Today after the close AMZN will report is Q4 earnings. The options market is implying about a 5% one-day move, or about $174 in either direction tomorrow which is a tad shy of the 6% average one-day post-earnings move over the last four quarters.

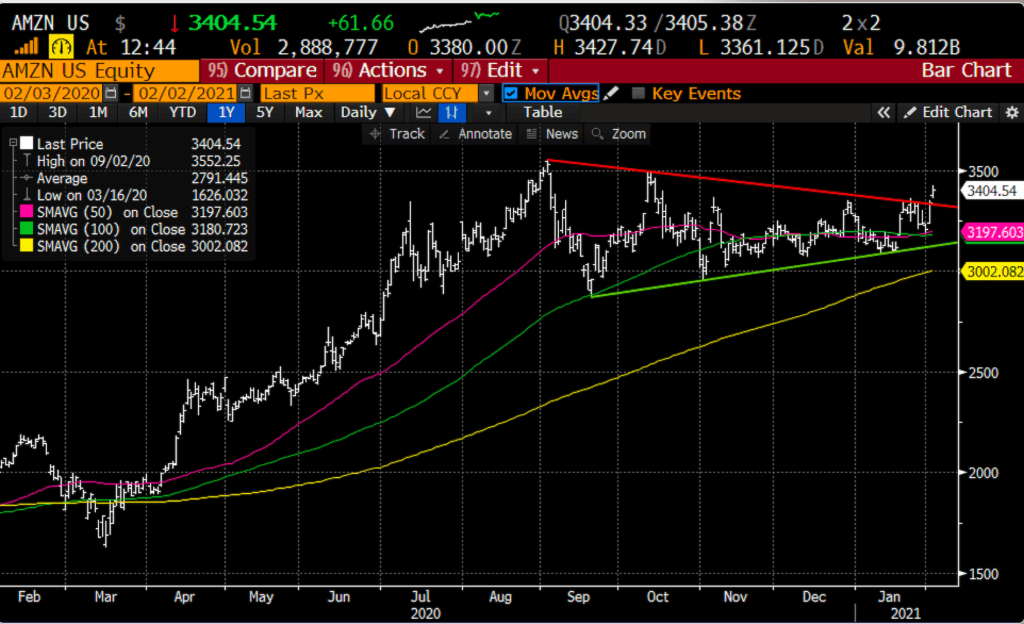

Shares of AMZN are up 4.5% on the year, but still down about 4% from its all-time high made on Sept 2nd. It is worth noting that AMZN is the only stock in the MAGA complex (MSFT, AAPL, GOOGL, AMZN) that has not made a new high since its all-time high made on Sept 2nd. Like the others, the stock has been in a long consolidation over the last four months as investors have rotated out of high priced growth into cyclical value anticipating the global economy coming out of the covid induced recession and hitting pre-pandemic levels in 2021 fueled by historically low interest rates the world over and of course trillions and trillions of stimulus.

The one year chart of AMZN might be one of the best looking, and most-watched in all of the market today (aside from GME). The stock found good support Friday at its 50 and 100-day moving averages, has been making a series of higher lows for months and today just broke out above the downtrend that has been in place from the Sept 2nd highs:

Despite the stock’s recent under-performance, Wall Street analysts remain white-hot on the stock with 53 Buy ratings, only 2 Holds, and NO Sells.

Following Q3 results, shares of AMZN sold off 4.5% the next day as investors were disappointed about guidance related to costs associated with the pandemic, per Barron’s:

Amazon’s forecast … operating income in the quarter to range from $1 billion to $4.5 billion, reflecting an expected $4 billion of costs related to the Covid-19 pandemic. Wall Street had forecast $5.8 billion.

I suspect they come in better than the guidance and going forward these costs abate a bit while the company also sees the tailwind that competitors like MSFT got from their cloud services business in the quarter just ended.

So what’s the trade?

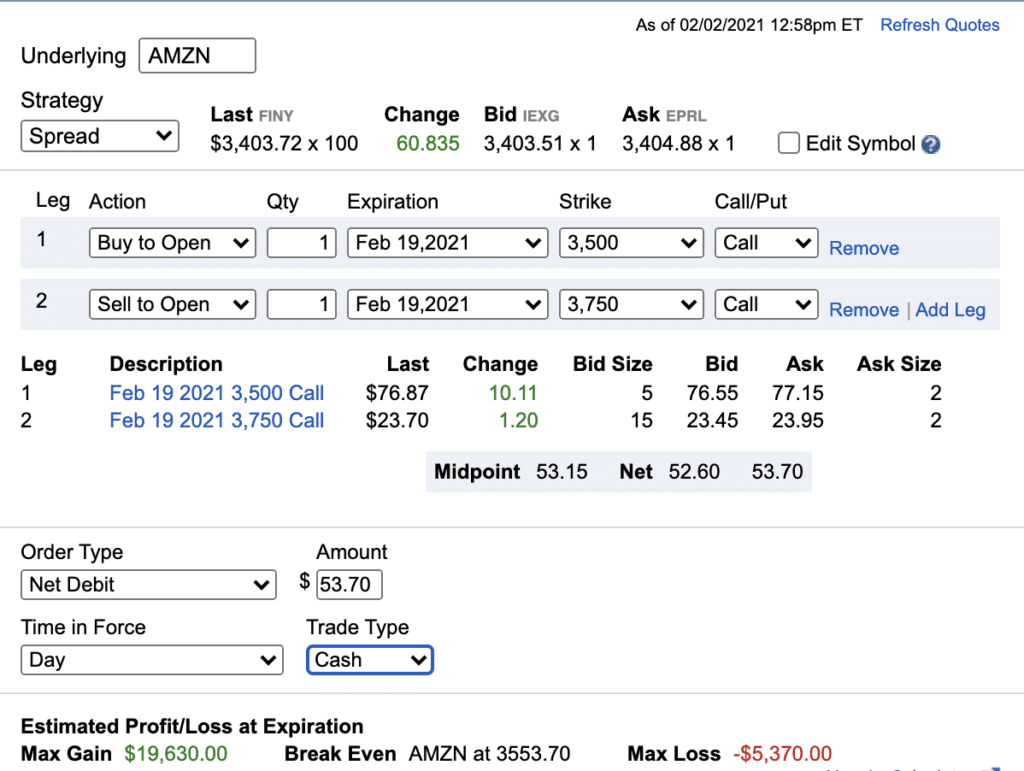

If I were inclined to play for a breakout to new highs I might consider the following call spread in Feb 19th expiration, playing for about a 10% move over the next two weeks:

Bullish Trade Idea: AMZN ($3400) Buy Feb 3500 – 3750 Call Spead for ~$53

Profits of up to 197 between 3553 and 3750 with max gain of 197 above 3750

Losses of up to 53 between 3500 and 3553 with a max loss of 53 below 53

Rationale: this trade idea risks 1.6% of the stock price, breaks even up 4.5% and has a max gain of 6% of the stock price if it is up 10% in two weeks.

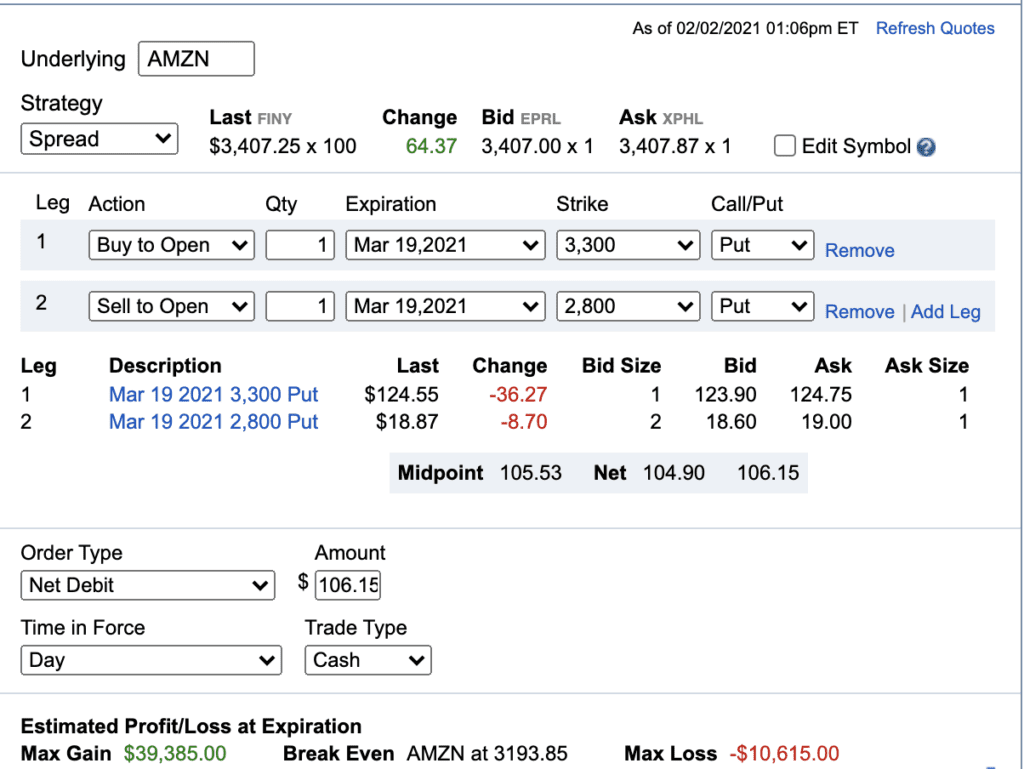

OR for AMZN LONGS looking for near-term protection, consider downside put spreads targeting worst-case scenario near the Sept lows near $2900 in the next month:

Bearish Trade Idea: AMZN ($3400) Buy March 3300 – 2800 Put spread for ~$105

Profits of up to 395 between 3195 and 2800 with max gain of 395 at 2800 or lower

Losses of up to 105 between 3195 and 3300 with max loss of 105 above 3300

This trade idea (hedge) risks 3% of the stock price, has a break-even down 6% and has a max profit of 11.5% if the stock were to decline 17.5% in a month.