In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

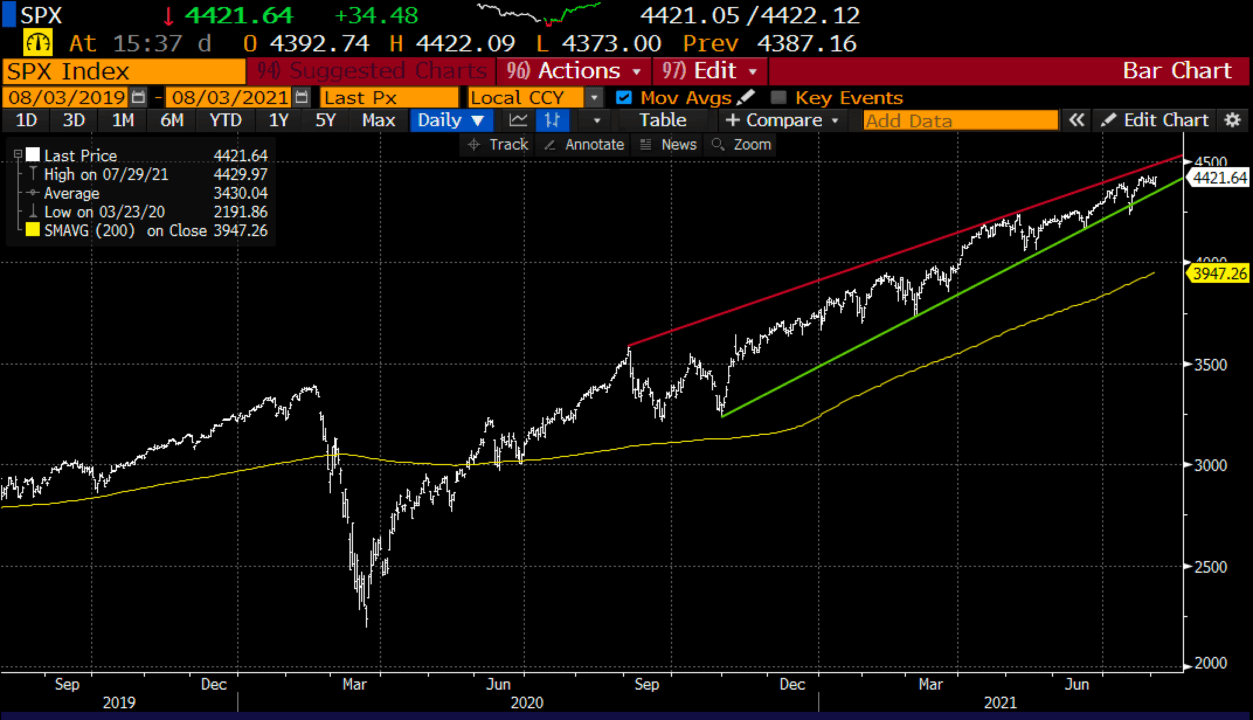

Macro: Stocks can’t stop, won’t stop…we’ve seen plenty of volatility of late in commodities, rates, fx, Chinese stocks, specific sectors in the U.S. stock market, but the major indices are within a whisper of their all-time highs. All of this in the face of weakening economic data (Q2 GDP, Consumer Confidence, ISM, Housing Starts) in just the last week as fiscal stimulus and eviction moratoriums are set to roll off and the delta variant of the coronavirus threatens to curtail the pace of the re-opening of the global economy that kicked into gear this past spring.

The S&P 500 (SPX) is increasingly finding itself in a tighter range as it squeezes higher, seemingly climbing a wall of worry:

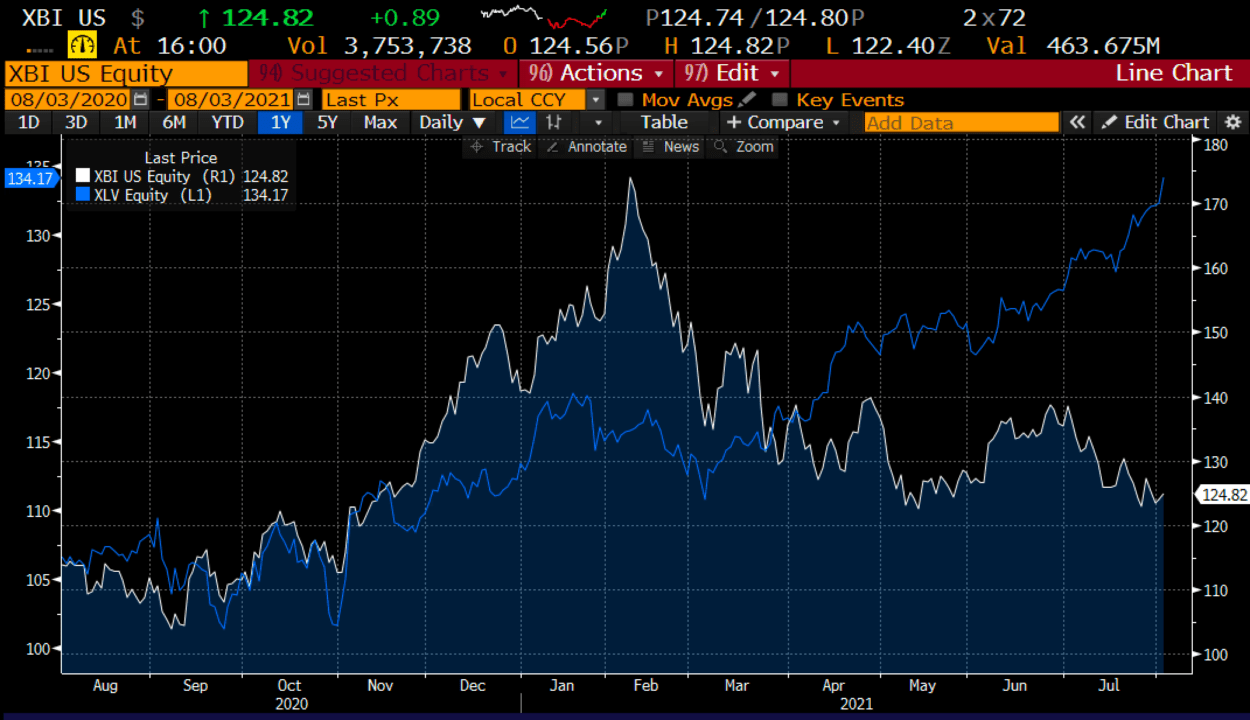

Might we see a rotation back into some of the stocks or sectors that performed well during the pandemic?

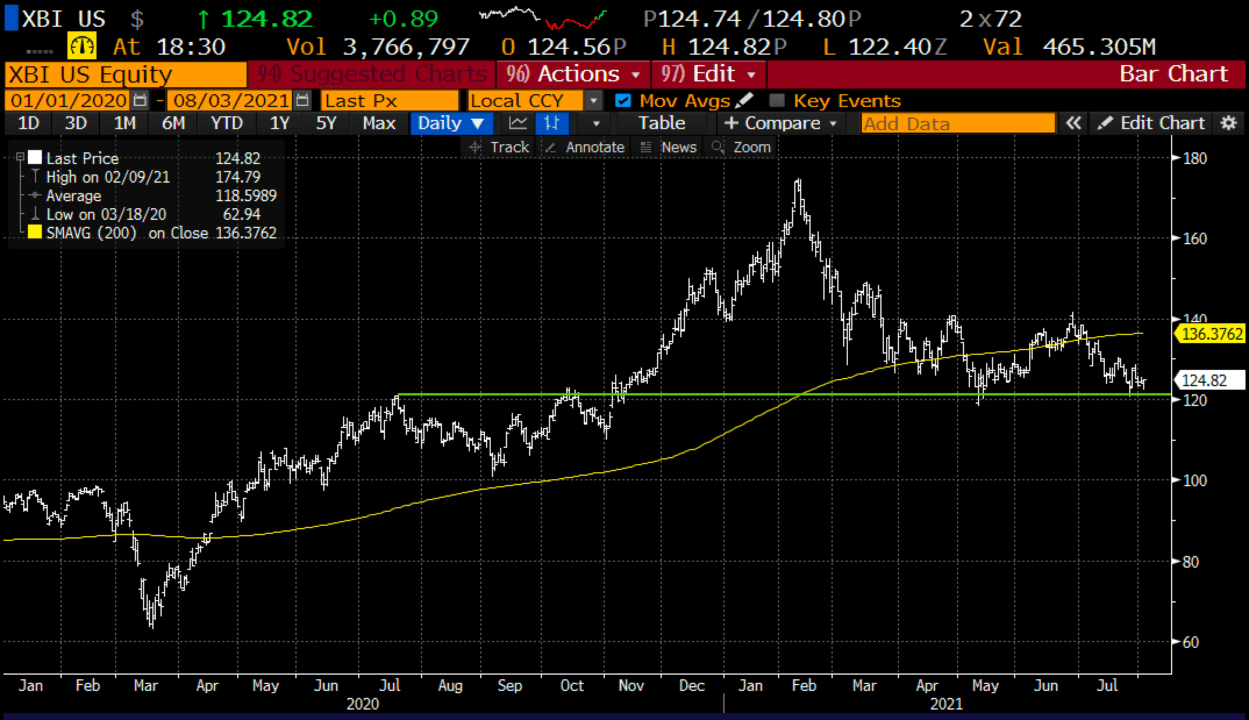

Trade Idea #1: In healthcare, it is a tale of two cities if you will in 2021, large-cap pharma stocks measured by the XLV, the S&P Healthcare Select ETF is up 17.5% YTD powered by new all-time highs by its largest components PFE, JNJ, and UNH, while the XBI, the S&P Biotech ETF is down 10% on the year and nearly 30% from its all-time highs made in Feb. Something has to give on this disparity and while I am not looking short to big pharma as there have been some really impressive technical breakouts in stocks like PFE and JNJ, but Biotech stocks as a group are so out of favor, are at key technical support on the chart, and looks appealing to play for a bounce with defined risk.

Bullish Trade Idea: XBI ($125) Buy Sept 125 – 140 call spread for $3.25

-Buy to open 1 Sept 125 call for $4

-Sell to open 1 Sept 140 call at 75 cents

Break-even on Sept expiration:

Profits of up to 11.75 between 128.25 and 140 with a max gain of 11.75 above 140

Losses of up to 3.25 between 125 and 128.25 with a max loss of 3.25 below 125

Rationale: this trade idea risks ~2.5% of the ETF price, breaks even up ~2.5%, and has a max gain of up to 9% of the ETF price if the XBI is up 12% in a month and a half.

$120 is massive support, this trade idea stops the trade at just above that level and targets a move back to the late June high, just above the 200-day moving average.

Trade Idea #2: Short AXP, two pieces of consumer data yesterday caught my eye:

Household debt jumps by the most in 14 years to nearly $15 trillion in the second quarter – CNBC

Household debt rose $313 billion in the second quarter to nearly $15 trillion. In dollar terms, that was the fastest growth since the second quarter of 2007, and at 2.1% was the fastest percent increase in seven and a half years.

Personal savings rate dipped to 9.4% in June, down from 10.3% in May … now at lowest since February 2020 pic.twitter.com/uCWFENMhDM

— Liz Ann Sonders (@LizAnnSonders) August 2, 2021

These two coupled with last week’s disappointing housing and consumer confidence data leads me to believe that in the face of fiscal stimulus rolling off and eviction moratoriums abating that the U.S. consumer might not be in as great of shape in late Q3 after a splurge of hate spending and may have pulled forward a lot of demand.

Bearish Trade Idea: AXP ($170) Buy Oct 165 – 145 put spread for $4.25

-Buy to open 1 Oct 165 put for $5.75

-Sell to open 1 Oct 145 put at $1.50

Break-even on Oct expiration:

Profits of up to 15.75 between 160.75 and 145 with a max gain of 15.75 below 145

Losses of up to 4.25 between 160.75 and 165 with a max loss of 4.25 above 165

Rationale: this trade idea risks 2.5% of the stock price, has a break-even down 5%, and has a max potential gain of 9% if the stock is down 15% in two and half months.

The stock is approaching the uptrend from its Oct lows, with no real support until its 200-day moving average near $140, also its April lows:

Lookback: On July 14th I detailed a bearish trade idea in XLF, bank stock ETF:

XLF ($36.50) Buy Sept 36 – 32 put spread for 80 cents

Now with the XLF $37 the put spread is worth…

Keep an eye on 10yr Yield, if it continues to go lower towards 1% and XLF is firm, I would close this position as I suspect they find support near 1%