In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

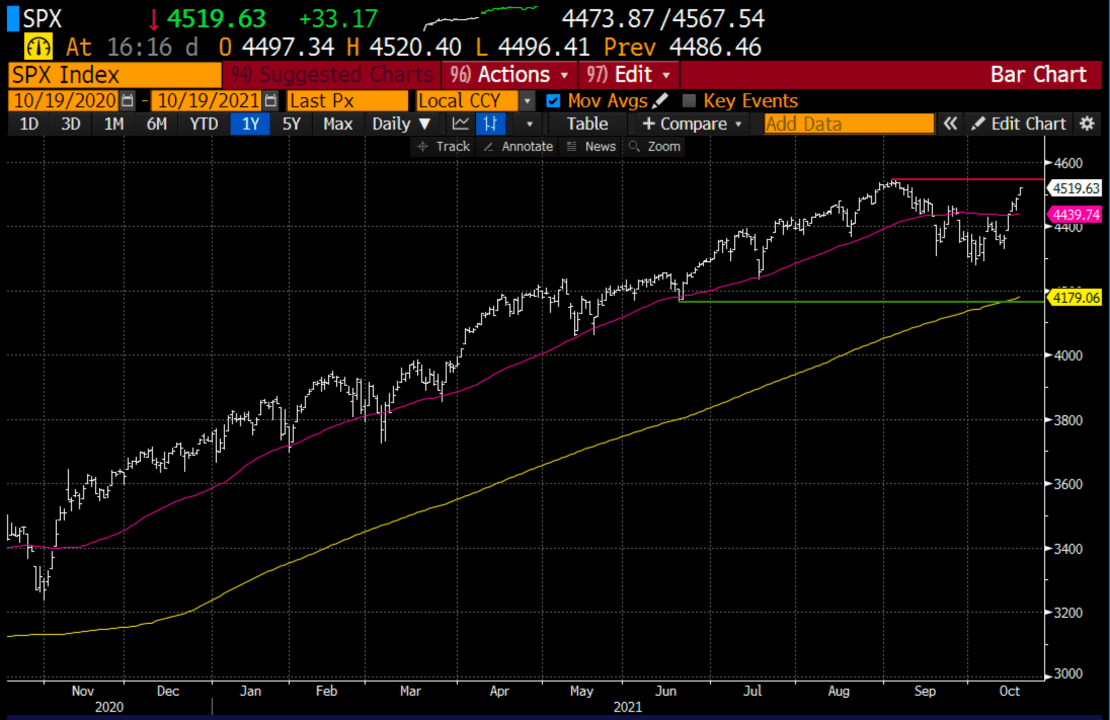

Macro: You know the drill, BUY. THE. DIP. Equity investors have been conditioned to this for years now as the Fed has remained overly accommodative since the global financial crisis. Despite the recent rise in interest rates, the market only suffered at a 5% peak to trough decline, about half of the decline it suffered last year during the month of Sept. If you blinked during Sept you missed the sell-off, but the next few weeks of earnings will give us a better sense of what the real bogeyman for investors should be, slowing growth, rising interest rates, a strengthening dollar or rising costs of goods, commodities, and services. Let’s see just how much fear has been priced into stocks as they approach last month’s prior all-time high:

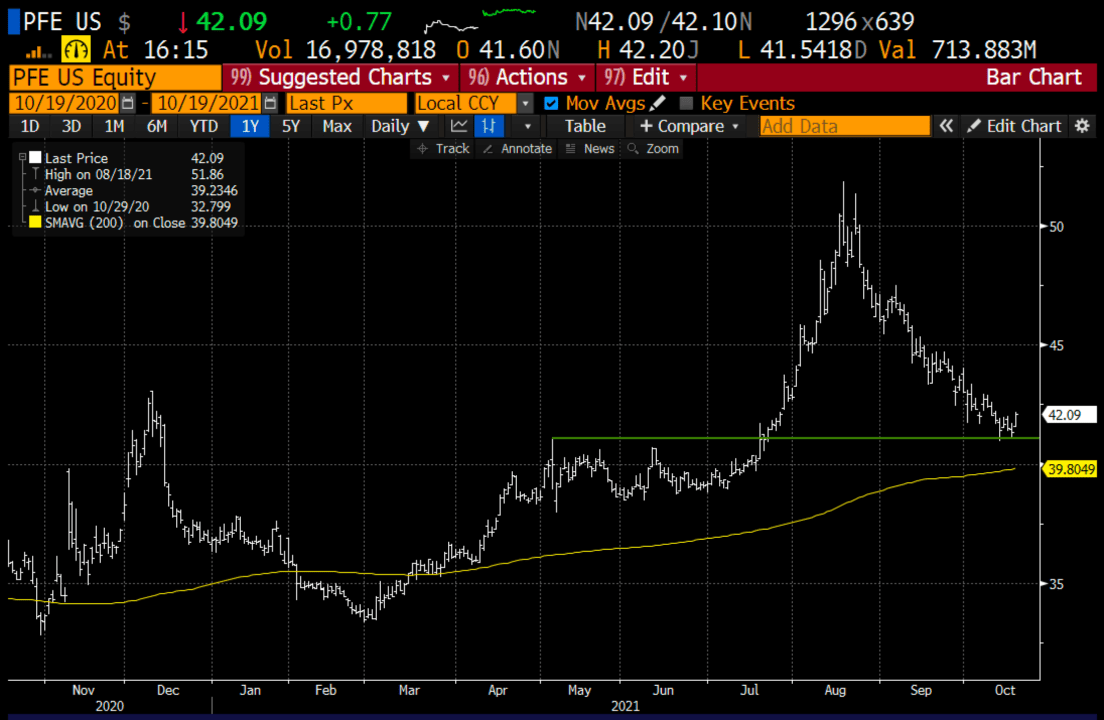

Trade Idea #1: PFE – The stock has had a volatile year, to say the least. In the Summer when the C19 Delta Variant was raging across the country, with Booster starting to be rolled out the stock rallied from $40 to $50 in about a month, to a new all-time high, but has since pulled back to the breakout level just above $40:

I suspect there will be a continued need for boosters for some time and the FDA’s guidance that they will be supportive of mix and match boosters should be a positive for PFE’s sales. The stock is cheap, trading around 11x eps with a 3.7% dividend yield, and only up 14% on the year, underperforming the SPX. The stock could set up nicely for a year-end rally if it can hold support which is its 200-day moving average, but I want to define my risk to that technical level.

Bullish Trade Idea: PFE ($42.50) Buy Dec 43 call for ~$1

Break-even on Dec expiration

Profits above $44

Losses of up to 1 between 43 and 44 with a max loss of 1 below 43

Rationale: This trade idea risks 2.5% of the stock price over the next 2 months and stops the trade down at the technical support level identified above.

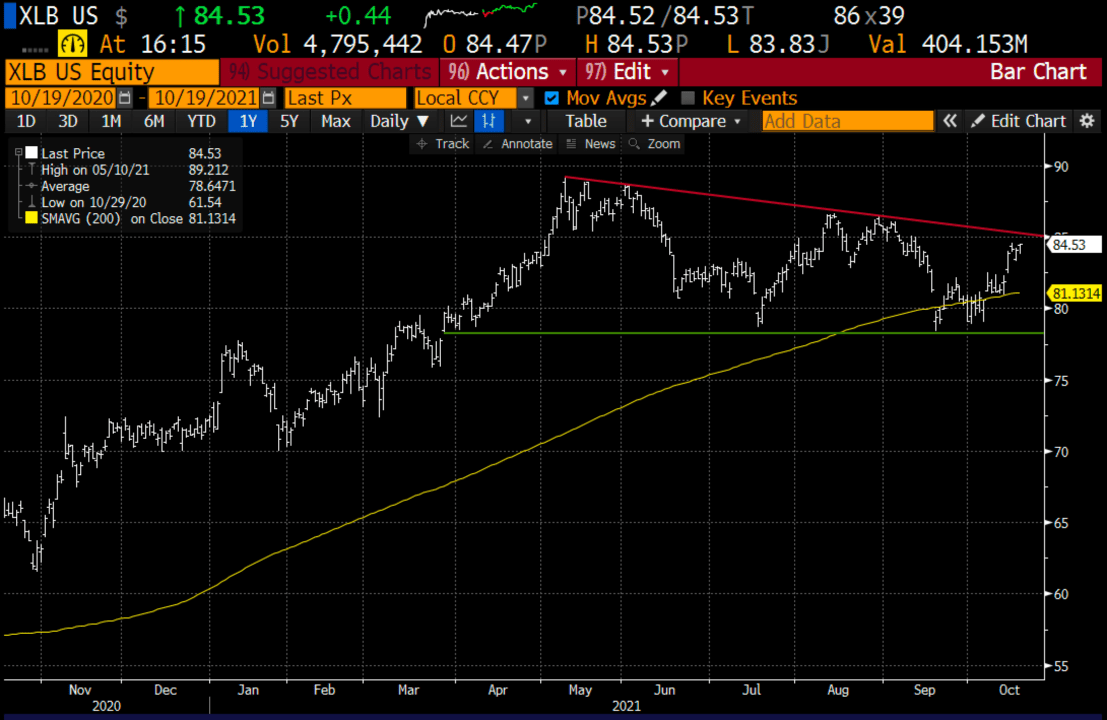

Trade Idea #2: Short Materials via XLB

Bearish Trade Idea: Short materials stocks via XLB ETF, chemicals, and the like, bottlenecks will abate soon, they have not confirmed the new high that is about to be made in stocks…

Trade Idea: XLB ($84.53) Buy Nov 84 – 79 put spread for ~$1

-Buy to open 1 Nov 84 put for $1.35

-Sell to open 1 Nov 79 put at 35 cents

Break-even on Nov expiration:

Profits of up to 4 between 83 and 79 with a max profit of 4 below 79

Losses of up to 1 between 84 and 83 with max loss of 1 above 84

Rationale: this trade idea risks 1.2% of the ETF price, breaks even down less than 2%, and has a max gain of 5% if the ETF is down 7% in a month.

Lookback: On Oct 6th I detailed a bullish trade idea in Blackstone (BX)

BX ($115) Buy Nov 115 call for $5

Now with BX Trading $128, and the 115 Nov call deep in the money it makes sense it makes sense to take the profit… it’s now worth $13.