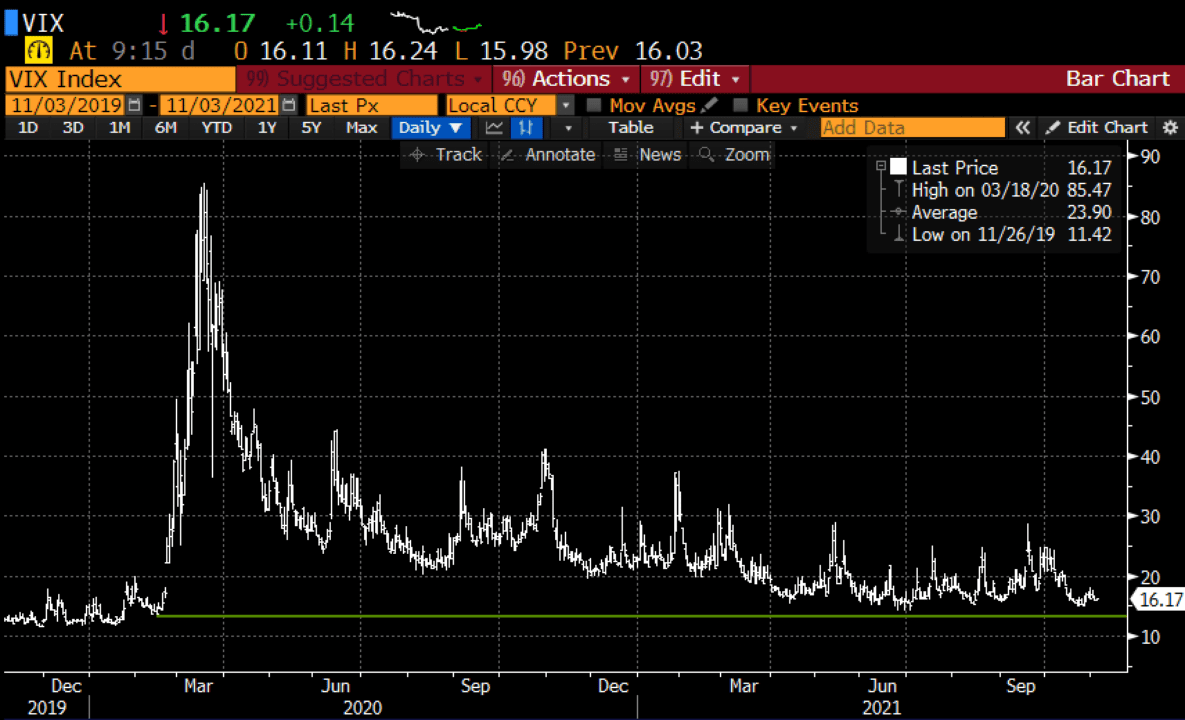

Macro: By the time you read this, the Fed will have announced their much-anticipated Taper of Quantitative Easing, $80 billion a month in Treasuries and $40 billion a month in mortgage-backed securities that were put in place at the very start of the pandemic. The intent at the time was to avoid the sort of credit crisis that our economy experienced during the great financial crisis. That with a zero interest rate policy and trillions of added fiscal stimulus, and I think it is safe to raise the banner “Mission Accomplished”. Inflation is a concern given the supply chain bottlenecks but I suspect we see this disruption abate in the new year and see commodity prices come in too. BUt markets are complacent!

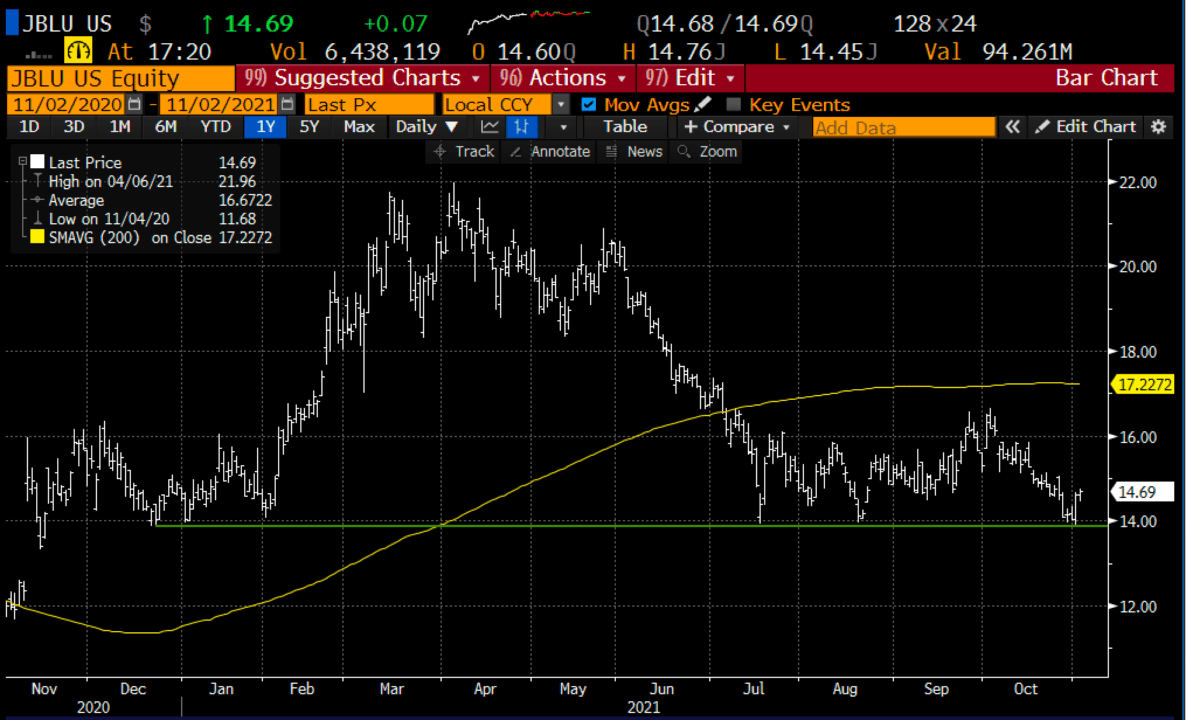

Trade Idea #1: Bullish Domestic Airline –> Jetblue

The stock stopped Monday to the penny at technical support around $14 down 30% from its 52-week highs and basically unchanged on the year. With the approval of vaccines for children, I suspect 2022 is going to be a massive travel year. analysts see the company getting back above record sales in 2022 and a rebound to profitability. The balance sheet is in good shape with $3.3billion of cash and $5 billion in debt.

Bullish Trade Idea: JBLU ($14.60) Buy Jan 15 call for $1

Break-even on Jan expiration:

Profits above 16

Losses of up to 1 between 15 and 16 with a max loss of 1 below 15

Rationale: look to spread by selling a higher strike call on a move above the long call strike.

Trade Idea #2: Facebook (FB), long holders might continue to look to add yield, or hedge, while allowing for potential upside in the stock, also defining their risk to the downside… Cover short call and add a collar (short call & long put) to long position.

From Oct 6th when FB was $333:

vs 100 shares FB long at 333 Sell 1 Dec 380 call at $4.15

Now FB is 328, a month later and the short 380 call is worth about $2. The stock is down $5, but the call sale has mitigated $2 of the decline. Now that the short call is just 1/2 a percent of the stock price cover and look to possibly hedge with a collar.

vs 100 shares of FB long at 325 Buy Feb 275 – 375 collar for even money

-Sell to open 1 Feb 375 call at $8

-Buy to open 1 Feb 275 put for $8

Break-even on Feb expiration:

Profits of up to $50 between current levels and 375 with profit capped

Losses of up to $50 down to $275 with losses capped below

Rationale: this hedge allows for gains of up to 14% between now and Feb expiration but also defines potential losses down 14%. Given up potential upside for defined risk to the downside.

Lookback: Oct 20 I detailed a bullish trade idea in PFE

PFE ($42.50) Buy Dec 43 call for ~$1

Now with the stock $45.70 it makes sense to take profit, spread long call or roll up and out. The call is $3 bid for $2 gain in 2 weeks…