In The Money is brought to you by

Shortly after the open Tuesday, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from Tuesday’s show:

Macro: Mega-Cap Stocks might be approaching a breaking point, after months of rotations in and out of groups like energy, industrials, financials, and transports based on the whims of interest rate moves, covid concerns, and supply chain disruptions. But through it all, the S&P 500 (SPX) could not be at all-time highs if it was not for the out-performance and continued crowding in the 6 biggest names in the stock market, Apple, Microsoft, Amazon, Alphabet, Facebook, and Tesla. And the $10 trillion question (equal to their combined market caps) is whether or not they can continue to keep the whole ship afloat? Some investors thought Small Caps by way of the Russell 2000 would be a nice place to broaden out, but it did after 9 months of consolidation and quickly failed.

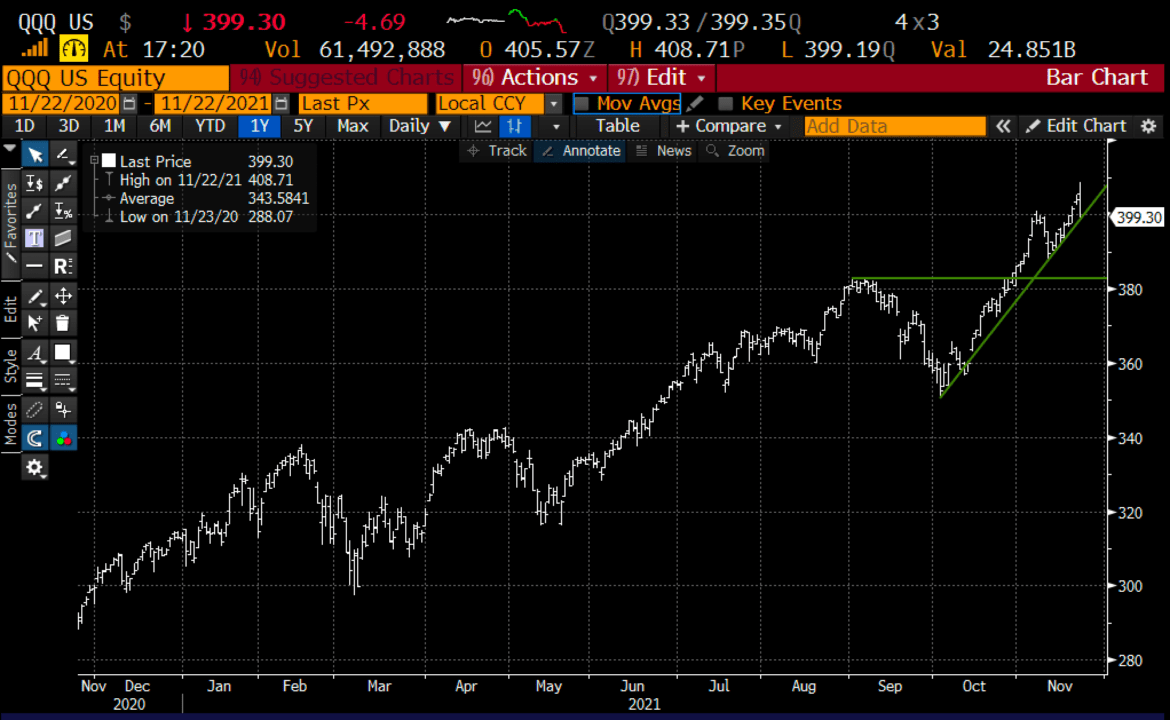

Trade Idea #1: Nasdaq 100 – The concentration in the mega-cap tech stocks that make up a disproportionate weight of the large major indices remains troubling, but a flip might have just flipped with rates, making them look far less attractive.

Bearish Trade Idea: QQQ ($400) Buy Jan 400 – 360 put spread for $9

-Buy to open 1 Jan 400 put for $13

-Sell to open 1 Jan 360 put at $4

Break-even on Jan expiration:

Profits of up to 31 between 391 and 360 with max gain of 31 at 360 or lower

Losses of up to 9 between 391 and 400 with max loss of 9 above $400

Rationale: this trade idea risks 2.2% of the ETF price, breaks even down the same and has a max potential gain of about 8% if the ETF is down about 10% in 2 months.

Trade Idea #2: LYFT is at a tricky spot on the chart, but last month company gave very upbeat guidance, rallied from $45 to $55, and has now given it all back. If it can hold $44-$45 could set up as a good bounce candidate into year-end

Bullish Trade Idea: LYFT ($46) Buy Jan 47.50 – 57.50 call spread for ~$2

-Buy to open 1 Jan 47.50 call for 2.65

-Sell to open 1 Jan 57.50 call at 65 cents

Break-even on Jan expiration:

Profits of up to 8 between 49.50 and 57.50 with max gain of 8 above 57.50

Losses of up to 2 between 49.50 and 47.50 with a max loss of 2 below 47.50

Rationale: this trade idea risks ~4.5% of the stock price and has a break-even up ~7.5% and has a max potential gain of ~17% if the stock is up 25% in two months.

Lookback: Nov 10 Bullish trade on TWTR need to adjust, stick to mental stop-

TWTR ($53.50) Buy Jan 52.50 – 70 call spread for $3.50

The stock is now down about $6.50 or about 12% in just two weeks and this call spread is now worth only $1.10, it makes sense to cut losses here as it has breached the mental stop.