In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

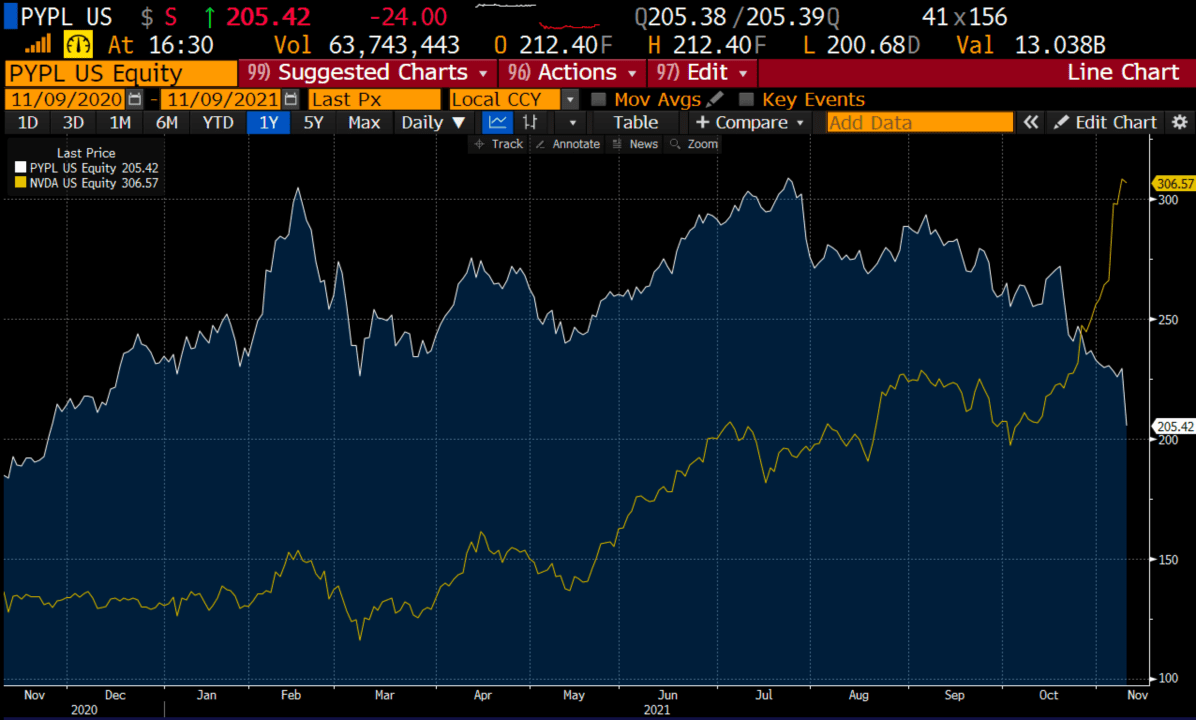

Macro: One of the big themes throughout 2021 has been rotations in and out of mega-cap tech and cyclical, more GDP-sensitive groups like energy, industrials, and transports. When growth expectations were low, and rates were low, the mega-cap trade in tech was on, and when rates were rising because of expectations about higher rates and higher GDP growth, mega-cap tech was out. Now there seems to be some bifurcation in mega-cap tech as investors start to price-in the end of the pandemic, companies that are experiencing decelerating growth are being punished and re-rated, while companies at the forefront of massive secular shifts like a more immersive internet (the metaverse) are blowing out… while e-payment stocks are getting creamed. With the stock market at highs, I see this sort of price action less than bullish.

Exhibit A: NVDA vs PYPL

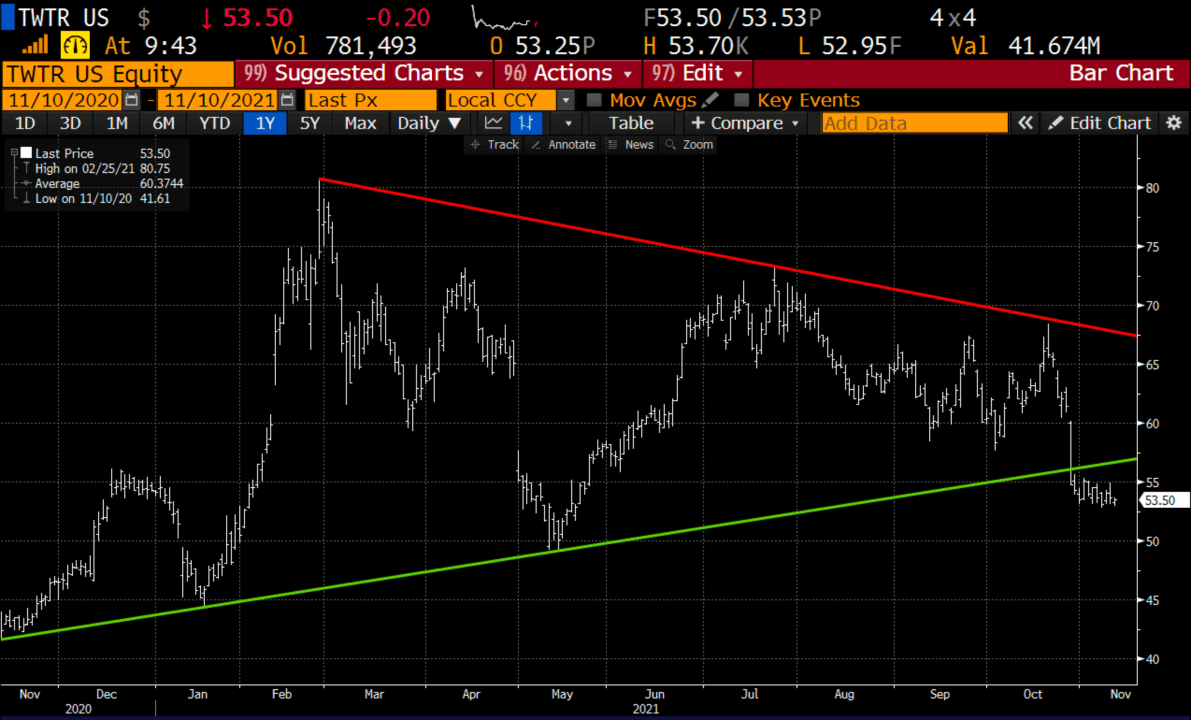

Trade Idea #1: Long TWTR… Twitter launched Twitter Blue, a recurring revenue service… this could be a fundamental inflection point if one of the pillars of the bear case has been under monetizing their existing users.

The chart is less than stellar with the recent breakdown below the 1yr uptrend, to be contrarian it makes sense to define your risk, and $50 on the downside, near its May low would not be a place I would want to be long below.

Bullish Trade Idea: TWTR ($53.50) Buy Jan 52.50 – 70 call spread for $3.50

-Buy to open 1 Jan 52.50 call for $4

-Sell to open 1 Jan 70 call at 50 cents

Breakeven on Jan expiration:

Profits of up to 14 between 56 and 70 with max gain of 14 above 70

Losses of up to 3.50 between 52.50 and 56 with max loss of 3.50 below 52.50

Rationale: This trade idea risks 6.5% of the stock price, has a break-even up ~4.5% and has a max gain of up to ~26% if the stock is up 30% in a little less than 3 months.

Trade Idea #2: Sell WFC as investors reconsider growth prospects and low rates…

Bad chart

Bearish Trade Idea: WFC ($50) Buy Dec 50 – 45 put spread for $1.30

-Buy to open 1 Dec 50 call for 1.75

-Sell to open 1 Dec 45 call at 45 cents

Break-even on Dec expiration:

Profits of up to 3.70 between 48.70 and 45 with max gain of 3.70 at 45 or lower

Losses of up to 1.30 between 48.70 and 50 with max loss of 1.30 above 50

Rationale: This trade idea risks ~2.5% of the stock price, has a break-even down 2.5%, and has a max potential gain of up nearly 3x the premium at risk if the stock is down 10% in a little more than a month.

Lookback: Oct 6 when the stock was 51 get long exposure after sharp drop

VZ ($51) Buy Dec 52.50 call for 90 cents

Now with the stock up $1.50, the Dec 52.50 call is worth $1, it might make sense to sell a higher strike call in Dec and turn into a call spread. You could sell 1 Dec 55 call at ~23 cents, leaving you long the dec 52.50 – 55 call spread for 67 cents, with a max potential gain of 1.83 of the stock is above 55 on Dec expiration.