Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

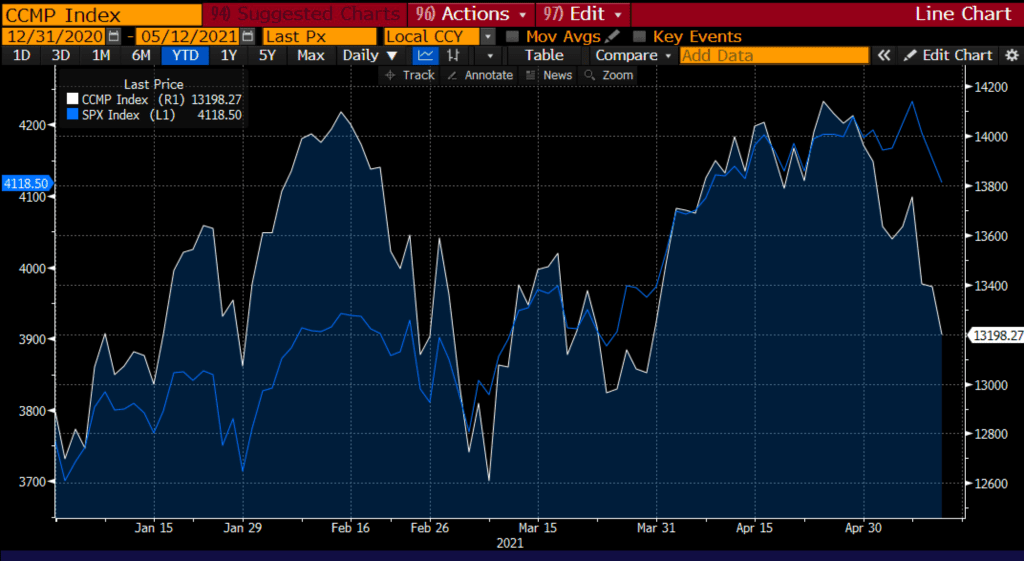

Macro: Nasdaq underperformance is a key theme in the stock market this year. The Nasdaq Comp failed to make a new closing high, vs dozens for the S&P 500 (SPX) this year. The Nasdaq is up 2.5% vs the SPX’s 10% ytd gains, which is only down 3% from its recent highs vs Nasdaq is down nearly 8%.

Three Main reasons IMO

1. Valuation

2. Expectations

3. Inflation / Rate Fears

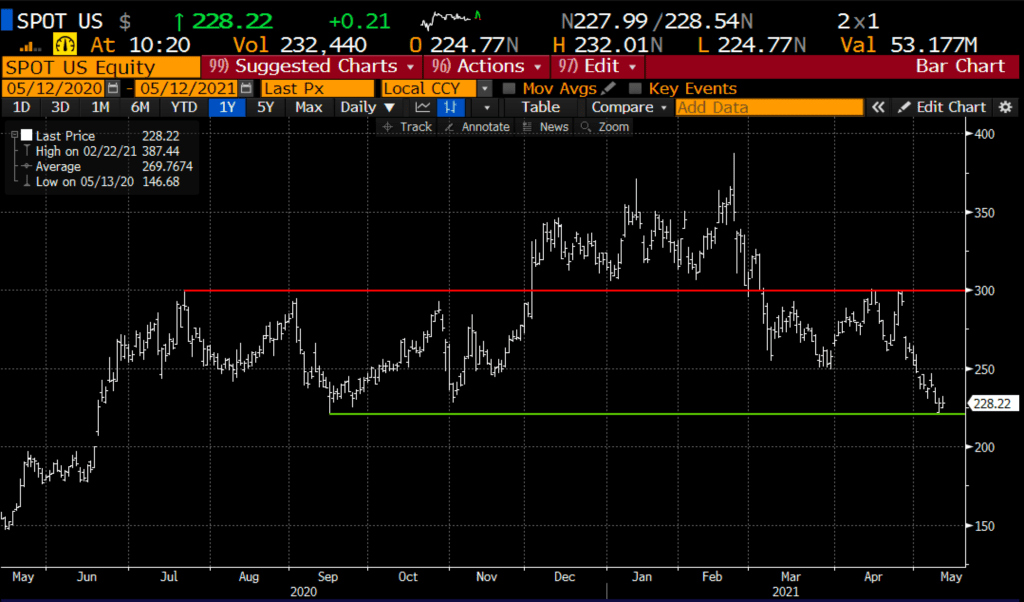

Trade Idea #1: Bullish Spotify

The stock is down 20% since earnings and 40% from all-time highs made in Feb. This is a great company with a great product, strong management, and valuation very reasonable to large-cap tech. The stock stopped right where it should have on the chart yesterday.

Bullish Trade Idea: SPOT ($228) Buy July 240 -290 call spread for $10

-Buy to open 1 July 240 call for 12

-Sell to open 1 July 290 call for 2

Break-even on July expiration:

Profits of up to 40 between 250 and 290 with max gain of 40 at 290 or higher

Losses of up to 10 between 250 and 240 with max loss of 10 below 240

Rationale: This trade idea risks ~4.5% of the stock price playing for a move back above recent breakdown level and back towards technical resistance below 300

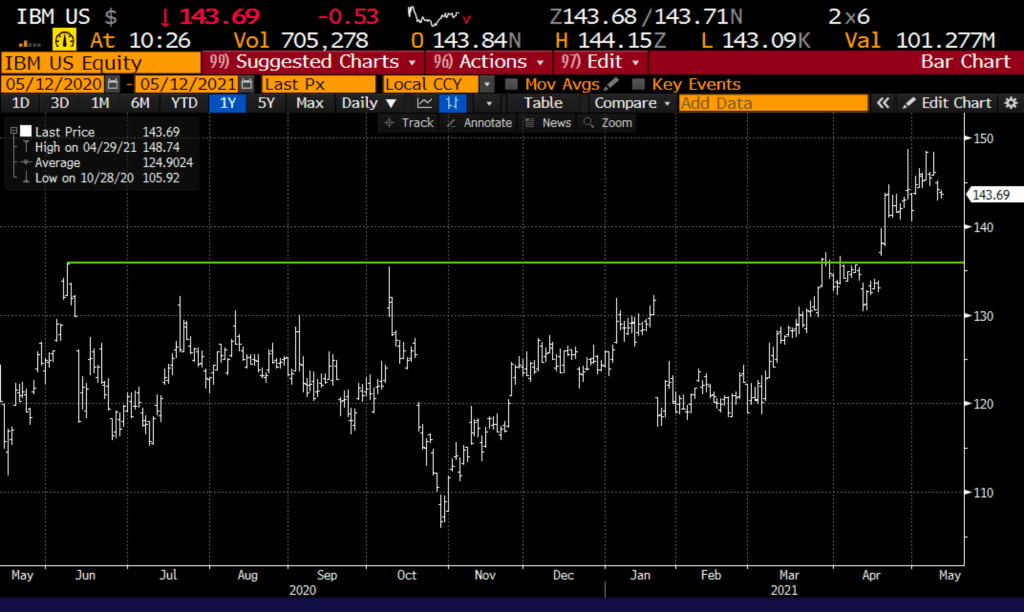

Trade Idea #2: Bearish IBM

The stock broke out after its recent earnings report… viewed as cheap cyclical, transforming its business to recurring cloud revenue… see a pullback to breakout level near $135… its a value trap.

Bearish Trade Idea: IBM (~$144) Buy June 145 – 135 put spread for $3

-Buy to open 1 June 145 put for 4.50

-Sell to open 1 June 135 put at 1.50

Break-even on June expiration:

Profits of up to 7 between 142 and 135 with max gain of 7 at 135 or lower

Losses of up to 3 between 142 and 135 with max loss of 3 at 145 or higher

Rationale: This trade idea risks 2% of the stock price with a breakeven down 1.4%, max gain down 6%

Lookback: On March 17th I detailed a hedge for TSLA holders:

vs 100 shares of TSLA ~$675 Buy the May 900 – 500 collar for even money

Now with stock 605… consider managing…the May 500 put is worth about $3.50 while the May 900 call is basically worthless.

The chart is nasty, having just broken important support… might consider zero cost collars again, rolling down call strike, and giving more time.