In The Money is brought to you by

Shortly after the open on Wednesday, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

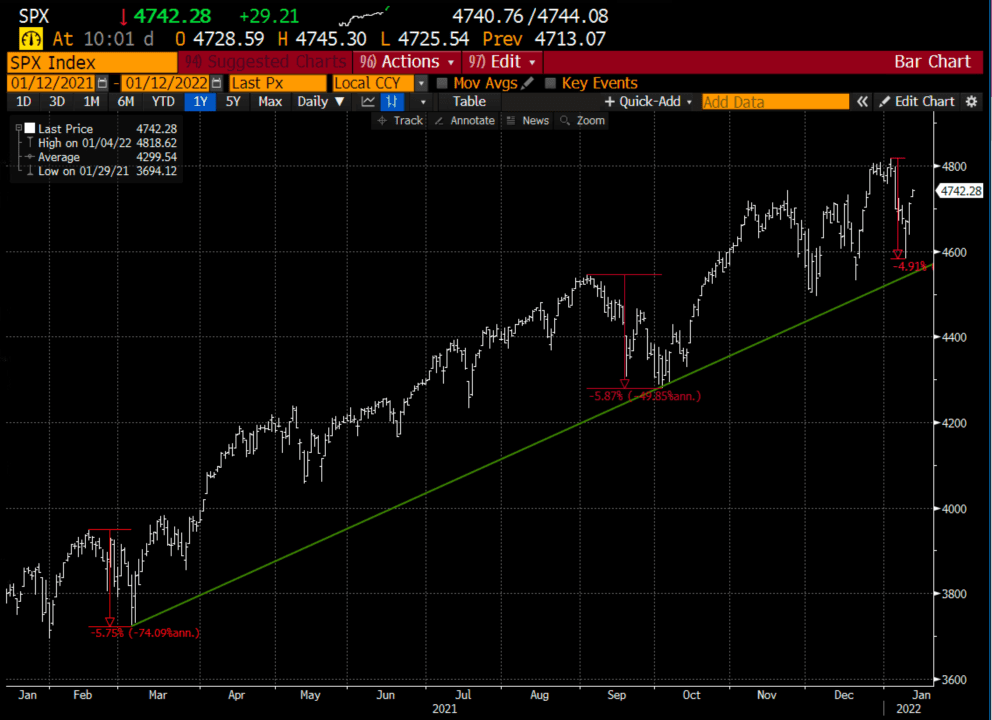

Macro: Fed Chair Powell at his Senate re-confirmation hearing yesterday renewed his pledge to take inflation head-on, which could mean greater than expected rate increases in 2022 and possibly rolling off some of the assets on its balance sheet that it has amassed over the last nearly two years since the start of the pandemic. For now, investors appear to be calmed after five consecutive days of losses in the S&P 500 (SPX), possibly suggesting that unchecked inflation is more of a risk to the stock market than higher interest rates and generally tighter monetary policy.

It would appear that investors have been very comfortable over the last year buying 5-6% dips from all-time highs that come above the uptrend that has been in place since last January:

Trade Idea #1: Long Gold, if you believe the Fed is right and inflation pressures are likely now to persist, Gold could finally have its day in the sun or at least break out from the triangle pattern it has been forming over the last two years, targeting a move back towards the high made last spring near $180:

Bullish Trade Idea: GLD ($170) Buy March 172 – 180 call spread for $2

-Buy to open 1 March 172 call for $3

-Sell to open 1 March 180 call at $1

Break-even on March expiration:

Profits of up to 6 between 174 and 180 with a max gain of 6 above 180

Losses of up to 2 between 172 and 174 with a max loss of 2 below 172

Rationale: this trade idea risks a little more than 1% of the etf price, has a break-even up ~2%, and has a max potential gain of 3x the premium at risk if the etf is up ~6% in a little more than 2 months

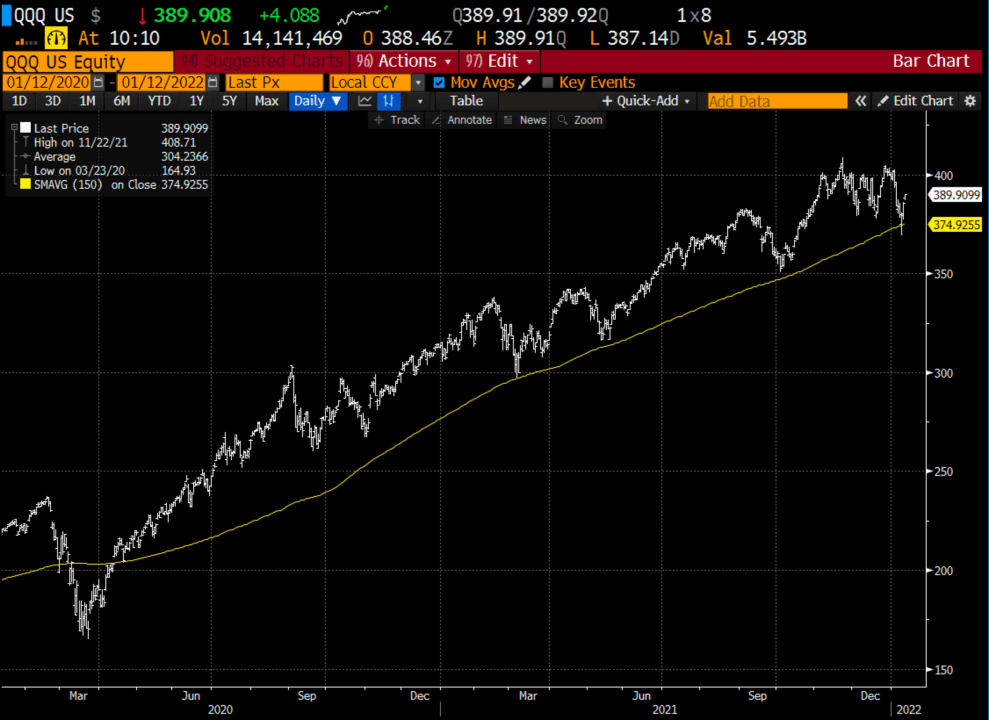

Trade Idea #2: QQQ – Re-short, Back in late Nov, before the Omicron variant was known, I detailed a bearish trade idea in the QQQ, the ETF that tracks the Nasdaq 100 (NDX), when it was very near its highs. It is notable that despite the S&P500 (SPX) making a new all-time high, the NDX has not since late November. In fact at the lows on Monday, more than 40% of the stock’s in the Nasdaq were down 50% from their 52-week highs. The largest components still hold the key to the QQQ, with the top 7 making up 50% of the weight of the index of 100. Monday’s breach of the 150-day moving average was significant per my good friend and chartist extraordinaire Carter Braxton Worth of Worth Charting. The bounce from the lows Monday was impressive, But I might look to sell the bounce, with defined risk, targeting a move back to the early October low near $350:

Bearish Trade Idea: QQQ ($390) Buy Feb 390 – 360 put spread for $7

-Buy to open 1 Feb 390 put for $10

-Sell to open 1 Feb 360 put at $3

Break-even on Feb expiration:

Profits of up to 23 between 383 and 360 with a max gain of 23 at 360 or lower

Losses of up to 7 between 383 and 390 with a max loss of 7 at 390 or higher.

Rationale: this trade idea risks less than 2% of the etf price, has a break-even down less than 2%, and has up to a 6% gain (or a little more than 3x the premium at risk) if the QQQ is down 8% in a little more than a month.

Lookback – Last week I detailed a bullish trade idea in Shake Shack (SHAK):

SHAK ($73.31) Buy March 75 – 100 Call Spread for $5

On Tuesday the company announced preliminary Q4 results that were better than expected and the stock rallied more than 13% off of a 52-week low. With the stock near $77, the call spread that cost $5 is now worth ~$7 and if it were to get to be a double, worth 2x the original premium it makes sense to take half off, or potentially roll to a higher call spread.