In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

Macro: stocks are rallying as bond yields are falling, despite the Fed’s continued hawkish stance about its intent to battle inflation. Let’s be honest, investor sentiment was downright awful into the Fed’s recent hike, and despite their admission of getting last year’s inflation wrong, labeling it transitory, market participants are likely doing their best to look out past what is likely to be a challenging second half of 2022 on the economic front and hoping that stocks will soon discount some the potential for a long and drawn-out recession and a protracted bear market. While many pockets of the U.S. stock market have been in a bear market for more than the last two quarters’s the S&P 500’s (SPX) and the Nasdaq 100’s (NDX) 22% and 32% peak to trough declines at their recent lows (respectively) are not likely THE bottom in my opinion. I suspect what we are seeing over the last week is nothing other than a counter-trend bear market rally. I suspect the SPX and the NDX before it’s all said and done will roundtrip their entire moves from their pre-pandemic highs in February 2020 or about 3,400 and 10,500 respectively.

3 Main Uses of Options for Equity Investors: As this is my last In The Money, I wanted to bookend two and half years of episodes with a theme that we discussed throughout but started out with, the three main uses options for equity investors; Yield Enhancement, Risk Management, and Leverage.

1. Yield Enhancement, overwriting stocks that you own by selling a short-dated out-of-the-money call, hoping that that the stock will be below the short call strike around expiration and you will take in the call premium, thus adding yield to your long stock position.

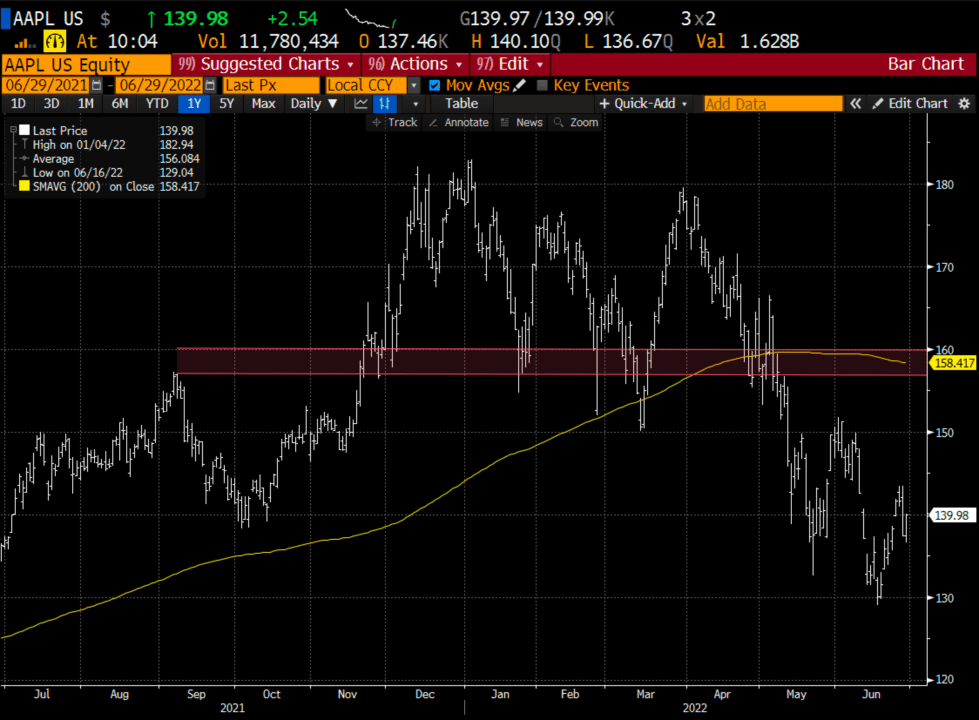

Example: AAPL vs 100 shares long at $140 Sell 1 Aug 160 call at $1.10

Profits of the stock up to 160, the call-away level at 161.10, the short call strike plus the premium received. If the stock is at 160 to above on Aug expiration stockholder can always cover the short call to keep the long stock position intact.

To the downside suffer losses of the stock below current levels less the 1.10 in premium received for selling the Aug 160 call.

Rationale: an investor would do this if they did not intend to sell the stock but also think there is a low likelihood that the stock will be above the short call strike on Aug expiration.

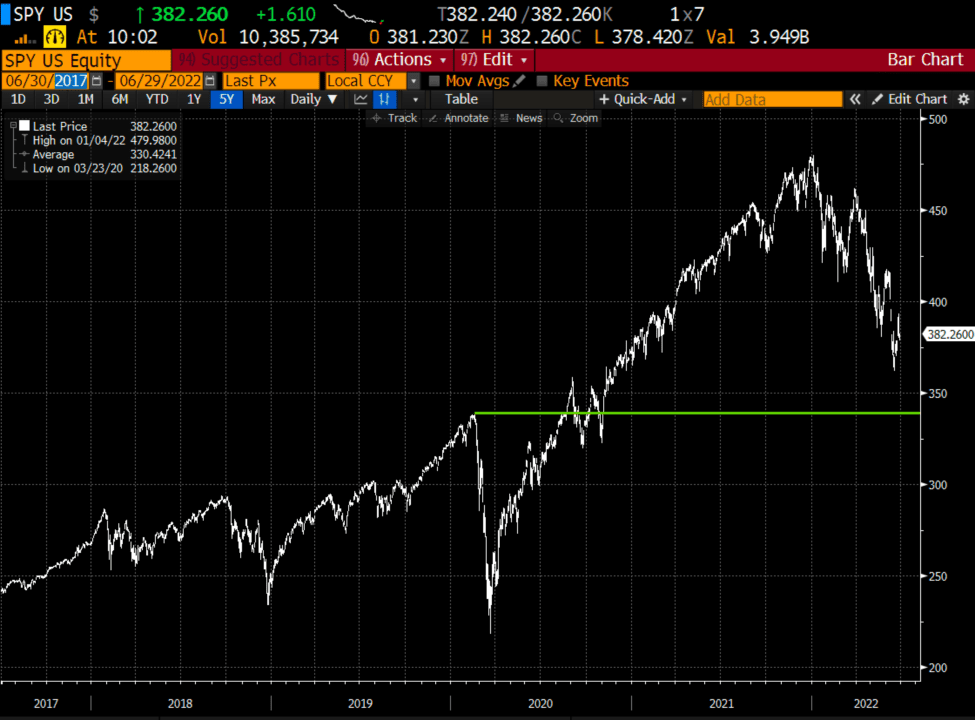

2. Risk Management / Portfolio Hedge: If you have a portfolio that maps to the SPY, the etf that tracks the S&P 500 and you don’t want to sell individual stocks but you do want to put some protection in place you might consider tactical hedges, specifically in uncertain economic times and volatile markets like we are in now. So let’s say you thought the rally that started last week could go through quarter-end but when we get into Q2 earnings season in the coming weeks we could make new lows and ultimately test the pre-pandemic high near $3400 or $340 in the SPY then you might consider some downside protection to that point.

Example: SPY $380 Buy Sept 380 – 300 Put Spread for $15

-Buy to open 1 Sept 380 put for $17

-Sell to open 1 Sept 300 put at $2

Break-even on Sept expiration:

Profits of up to $65 between 365 and 300 with a max gain of 65 below 300

Losses of up to 15 between 380 and 365 with a max loss of 15 at or above 380

Rationale: this trade idea risks about 4% of the ETF price and breaks even down 4% with a max potential gain of 17% if the tef is down 20% in about 3 months.

3. Leverage: Risking what you are willing to lose, is one of the most attractive attributes of buying options to express a directional view in stock or ETF, but it can also be a costly endeavor if positions are not risk-managed. I have probably said it dozens of times on In The Money over the last couple of years when expressing a directional view with long options, every day the position does not move in your favor, or at the speed at which the options were priced to move, then the position will be decaying. So you can get the direction right but the timing and velocity of the move wrong and lose money. I Like to use a 50% mental stop on the initial premium that I spent.

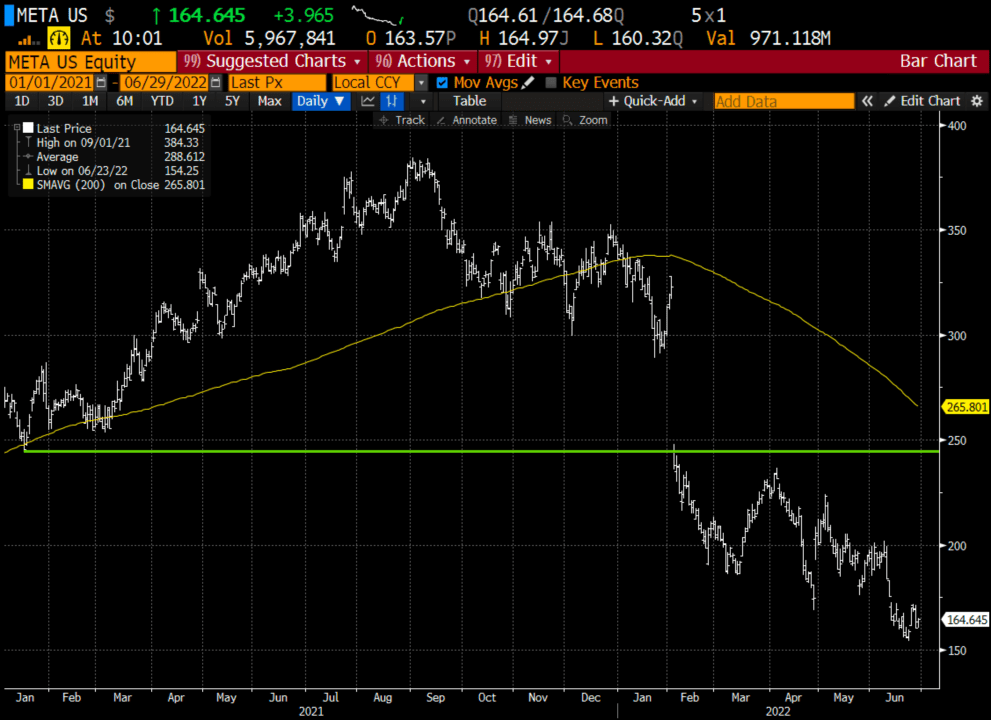

Example: META ($164) Buy Sept 170 call for $15

Profits above 185

Losses of up to 15 between 170 and 185 with max loss below 170

Rationale: risking 9% of the stock price, breakeven up 13% in 3 months.