In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

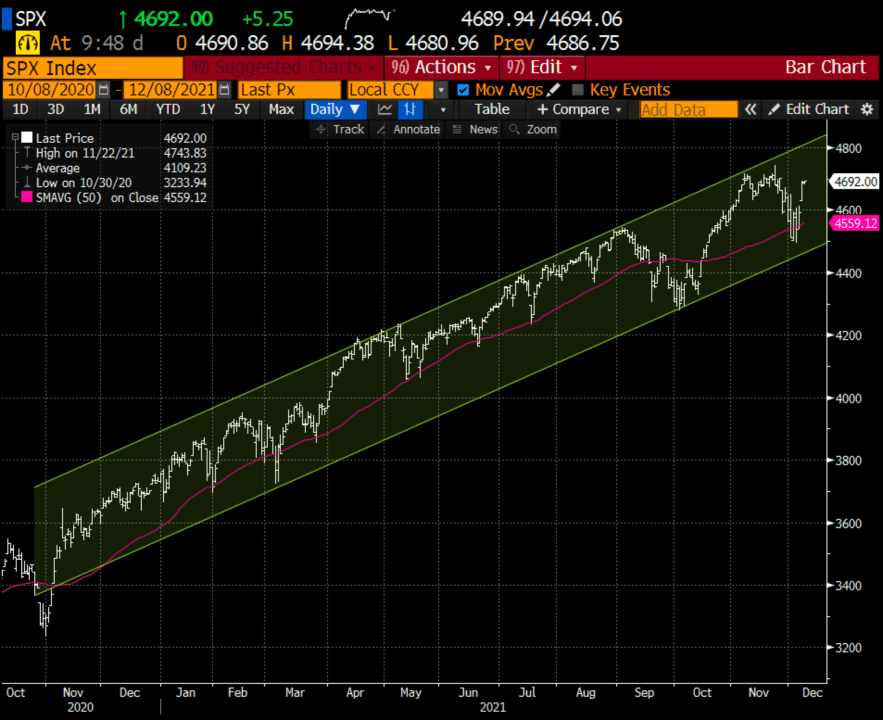

Macro: as we touched upon last week, the market gyrations given the uncertainty of the latest COVID variant was likely to abate, as has been the case with past scares. The 6% peak to trough decline in the SPX was the largest of the year, and likely the last. But also as discussed there have been fairly dramatic disconnects in the stock market as many high valuation stocks/groups have crashed, while money piles into the largest names. This will likely revert a bit in the new year.

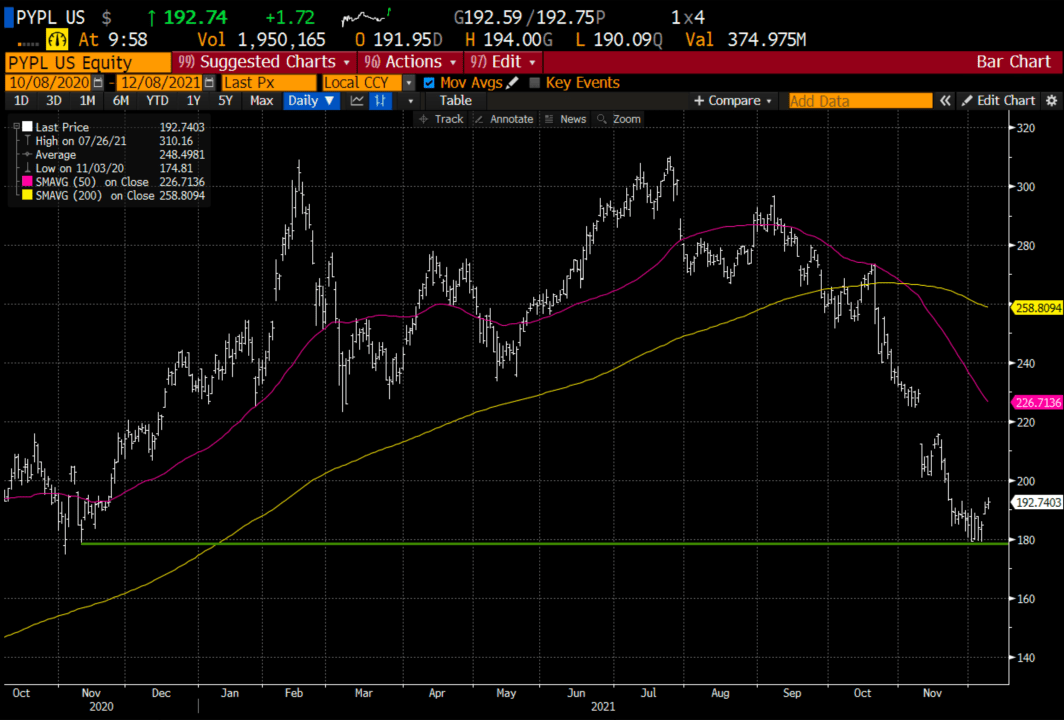

Trade Idea #1: Long PYPL – Since making an all-time high in late July the stock has cratered 38%, down 18% on the year. Valuation is still rich, but the sentiment is so bad could set up as a good bounce candidate into year-end.

Bullish Trade Idea: PYPL ($192.50) Buy Feb 200 – 250 call spread for $9

-Buy 1 Feb 200 call for $11

-Sell 1 Feb 250 call at $2

Break-even on Feb expiration:

-Profits of up to 41 between 209 and 250 with max gain of 41 above 250

-Losses of up to 9 between 200 and 209 with max loss of 9 below 200

Rationale: this trade idea risks less than 5% of the stock price breaks even up ~9% and has a max potential gain of 21% of the stock price if up a little more than 30% in two and a half months.

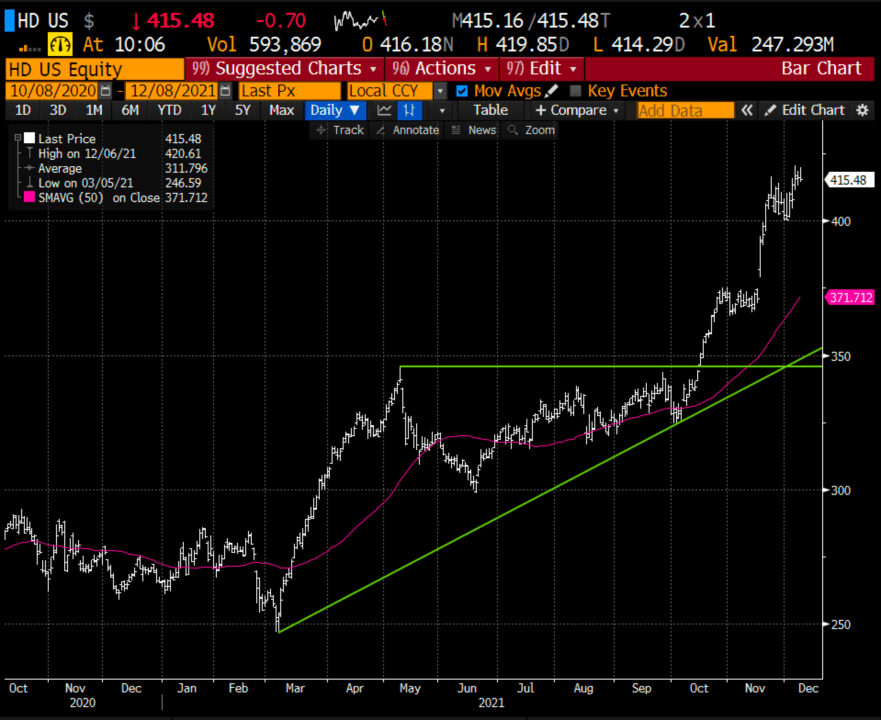

Trade Idea #2: Short HD – Shares of HD are up 56% on the year, up 20% in two months gaining nearly $100 billion in market cap.

The stock trades rich to its past at 25x FY 2023 despite expected Eps and sales growth to slow meaningfully to mid to low single digits

Bearish Trade Idea: Trade Idea HD ($415) Buy Jan 400 – 370 put spread for ~$5

-Buy 1 Jan 400 put for ~$7.50

-Sell 1 Jan 370 put at ~$2.50

Break-even on Jan expiration:

-Profits of up to 25 between 395 and 370 with max gain of 25 below 370

-Losses of up to 5 between 400 and 395 with max loss of 5 above 400

Rationale: this trade idea risks less than ~1.5% of the stock price breaks even down 3.5% and has a max potential gain of 6% of the stock price of down a little more than 10% in a month and a half.

Lookback #1: last week laid out the bullish idea in INTC, now stock ~$52.50 and the call is worth about ~$3.50

Bullish Trade Idea: INTC ($49.80) Buy Jan 50 call for $2

The stock has had a big run on fundamental news but given some back from this week’s highs. Consider spreading by selling a higher strike call, possibly the Jan 57.50, or sell and use a portion of profit to roll up and buy a higher strike call.

Lookback #2 last week I detailed a bullish trade idea in AXP, with the stock ~$170 the Jan 160 call is now ~$13

Bullish Trade Idea: AXP ($155) Buy Jan 160 call for $5

Sell and take Profit, look for a better long entry for a move back to prior highs in the new year.