In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

Macro: FUD–> Fear, Uncertainty & Doubt. This is a term that has generally been reserved of late for the crypto markets, usually referring to its naysayers and all of the reasons they suggest this new asset class will fail. I think we stock market folks can start applying this expression to the U.S. Fed, Fear that the Fed will make a policy mistake, raising too aggressively after keeping rates and policy unusually low for too long… The Uncertainty that they are right this time on inflation after obviously being wrong for some time, and Doubt that they will be able to secure a soft landing for the economy and avoid a recession, and thus at least a meaningful stock market correction, possibly a bear market. The 10-Yr U.S. Treasury Yield has risen nearly one full point in a month, from a low of 1.66% on March 7th to 2.65% today, this volatility in my opinion screams FUD.

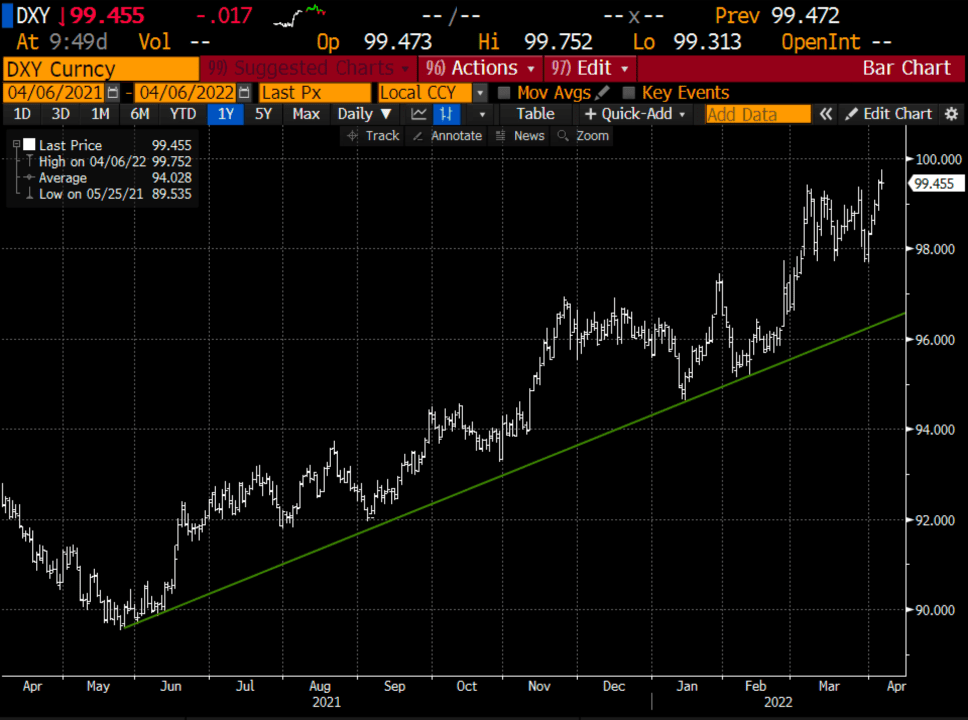

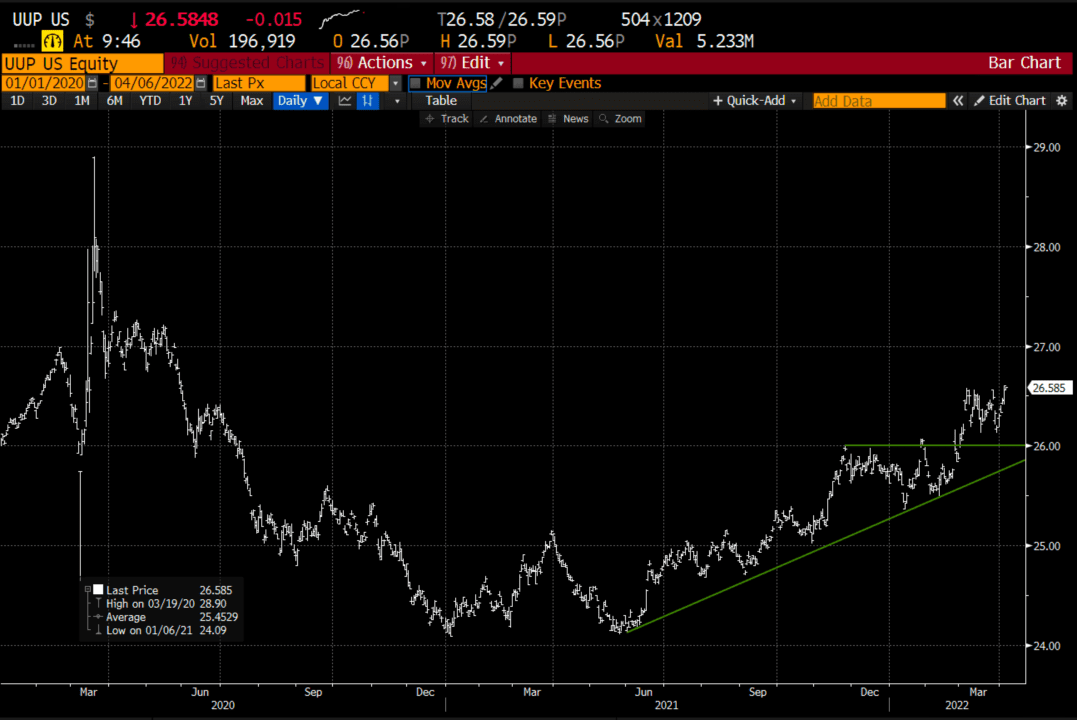

Trade Idea #1: Flight to Perceived Safety in Uncertain times. The U.S. Dollar should continue to catch a bid. The DXY, which is basically 50% Euro, should benefit from the potential for Europe to enter a recession first plus the Fed’s intent to be increasingly hawkish in the near term, possibly starting QT in May.

The UUP is the ETF that tracks the DXY, I suspect we see $28 this spring:

Bullish Trade Idea: UUP ($26.57) Buy Sept 27 call for 50 cents

Break-even on Sept expiration:

Profits above 27.50

Losses of up to 50 cents between 27 and 27.50 with max loss of 50 cents below 27

Rationale: this trade idea risks ~2% of the etf price and has a break-even up of about 4%, but could serve as a dollar cheap macro hedge if things go haywire if the Fed basically loses control of the FUD.

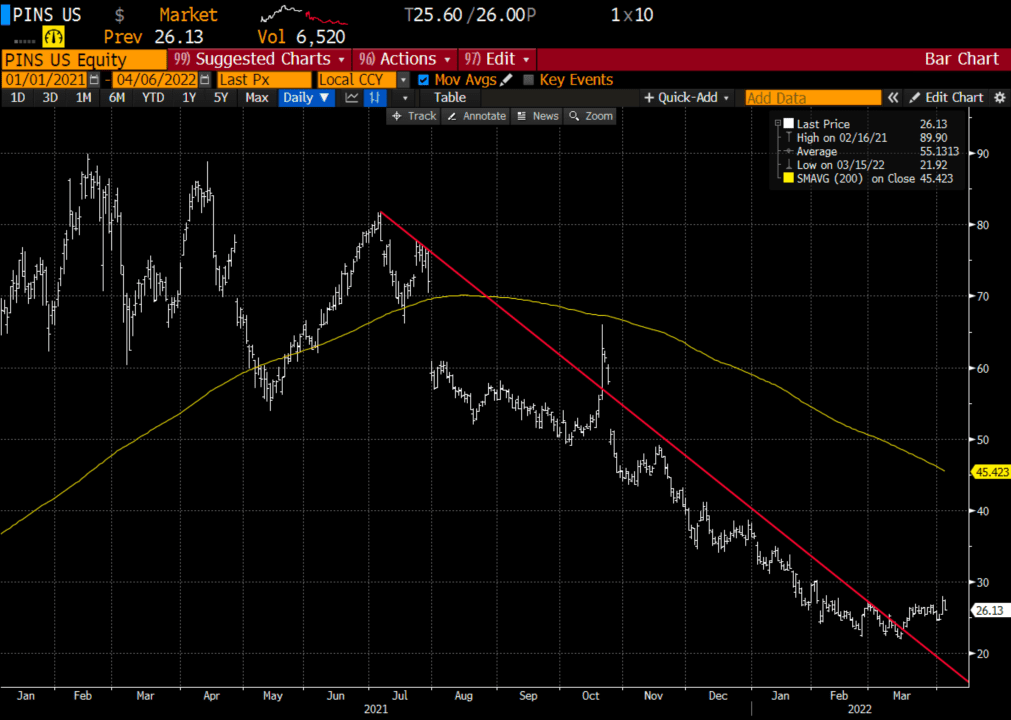

Trade Idea #2: PINS, earlier this week shares of TWTR rocketed 30% in a day as TSLA’s founder, and the richest man took a 9% stake in the stock and was a day later added to its board. Are their other beaten-up internet stocks ripe for activism, and also ripe for a massive short squeeze? Well PINS is down 70% from its 52-week highs, and down 28% on the year could fall into this category. Not to mention trading 21x next year’s expected earnings and ~4x sales it is no longer that expensive, so maybe where there was potential M&A interest in the fall at higher levels, there could once again be interested strategic buyers. The chart has broken the long nasty downtrend:

Bullish Trade Idea: PINS ($24.60) Buy June 30 – 40 call spread for $1

-Buy to open 1 June 30 call for $1.2

-Sell to open 1 June 40 call at 20 cents

Break-even on June expiration:

Profits of up to 9 between 31 and 40 with max gain of 9 above 40

Losses of up to 1 between 30 and 31 with max loss of 1 below 30

Rationale: this is a bit of a long-shot, with a break-even up 2~5% or so, with a max potential gain of 36% of the stock price if the stock is up ~60%, but if the stock were 40 on June expiration, it would still be down 55% from its highs and back where it was trading in Nov after rumors of a PYPL takeover were dismissed.

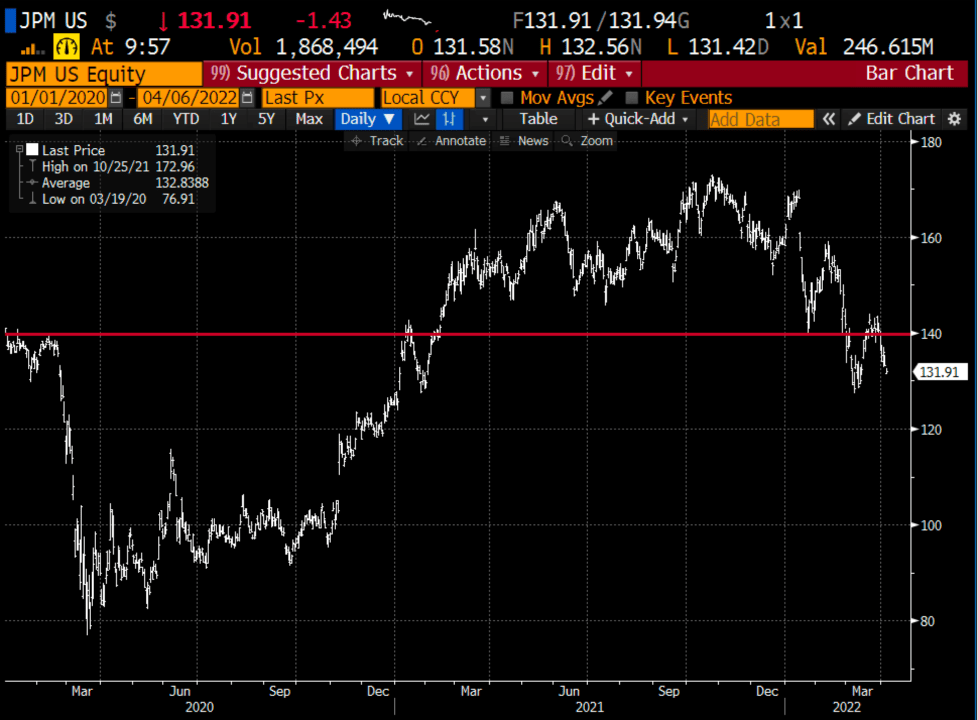

Lookback – Last week I detailed a bearish trade idea in JPM:

JPM ($141) Apr 140 – 130 put spread for $2.50

Today the stock is trading $132 and the put spread that cost 2.50 is now worth about 6.30. It makes sense to close this and look for a better re-entry or better strikes to continue to express this bearish view into earnings next week, possibly rolling down and out. You could also always wait for the results and re-access the view. I still think $120 is in the cards in the not so distant future.