In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

Macro: Investors in the stock market in 2022 are getting a lesson in Murphy’s Law, which states “anything that can go wrong will go wrong.” For the first time in two years, investors are having to decipher macro events that will impact their investments on the single-stock level, which is a very hard task given the uncertain nature of war, geopolitics, pandemics, generational high inflation, and asset bubbles spurred on by what many think is the recklessness of global central banks.

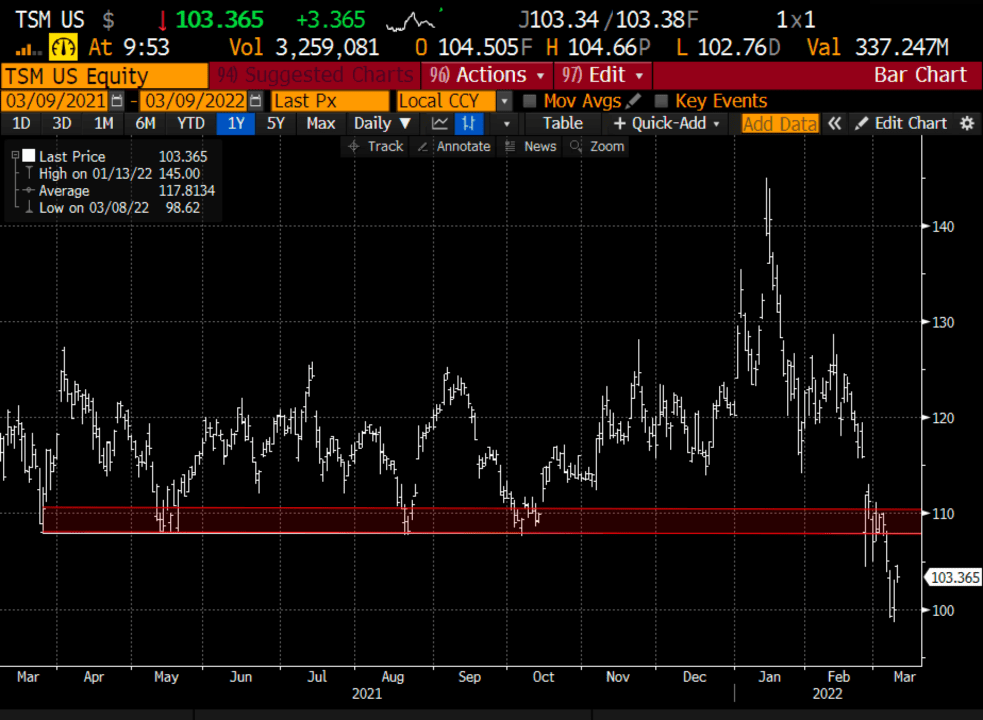

Trade Idea #1: Shares of TSM have declined 30% in the last two months since making a new all-time high in January at $145, down 30%. Macro fears of further supply chain disruptions causing delays in semiconductor manufacturing have clearly taken their toll on the largest manufacturer in the world. I’d love to tell you that the nice round number of $100 is great support, but to be frank, the stock is in a free fall. But if the situation in Ukraine were to de-escalate, and China was not to agitate further their tensions with Taiwan, and the globe could get back to its endemic reopening, then TSM should be back above its 200-day fairly soon.

Bullish Trade Idea: $TSM ($103.50) Buy May 110 call for $5

Break-even on May expiration:

Profits above 115

Losses of up to 5 between 110 and 115, max loss of 5 at or below 110

Rationale: this trade idea risks 5% of the stock price, has a break-even up 11%, again the stock is down 30% in two months.

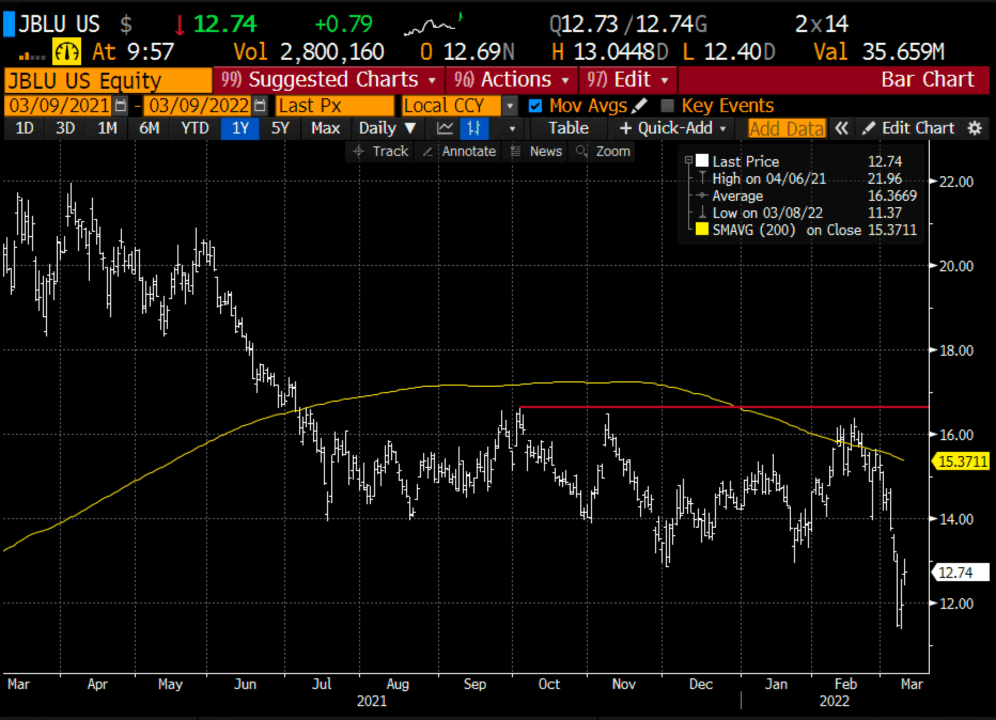

Trade Idea #2: Shares of airlines globally have been hammered, again with geopolitical events pushing out long-haul travel for both business and pent-up vacation travel. U.S. consumers will likely once again be inclined to travel domestically. Jetblue (JBLU) is attractive near 52-week lows.

Bullish Trade Idea: JBLU ($12.50) Buy June 13 – 17 call spread for $1

-Buy to open 1 June 13 call for $1.40

-Sell to open 1 June 17 call at 40 cents

Break-even on June expiration:

Profits of up to 3 between 14 and 17 with max gain of 3 above 17

Losses of up to 1 between 13 and 14 with max loss of 1 below 13

Rationale: this trade risks less than 10% of the stock price, has a break-even up about 8.5%, and has a max gain of 4x the premium at risk if the stock is back near its breakdown level from last spring.

Lookback – Last week I detailed a bearish trade idea in AAPL:

AAPL ($164) Buy April 160 – 140 put spread for $4

The stock has remained resilient, I think you stay the course if you think the market has not bottomed. Near-term I don’t see how they will be immune to supply chain issues and if the stock breaks its 200-day could see $140 quickly.