In The Money is brought to you by

Shortly after the open today, I filmed my weekly In The Money segment with Fidelity Investments. Click below to watch and see my notes below the video:

Here are my notes from today’s show:

Macro: Fed Chair Powell Blinked, inflation is no longer deemed to be “transitory” and despite investor fears about a new strain of covid which is causing some trepidation in Europe, which could cause lockdowns, further exasperating supply chain issues and thus stoke inflation fears…AGAIN, the Fed actually got more hawkish, suggesting they may speed up the pace of their taper of bond buying. This choice suggests they are more interested in meeting inflation fears head-on at the risk of spooking the stock market.

The concentration in the stock market among a half dozen stocks has kept losses from last week’s all-time highs somewhat muted. The S&P 500 (SPX) is down less than 4%, while the equal weight SPX is down nearly 6%, suggesting poor breadth among stocks. Let’s see how low the market has to go near term before Fed Chair Powell addresses the weakness prior to their final FOMC meeting of 2021.

I want to look to be constructive on stocks that I think have been hit unfairly due to omicron concerns as this will likely pass.

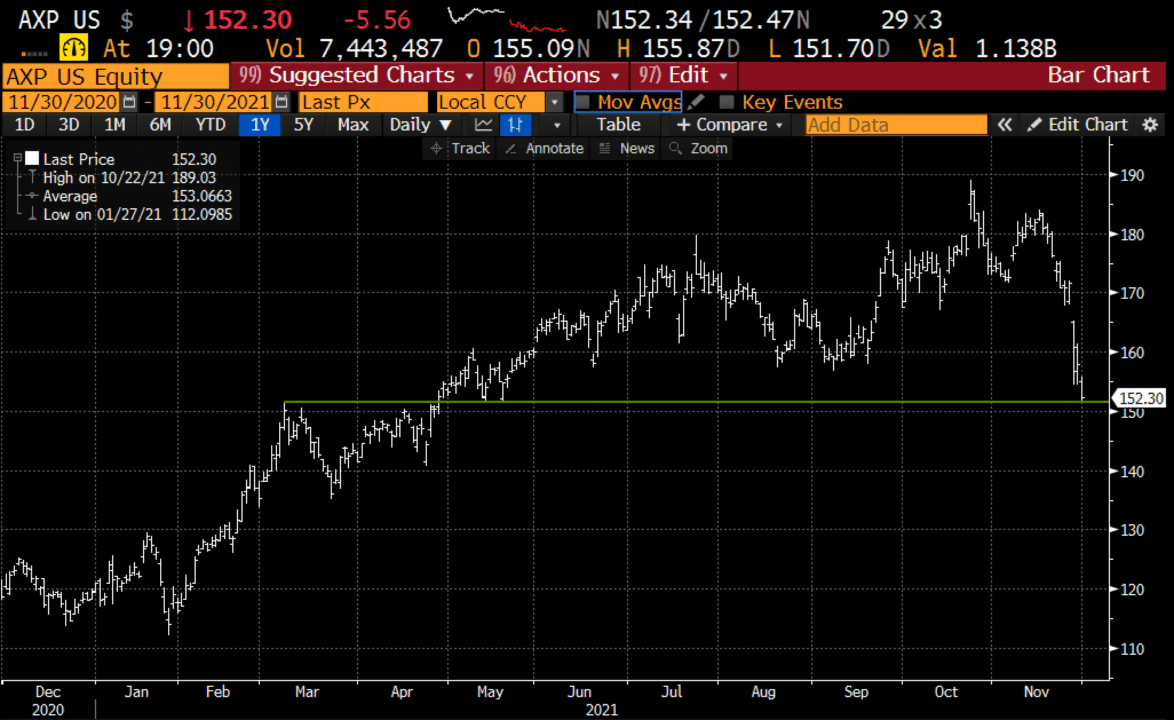

Trade Idea #1: AXP has sold off 20% from its recent all-time highs following its better than expected Q3 results and guidance. The next stop is $140 on the downside if breaks support, which is why when being contrarian it makes sense to define your risk.

Bullish Trade Idea: AXP ($155) Buy Jan 160 call for $5

Break-even on Jan expiration:

Profits above 165

Losses of up to 5 between 160 and 165 with max loss of 5 below 160

Rationale: this trade idea risks a little more than 3% of the stock price and breakeven up ~6.5% and allows for the potential to spread by selling a higher strike call if the stock were to quickly move in the money.

Trade Idea #2: INTC suffered in 2021 from some poor execution, allowing competitors like AMD to take market share. The stock has sorely lagged the group, basically flat on the year. The company may soon start to emphasize some advancements in high-end server chips for datacenter and AI chips from their Mobileeye unit for autonomous driving.

The stock is cheap, nearly washed out, with a near-term risk down towards $45. Again, to be contrarian in a volatile market, in an out of favor stock, look to define risk.

Bullish Trade Idea: INTC ($49.80) Buy Jan 50 put for $2

Break-even on Jan expiration:

Profits above $48

Losses of up to 2 between 50 and 52 with max loss of 2 below 50

Rationale: this trade idea risks about 4% of the stock price and has a breakeven up about the same.

Lookback: Back on Nov 17 I detailed a bullish trade on PINS

PINS ($48) Buy Jan 50 – 65 call spread for $2.50

PINS has collapsed down $8! the call spread that cost 2.50 is now worth only 50 cents… USE MENTAL STOPS aside from just the premium. CLose and recoup what premium u can if not down at 50% “mental stop” that we often talk about.

And a bearish trade idea on GLD:

GLD ($174) Buy Dec 173 – 165 put spread for $2

GLD is down $6. and the put spread is nearing the short put strike. Take profit. Put spread now worth ~$5 can only be worth 8 and paid $2 for it. Sell to close.