Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

Macro: Stocks are at all-time highs, the SPX up ~4% & NDX up ~8% YTD, only one and half months into the year. Expectations are for the winter virus surge to abate soon as vaccinations kick into high gear, with the Biden admin possibly delivering on well over their total of 100 million vaccinations in its first 100 days. The former FDA chief Scott Gottlieb said on Monday that with the oncoming JNJ vaccine, we could have 150 million Americans inoculated in March or April. That, coupled with the Biden Admin’s push for nearly $2 trillion in added fiscal stimulus, on top of last year’s $3 trillion, is likely to ignite a risk asset bubble of epic proportions in the back half of 2021.

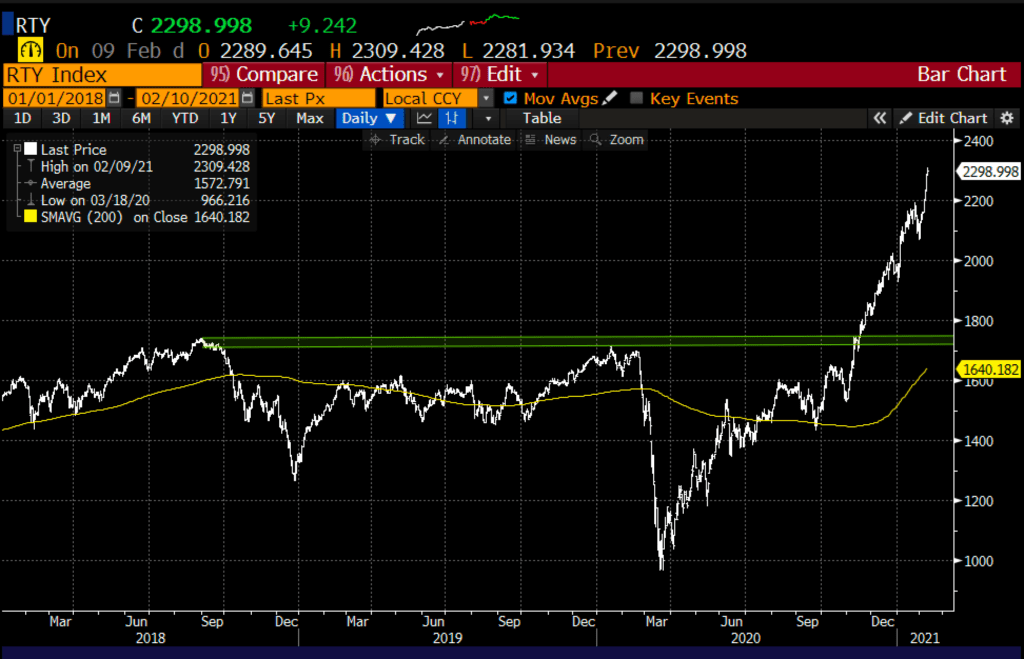

The domestically focused small-cap index, the Russell 2000 reflects this optimism, up ~16% on the year, up 41% from Election Day in early November, which also happens to be the index’s 200-day moving average and massive long-term technical support, coinciding with its breakout to new all-time highs.

RTY 3yr Chart

_______________________________________________________________________________________

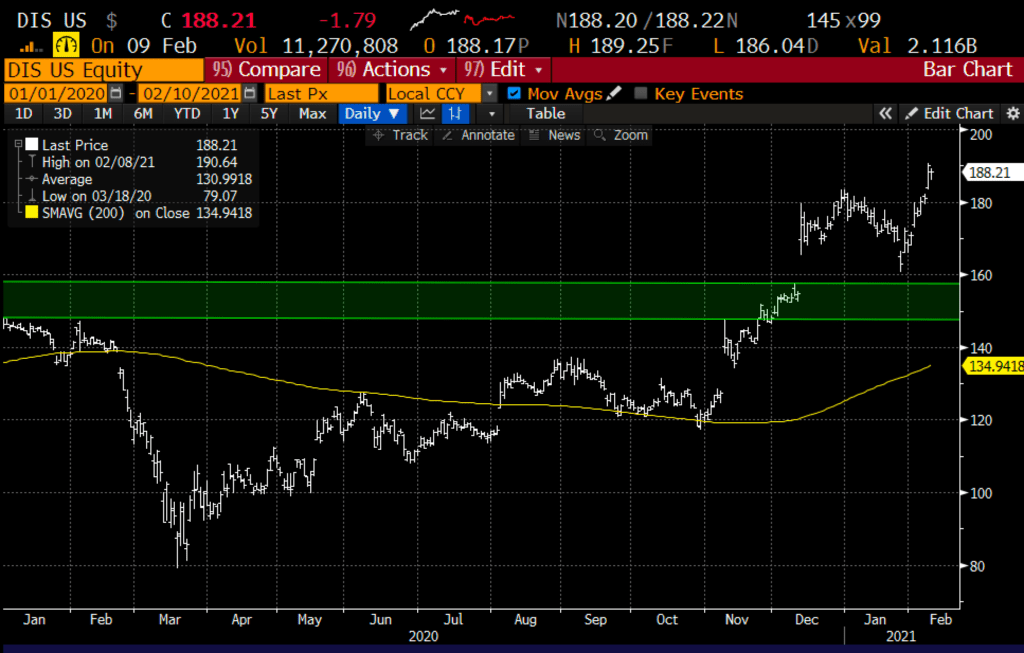

Trade Idea #1: Neutral View on Disney

(DIS) Will Report Fiscal Q1 earnings Thursday after the close.

The options market is implying about a 6% one-day move on Friday, or about $11 in either direction. The stock has had an epic 45% run since its Q4 results which were highlighted by the Disney+ streaming service knocking the cover off of the ball. This company will be a clear beneficiary from our economy reopening, but for long holders, it might make sense to look for a bit of consolidation at all-time highs before the stock pushes forward in the late Spring/Summer.

Bearish Trade Idea/Yield Enhancement: DIS ($186.50) Sell 1 March 210 Call at $3.15 vs 100 shares long

Break-even on March expiration:

Profits of the stock up to $210, with an effective call-away level of $213.15, up ~14%. If the stock is 210 or lower you collect $3.15 in premium today. If the stock is at or above 210 prior to March expiration, the long holder could always cover the short call and keep the long position intact.

Losses of the stock below current levels, but the $3.15 in premium received will serve as a small buffer to the downside.

_______________________________________________________________________________________

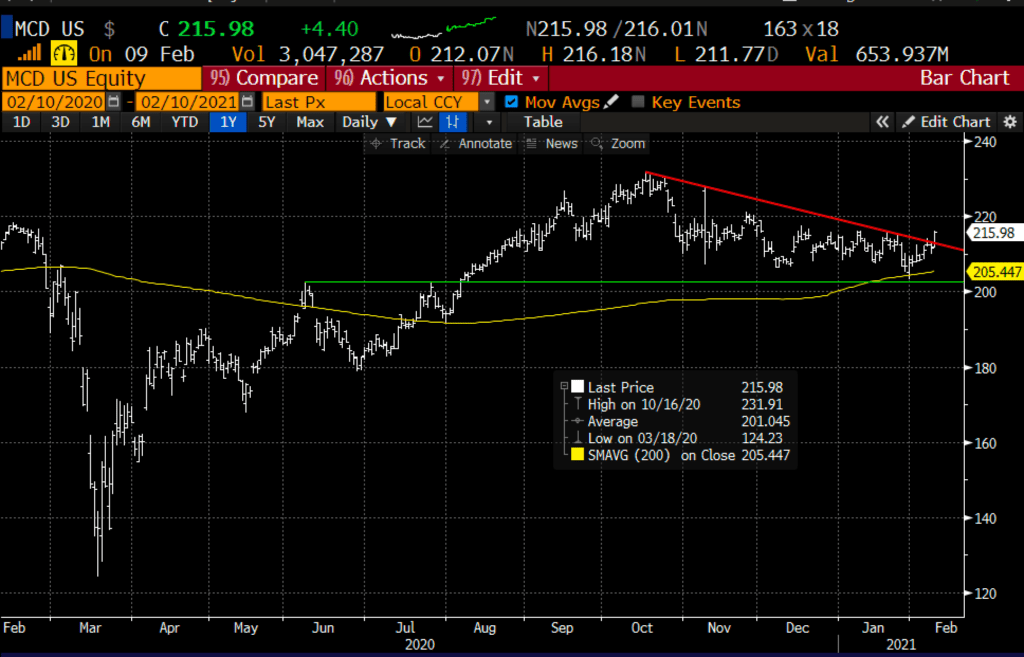

Trade Idea #2: Bullish McDonalds (MCD)

Since breaking out to new all-time highs in Sept, the stock has been in a downtrend since mid-Oct, not keeping pace with many of its QSR peers and the broad market.

Yesterday the stock broke out above the well-defined downtrend, after bouncing off of technical support last week at its 200-day moving average near $205:

For those looking for high-quality stocks to play catch-up to the broad market, MCD looks attractive both technically and from a fundamental standpoint at about 25x the current year’s earnings which should be a new high.

Bullish Trade Idea: MCD ($215.50) Buy March 220 – 230 call spread for $2.30

-Buy to open 1 March 220 call for 3.60

-Sell to open 1 March 230 call at 1.30

Break-even on March expiration:

Profits of up to 7.70 between 222.30 and 230 with max gain of 7.70 at 230 or higher

Losses of up to 2.30 between 220 and 222.30 with max loss of 2.30 at 220 or lower

Rationale: this trade idea risks 1% of the stock price, has a break-even up 3%, and a max gain of 3.5% of the stock price if it is up 6.5% in a little more than a month

Lookback: On Jan 20th, I detailed a bullish trade idea on Twitter (TWTR):

Bullish Trade Idea: TWTR ($46.60) Buy Feb 47 – 53 call spread for $2

Now with TWTR trading near $60, well above the short call, the $6 wide call spread can only be worth $6 on expiration. Close this prior to expiration when close to $6.