Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

Macro: Interest rates keep rising, despite the Fed’s insistence that they will keep them low until they reach full employment, which means they probably have about 10 million jobs to get to the pre-pandemic 60-year lows near 35%.

But bond investors don’t trust the Fed to nail the landing, they are selling U.S. treasuries, causing yields to rise fairly precipitously this year with the 10yr U.S. Yield at its one-year high this morning at 1.66%. Many strategists think we’re going straight to 2%.

This ten-year chart of the 10-yr yield shows we are through support, nearing 2% level which might be psychologically important for equities… the circles show the “Taper Tantrum in 2013” when the S&P 500 sold off nearly 10% and in late 2018, when the S&P 500 sold off 20%, when the 10yr got near 3%. Is 2% the new 3%?

Might investors start to position for an eventual pullback as they rerate some high growth stocks that have done a lot of the heavy lifting in large caps, as the SPX rally appears at dizzying heights?

Trade Idea – Hedge Tesla (TSLA)…Collar… Fever Broke, competition is coming. I picked up my first EV last weekend, a Ford Mustang Mach-e Crossover SUV, and as the kids would say “It is fire emoji!” Competition not just coming from Detroit, but China, Germany, Italy, Korea, and Japan.

The chart has very good support at $500, the intersection of the 1yr uptrend, the Nov breakout, and its 200-day moving average, but just as the stock overshot to the upside it has the potential to do so to the downside if the fundamental story is shifting.

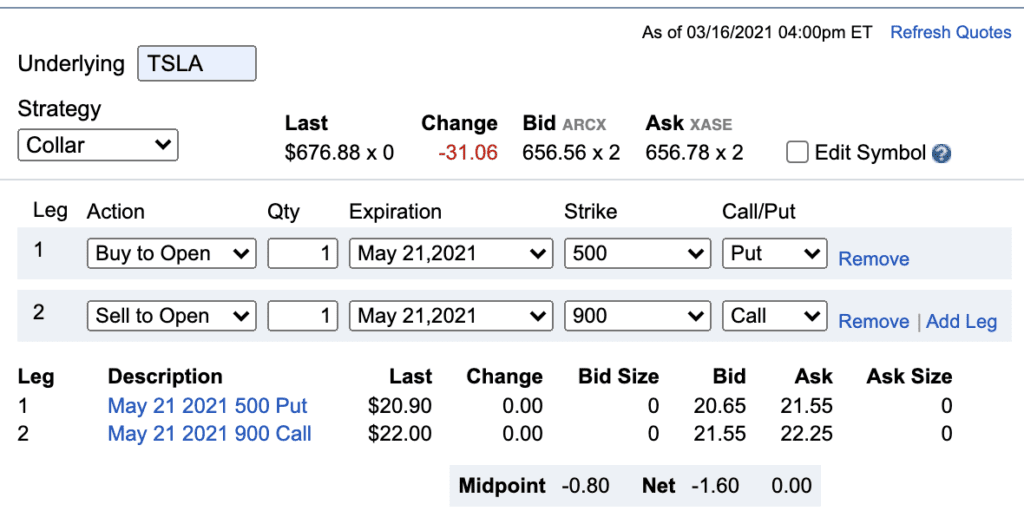

Trade Idea: vs 100 shares of TSLA ~$675 Buy the May 900 – 500 collar for even money

-Sell to open 1 May 900 May call at ~$21

-Buy to open 1 May 500 May put for ~$21

Break-even on May expiration:

Profits of stock up to 900, called away at 900, but the long holder can always cover short call prior to expiration to keep long intact

Losses of the stock down to $500 but protected below

Rationale: While TSLA is down 25% from its recent all-time highs, it is still up 750% from its 52-week lows… the Nov breakout to new highs following the S&P 500 addition announcement might be the line in the sand for some who bought it last year.

One of the first trade ideas of the year on ITM was BULLISH FORD when the stock was below $9 – it was about a re-rating based on their EV ambitions.

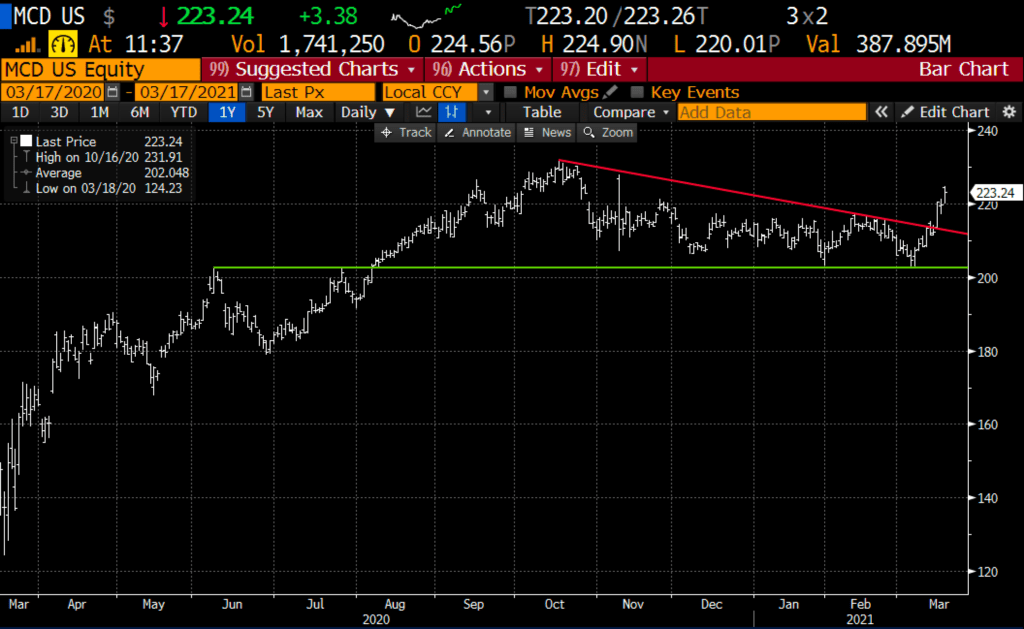

Lookback #1: On Feb 10 when MCD was $215.50, I detailed a bullish trade idea in the stock:

MCD ($215.50) Buy March 220 – 230 call spread for $2.30

Now with just a few days to expiration, it makes sense to manage this trade as it trading very near the long strike, but underwater. If the stock were to close here on Friday, the trade would expire worthless. Cut losses soon if you think the recent rally runs out of steam.

With the stock at $223, the call spread is worth about $3, it might make sense to take this gain with

Lookback #2: On Feb 24th, I detailed a bullish trade idea in industrial stocks via the XLI etf

XLI $91.55 Buy Apr 94 – 100 call spread for $1.25

Now with the etf above $96.75, this trade idea is worth about $2.90, or more than a double, it makes sense to take half off, locking in the original premium paid. Possibly take the trade as we got the breakout and maybe we see the etf settle back near support.